The volume of GC (centralized generation) solar energy projects is approaching the 45 GW mark, according to a new study released by Greener, one of the main consultancy and research companies in the solar energy market in Brazil.

The study aims to analyze the panorama of the market for large solar projects in free and regulated contracting environments, also creating references for current and future projects according to market dynamics and impacts on attractiveness, in addition to demonstrating how the sector Centralized generation photovoltaic technology has evolved in recent years.

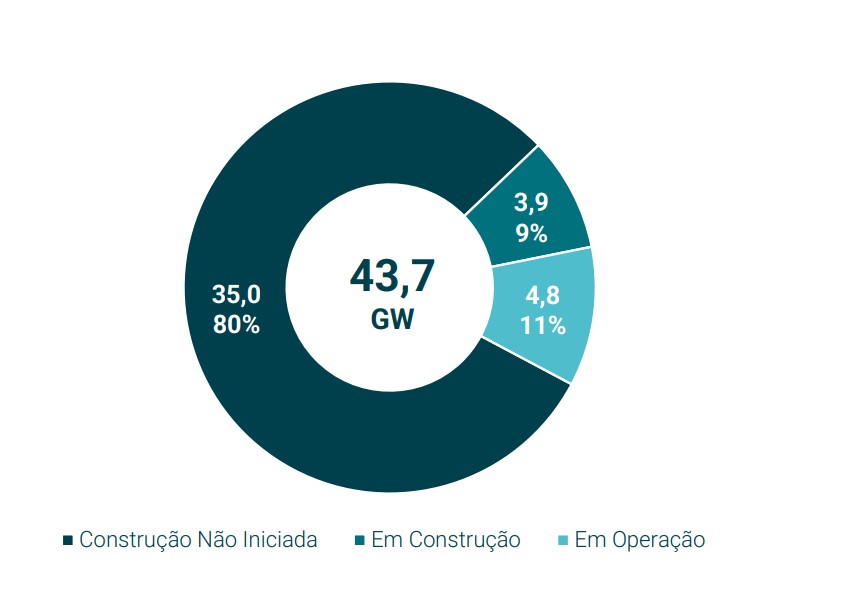

According to the document, of the 43.7 GW in projects, both in ACL (Free Contracting Environment) as in ACR (Regulated Contracting Environment), around 4.8 GW are already in operation, while 3.9 GW are under construction and another 35 GW have not yet started construction.

Of the amount that is already in operation in the country, just over three quarters were sold in the ACR, formed by captive consumers, in which energy is purchased by distributors through auctions and the price is determined by the ANEEL (National Electric Energy Agency).

Regarding the granted complexes, around 82% are or will be connected to the basic grid (with power equal to or greater than 230 kV), indicating a tendency for new grants to be connected at higher voltage levels, due to the larger size of the projects and the availability of the electrical grid itself.

On average, new projects increased in size in relation to plants already in operation, according to Greener. “The gain in efficiency with the increase in scale has encouraged entrepreneurs to develop larger projects, which optimizes investment and operational costs”, highlights the study.

Market Projections

The consultancy company's research also shows that, over the next 10 years, an increase of more than 27 GWm is expected in the country in relation to the previous reference scenario, which would represent an increase of 38% in relation to the year 2021.

The deadlines for implementing the grants issued by ANEEL also point, according to the document, to a total of 38 GW in operation by 2027, with the majority (37.7 GW) destined for the ACL and only 2.3 GW destined for the ACR. Approximately 32 GW of the total has not yet started construction.

