With collaboration from journalist Ericka Araújo

For many years, the calculation of PIS/COFINS (Contribution for Social Security Financing) and ICMS (Tax on Circulation of Goods and Services) taxes on the energy bill executed by distributors presented an important conceptual problem, which ended up harming consumers.

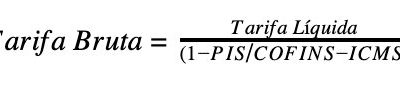

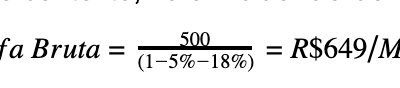

The incidence of ICMS on PIS/COFINS made energy more expensive in the country. This article exemplifies this incidence to better understand how it was carried out and how the calculation between energy distributors in Brazil will be carried out. Old formula:

|

Gross Fare |

649,35 |

|

PIS/COFINS (5%) |

32,47 |

|

ICMS (18%) |

116,88 |

|

Net Rate |

500,00 |

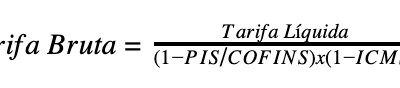

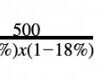

New formula:

| Gross Fare | 641,85 |

| ICMS (25%) | 115,53 |

| PIS/COFINS net tariff | 526,32 |

| PIS/COFINS (5%) | 26,32 |

| Net Rate | 500,00 |

In the practical example, we consider an average PIS/COFINS of 5% and the São Paulo ICMS rate. The value used for the tariff is for example only and does not correspond to the tariff of any energy concessionaire. We conclude that there is a reduction of approximately 1.2% in energy costs. This percentage must vary according to the ICMS rate of the state where the consumer is located.

ANEEL proposes return of tax credits to consumers

Last Tuesday (9), the agency opened a public consultation that aims to discuss how to return more than R$ 50.1 billion in tax credits to consumers, referring to court decisions on the removal of ICMS from the PIS/Pasep and Cofins calculation base on electricity bills. The proposal put out for public consultation by the ANEEL board provides for the return of the amounts through rebates in the next tariff adjustments, within a period of up to five years.

STF decision

In 2017, the STF (Supreme Federal Court) decided that the PIS/Pasep and Cofins calculation basis could not consider ICMS as part of companies' revenue. Several distributors already had similar questions in court, the merits of which ended up being decided in a favorable manner to the claims.

Using August 2020 as the base date, it was identified that, of the total of 53 distribution concessionaires, 49 took legal action against the National Treasury. Among the actions that have already become final and unappealable, R$ 26.5 billion has already been authorized by the Federal Revenue, R$ 7.8 billion does not yet have authorization and R$ 1.2 billion has been deposited in court.

Furthermore, R$ 14.6 billion is estimated for actions that are underway. In addition to discussing the return, the agency also intends to gather contributions on the procedure to be adopted with four other distributors (DEMEI, DME, JOÃO CESA, COOPERALIANÇA) that did not file lawsuits.

Among the distribution licensees, three have final and unappealable actions and five are ongoing. The estimated value for the permission holders is R$ 17.8 million.

4 Responses

How to calculate PIS/COFINS? The Equatorial invoice shows the two separately and not together as in the example

These taxes on my electricity bill are very high, how do I know if this calculation is correct if it is higher than what they would have to charge my bill is at 500 I'm desperate

Congratulations on the article and the level of detail. What was the source of this new calculation basis? I ask because I looked at the technical notes on the ANEEL website that talk about this topic, and I didn't even find a reference for charging with this new methodology. If you could reference the source or what led to the design of this formula, I would be very grateful. Thanks.

It's just a misdirection. Distraction.

The problem is the undue charging of ICMS on the SERVICE for using the distribution network (TUSD).

What circulates is just ENERGY!

The only service that can be charged ICMS is telecommunications, as it does not qualify as consumption.

May God enlighten us so that we see the truth.