A Eletrobras announced this Monday (10) the sale of thermoelectric assets for Âmbar Energia, decreeing the exit of the largest Brazilian electricity company from the fossil thermal generation segment. For business, the Amber will pay R$ 4.7 billion.

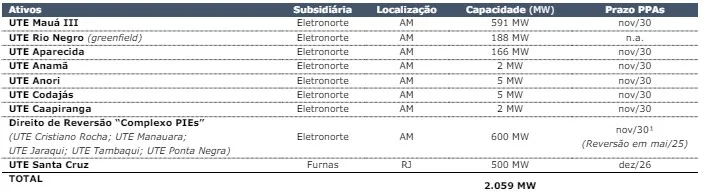

The operation involves seven assets in operation, a greenfield, in addition to the right of reversion of another 5 thermal plants, totaling a portfolio of 13 plants or 2,059 MW.

“The disposal of assets is the result of a competitive process, with high engagement, which began in July 2023. The result of the process enabled the Company to maximize the value of your assets with adequate risk allocation, immediately eliminating the impacts of default related to energy sales contracts”, wrote Eletrobras in a statement released to the market.

The negotiated plants have supply contracts ending in December 2026 and November 2030. The portfolio will be transferred without any debt or cash.

In 2023, assets recorded a net revenue of R$ 2.4 billion and EBITDA (earnings before interest, tax, depreciation and amortization) of R$ 1.1 billion.

In parallel, Eletrobras signed two additional agreements with Grupo Âmbar Energia, a company belonging to the J&F group, the holding company of the Batista family.

If there is a transfer of control of the distributor Amazon Energy, counterparty to the thermoelectric asset contracts, Eletrobras will assign all of the credits to Âmbar. In return, Eletrobras will have a purchase option enabling it to capture the economic benefit resulting from the distributor's operational and financial recovery.

Amazonas Energia is facing financial and operational difficulties, and is at risk of having its concession revoked.

The parties also agreed to edit the option to purchase the Baleia wind complex. The agreement allows Eletrobras to receive the full result of a compensation collection action, still under discussion with the insurance company.

According to Eletrobras, the deal reinforces the company's commitment to “mitigate operational and financial risks, advance the optimization of its portfolio and capital allocation. Finally, with this transaction, Eletrobras accelerates the achievement of its Net Zero 2030 goal.”

All content on Canal Solar is protected by copyright law, and partial or total reproduction of this site in any medium is expressly prohibited. If you are interested in collaborating or reusing some of our material, we ask that you contact us via email: [email protected].