Awareness of the importance of investing money is one of the many consequences that the pandemic has brought to society. After sanitary and health issues, financial concerns are one of the most latent among Brazilians, who have seen their purchasing power decreases due to rising inflation and prices, whether in the market or on the electricity bill.

Faced with this scenario, many families were forced to keep their accounts straight, balance income and expenses and, therefore, look for new forms of investment in an attempt to make their money go further.

The Stock Exchange, for example, has never registered as many active investors as it does today. On the other hand, many more conservative Brazilians have started to invest in investments where the risk is lower, but the annual return tends to be less advantageous, such as in Poupança and Tesouro Direto.

However, the question remains: do these investments, whether post-fixed to inflation or on the Stock Exchange, guarantee a greater financial return than if they were invested in the installation of a residential photovoltaic system?

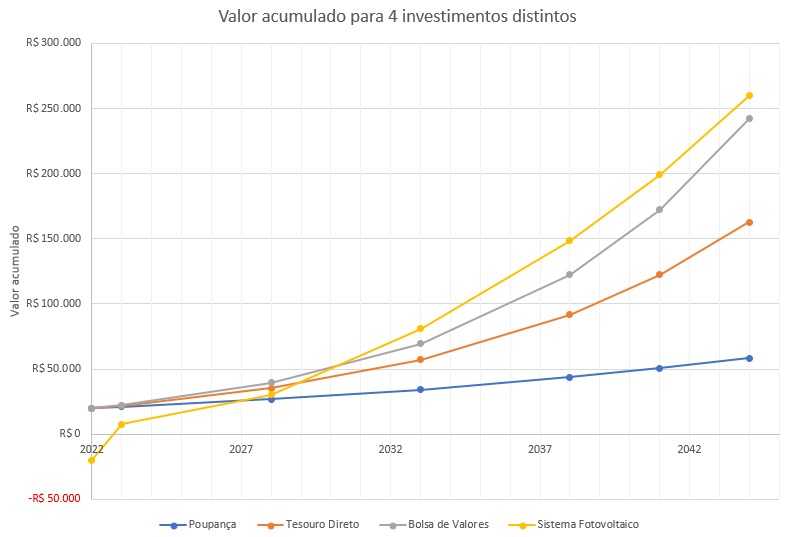

To answer this question, the electrical engineer and professor at Canal Solar Mateus Vinturini calculated different scenarios, in which the investor invests an amount of R$ 20 thousand with the prospect of withdrawing the accumulated money at the end of 2044.

In the first of them, R$ 20 thousand were put into savings, at an annual rate of around 5%. At the end of 2044, the accumulated gain would be R$ R$ 58.5 thousand. At Tesouro Direto, the same investment is much more advantageous, with a yield of R$ 162.8 thousand, at a rate of 10% per year.

In the case of investments in Stock Exchange securities, the calculation took into account the average rate of return on Brazilian shares over the last 5 years, 12% per year. If the investor maintains this average, he will profit around 242 thousand by the end of 2044.

As for the investment made in a residential solar system with 5 kWp of installed power, Vinturini considered, to compose his calculation base, an increase in the energy tariff of the order of 7% and an annual system degradation rate of 0.99%.

Emphasizing that the teacher considered the current rules in force, without the updates proposed by the GD Legal Framework and which come into effect from January 6, 2023. Adding all this up, we come to the conclusion that consumers are guaranteed savings of around R$ 259.8 thousand by the end of 2044 with the installation of solar panels in their residences.

In other words, based on the calculations presented, solar energy ends up being an investment that brings higher returns when compared to post-fixed investments and also in relation to the average annual return on the Stock Exchange, which, by the way, is more volatile and risky.

What does the accumulated income from R$ 20 thousand investments look like over the years?

Electricity bill

The electricity bill in Brazil has risen more than twice as much as inflation since 2015, according to data from Embraceel (Brazilian Association of Energy Traders) published at the beginning of the week by Jornal Estado de S. Paulo.

The numbers show that Brazilians' residential tariffs have increased by 114% in the last six years, a difference of 137% in relation to the 48% growth in inflation in the same period.

From 2015 to 2021, the cost of electricity rose, on average, 16.3% per year, while the IPCA (Broad Consumer Price Index), the country's official inflation, varied around 6.7% per year. For 2022, new increases in the electricity bill are already planned.

The adjustment that official documents from the Federal Government and the electricity sector predict for the year is higher than 21%, a rise that will further boost inflation and erode citizens' income.

3 Responses

Please, Henry.

Based on the graph, the recovery of the capital invested in the photovoltaic system takes place from the fifth year onwards. That's right?

Good afternoon, Marcus, how are you? From the second/third you start to recover.

Photovoltaic energy for sure, with the #LightDeFi…