Supply Chair

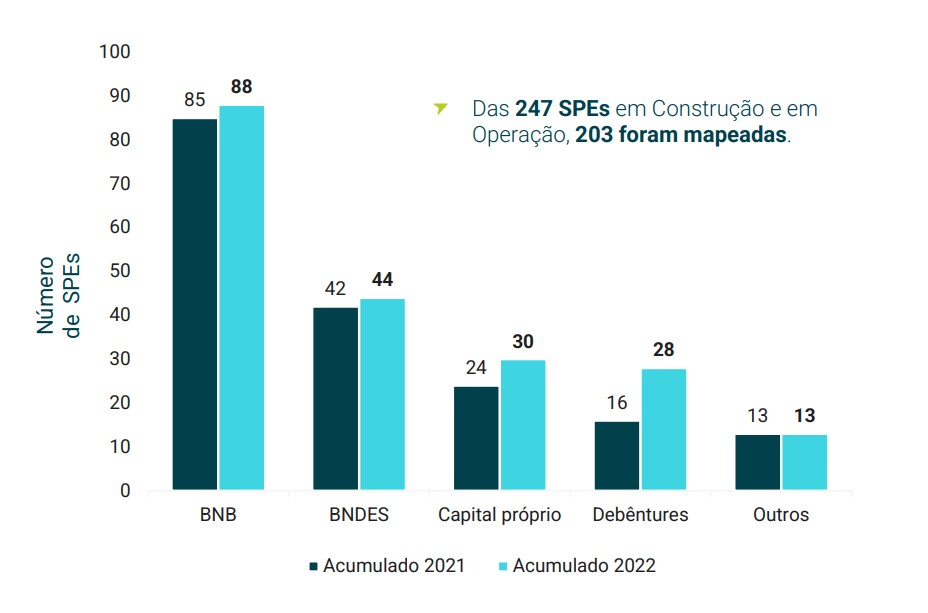

According to the Greener study, more than half of the amount of solar projects in Brazil were financed by BNB (Banco do Nordeste).

However, the Debenture was the main form of fundraising for new projects mapped by Greener between 2021 and March 2022, becoming an important financing alternative.

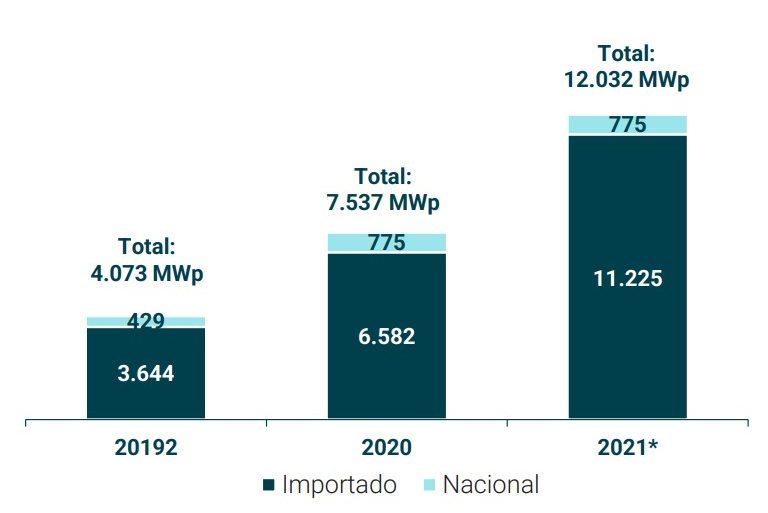

The total volume of new module supply contracts mapped was 4.3 GWp, an increase of 17% in relation to that mapped in the previous year (3.6 GWp). From 2018 until the end of the study, the country accumulated just over 12 GWp.

Modules and inverters

According to the study, the photovoltaic modules used in projects are mostly imported, representing 97% of the accumulated amount.

In this new study, for example, Greener reported that there was no hiring of modules of national origin between 2021 and March 2022.

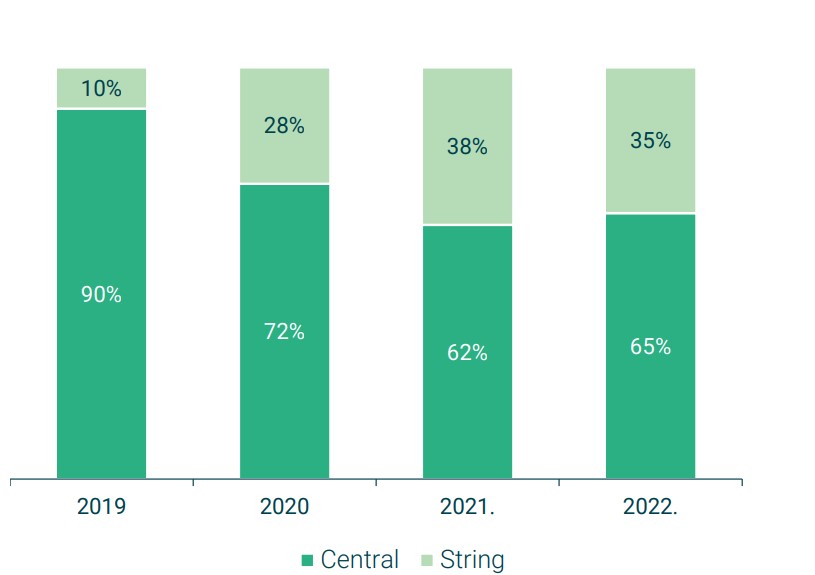

Regarding inverters, although the central topology represents the majority of equipment used in centralized generation plants, string inverters are gaining ground in large plants.

Its share increased from 10% in 2019 to 38% in 2021. Of the contracts closed between 2021 and March 2022, around 39% were string topology, compared to 66% in the previous year.