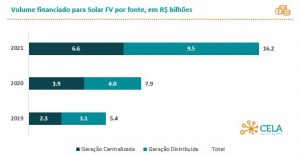

Financing for solar energy generation in Brazil reached the mark of R$ 16.2 billion in 2021, according to a survey carried out by Cell (Clean Energy Latin America), based on data from the main financial institutions that promote the sector.

In total, R$ 9.5 billion was allocated to DG (distributed generation) and R$ 6.6 billion to GC (centralized generation).

This is the third consecutive year that the country has set a record for financing in the sector, which demonstrates a growing interest among organizations in leveraging renewable energy projects.

In the DG segment alone, for example, the sum of resources obtained through loans in 2021 exceeds the entire collection volume of the previous year by more than 100%: R$ 4 million in 2020.

In GC, there was an increase of 70% in the volume financed compared to R$ 3.9 billion in 2020, due to the maturity of solar projects for the free energy market with many contracts signed and leaving the drawing board.

What to expect in 2022?

For 2022, Cela's expectation is that financing for solar energy systems will once again remain attractive, even with a possible increase in interest rates – the result of inflation that is already in double digits.

For GD, the entity believes that the variation in interest rates will be less important if consumers are able to exchange the electricity bill for the financing installment.

In addition, 2022 will be the first year in force of the Law No. 14,300, which instituted its own legislation for the microgeneration and distributed minigeneration segment, which can bring greater comfort to financial institutions.

As for GC, the likely scenario points to a dominance of development banks, such as BNB and BNDES, in addition to the opportunity for financing in foreign currency.

“We believe that, this year, we have everything to double (financing) again in the distributed generation sector. In the centralized (generation), we still have room to grow, but I believe not enough to double (the numbers)”, said Camila Ramos, director and founder of Cela.

She also recalled that, over the years, financing models became increasingly better, such as lengthening deadlines to fit consumers' budgets, which increased people's interest in photovoltaic systems.