“The future will be increasingly solar”, this is the analysis of industry experts. According to Ronaldo Koloszuk, president of the Board of Directors of ABSOLAR (Brazilian Photovoltaic Solar Energy Association), The expectation is for accelerated growth in projects for 2021.

Lucas Freitas, CEO of Genyx, also commented that with technology even more widespread, payback more than proven and prices becoming more accessible, the forecast It's an explosion of demand.

There is no doubt, the photovoltaic market has been following an exponential growth curve in recent years and the tendency is to leverage even more in the future. Therefore, companies from different segments are betting on solar, such as financial institutions.

The BNDES (National Bank for Economic and Social Development), for example, approved a financing of R$ 191 million for Powertis, specialized in large-scale solar projects in Brazil, Italy and Spain, for the construction of a photovoltaic system in the state of São Paulo.

Banco do Brasil was not left out either, it already has solar plants installed across the country and will also provide R$ 200 million in credit limits to finance investments in the installation of panels on farms for the Brazilian multinational in the food sector BRF.

And it doesn't stop there, a survey carried out by Solar Channel pointed out that at least four banks expect growth in operations in their credit lines focused on renewables this year: Banco do Nordeste, Banco do Brasil, Santander and Caixa.

Below are the values contracted in 2020 and expectations for 2021:

Banco do Nordeste

In 2020, Banco do Nordeste contracted R$ 264.12 million through the FNE Sol financing line. The credit intended for micro and mini distributed energy generation was attributed to companies, rural producers and individuals, in 4,548 operations distributed across the states of the Northeast and the north of Minas Gerais and Espírito Santo, the company's area of operation.

Among the sectors that hired the most FNE Sol last year were individuals located in urban areas, with the amount of R$ 112.9 million in 3,713 operations, and the commerce and services sector, with R$ 68.7 million in 539 operations.

According to Banco do Nordeste, the target for 2021 for FNE Sol contracts for individuals is R$ 80 million.

As for centralized photovoltaic generation, the values were R$ 1.2 billion in 2020. In 2021, the company announced that R$ 482 million had already been contracted.

Bank of Brazil

Banco do Brasil reported that, in 2020, a volume greater than R$ 165 million was sold in quotas relating to the acquisition and installation of renewable energy systems.

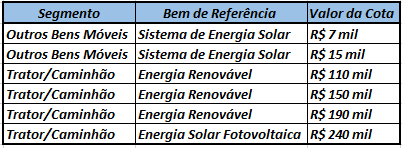

BB Consórcios provides customers with solutions for purchasing renewable energy systems through consortium quotas in the Tractor/Truck and Other Movable Goods segments, with values ranging from R$ 7 thousand to R$ 240 thousand. He follows:

Regarding the amount disbursed in the 2019/2020 Harvest, for example, an increase of 43% was observed compared to the previous one. “This reaffirms our commitment to financing clean and sustainable energy sources,” said Banco do Brasil in a note.

For 2021, the financial institution expects that the company's movement in lines aimed at financing the implementation of micro and mini renewable energy generating plants will continue on the rise.

Santander

According to Fernando Charrone, Commercial Superintendent at Santander Financiamentos, the company's projections regarding financing point to an increase in the photovoltaic market in 2021.

“Santander is the photovoltaic bank. The finance company is prepared to meet this demand and also encourage new business this year. Santander Financiamentos expects to double its production in 2021 compared to 2020. This means releasing twice as many credits for photovoltaic financing throughout Brazil, for companies and individuals”, highlighted Charrone.

“The solar energy market is constantly expanding both due to environmental awareness and energy savings. Furthermore, our commercial conditions associated with the emergence of new commercial partners allow this market to become even more attractive”, he assessed.

The executive also highlighted that photovoltaic financing through Santander, in addition to being competitive, is very simple and fast. “It is worth highlighting that we have increased our commercial strength, allowing better service to partner companies in the national market, in addition to working with integrators”.

Box

Caixa's credit lines for financing energy eco-efficiency projects grew by 35% last year. For 2021, the institution's expectation is to double this number.

The company reported that machines and equipment are financeable for the following purposes:

- Micro and mini energy generation system using renewable sources;

- Solar water heating system;

- Energy efficiency.

The BCD Ecoficiency line is aimed at entrepreneurs looking to finance equipment for generating solar energy. It is possible to finance up to 100% of products to be installed in the company for photovoltaic energy.

Also through the line of credit, Consumer Durable Goods Companies can also be financed up to 100% of the value of the goods purchased for energy eco-efficiency.

One Response

This is if the government does not get in the way and the associations that defend the sector do not move to prevent these political tax interferences, which could result in consumer disincentives.