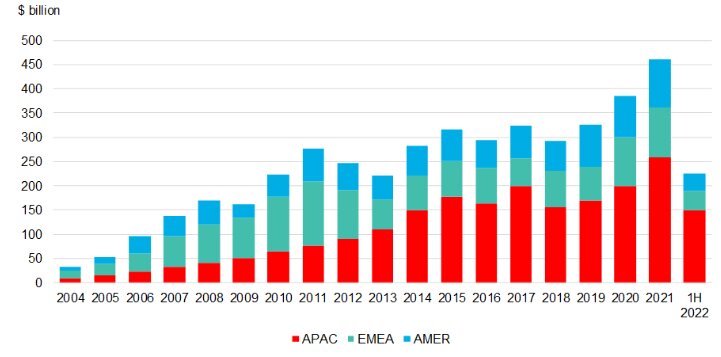

O global investment in renewable energy totaled US$ 226 billion in the first half of 2022, setting a new record for the first six months of a year, points out the Renewable Energy Investment Tracker 2H 2022 -report published by research company BNEF (BloombergNEF).

According to the survey, the increase in investment reflects an acceleration in demand for clean energy supplies to face current global energy and climate crises.

Investment in new large and small scale solar projects rose to a record US$ 120 billion, an increase of 33% compared to the first half of 2021. Financing of wind projects increased by 16% compared to the first half of 2021, at US$ 84 billion.

BloombergNEF highlights in the report that both sectors have been challenged by rising input costs such as steel and polysilicon, as well as supply chain disruptions and rising financing costs.

However, the research firm considers that the figures presented indicate that investor appetite is stronger than ever, in part due to the very high energy prices currently observed in many markets around the world.

More records

The Renewable Energy Investment Tracker summarizes BloombergNEF's tracking of global renewable energy investment through the first half of 2022 and covers project investments and corporate fundraising.

In addition to seeing investments in expanding projects, the first half of the year also saw an all-time high in venture capital investments and private equity in renewables and energy storage, with US$ 9.6 billion raised – an increase of 63% on the previous year.

China stands out

A China has recorded remarkable growth of investment in financing of wind and solar projects. The country's large-scale solar investments totaled US$ 41 billion in the first half of 2022, an increase of 173% compared to the previous year. US$58 billion was also invested in new wind projects, an increase of 107% year on year.

“Green infrastructure is the most important area of investment that China is relying on to boost its weak economy in the second half of 2022. The investment growth trend follows China's strategy of building new renewable generation capacity so that it can replace its existing coal fleet. China is on track to achieve its solar and wind capacity target of 1,200 gigawatts by 2030,” he comments Nannan Kou, head of China analysis at BNEF.

Offshore wind energy was another sector that saw a sharp increase, with investment up 52% year-on-year to US$ 32 billion.

“Investments in 2022 will flow into projects that come into operation in the coming years, as the offshore wind installed base is expected to grow tenfold from 53 GW in 2021 to 504 GW in 2035. Offshore wind projects enable companies and governments to advance towards your decarbonization goals at scale. The United Kingdom, France and Germany are just some of the countries that have increased their offshore wind energy targets in the first half of 2022, signaling more support for investment in the technology”, analyzes Chelsea Jean-Michel, offshore wind energy analyst at BNEF.