Faced with the global need for economic development increasingly less based on fossil fuels, the energy transition is key to promoting a more sustainable future.

In this way, according to the Greener, O investment in renewable sources has been directing and influencing the economy of countries around the world.

“Among renewables, photovoltaic solar source stands out and, depending on certain conditions, it creates an attractive environment for investments and becomes increasingly important in the global energy matrix”, they highlighted.

In this context, the Brazil stands out in generating electricity through the Sun, and, depending on this scenario, analyzing the photovoltaic market becomes essential to ensure its continuous evolution.

Check out below the analysis done by Greener.

Renewables and solar in the world

In an attempt to adapt to decarbonization goals, some nations continue to make agreements that demonstrate commitment to climate control objectives.

Recently, at an IEA (International Energy Agency) conference, forty-five countries, including Brazil, set the goal of doubling the rate of energy efficiency improvements by the end of the decade.

In addition to strengthening the energy security of these countries and diversifying their respective matrices by reducing dependence on fossils, this movement aims to limit global warming to 1.5°C. Furthermore, this goal could boost the world economy and create around 12 million jobs by 2030.

Worldwide, renewables are expected to grow by around 33% by the end of 2023. The capacity of these sources is expected to increase by 107 GW this year, reaching 440 GW, according to data from the International Energy Agency.

“In Europe, concerns about energy security due to the war between Russia and Ukraine have contributed to this growth. Furthermore, volatile fossil fuel prices and incentives for a low-carbon economy by the European government are also relevant factors”, they pointed out.

Analyzing the following graph, Greener highlighted that, since 2016, investments in clean energy in the world have exceeded investments in fossil fuels and each year the difference increases.

Therefore, in 2023, according to the IEA report, of the US$ 2.8 trillion invested globally in energy, more than US$ 1.7 trillion should be allocated to clean technologies. In the context of photovoltaic solar generation, global investment in the source will surpass that of oil for the first time in history.

Brazilian scenario

In the case of Brazil, the federal government, through the CNPE (National Energy Policy Council) and the MME (Ministry of Mines and Energy), intends to launch a policy for energy transition. “The policy must unify actions planned by the government and related to this topic in different sectors”, reported the consultancy.

Furthermore, the country's predominantly renewable electrical matrix stands out due, among other factors, to the participation of photovoltaic sources. In 2022, Brazil was the fourth largest solar market in the world, being the year with the best result in the country's entire historical series.

“With a great influence of projects started in 2022, which aimed at more beneficial rules in the compensation of credits in the case of distributed generation, or the discount on the TUST (Tariff for Use of the Transmission System) and Distribution in the case of centralized generation, the installed power from photovoltaic generation continues to evolve in the country in 2023, accumulating 31.68 GW”, they indicated.

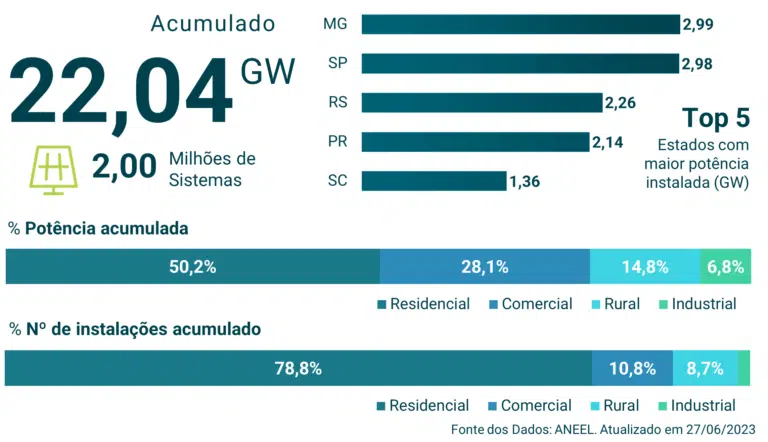

As shown by data from ANEEL (National Electric Energy Agency), within the scope of distributed generation, the number of installed systems already exceeds 2 million.

The DG modality has great strength with installations on roofs, given the prominence of the residential class. Worldwide, 49.5% of photovoltaic installations during 2022 were on rooftops.

Brazil had a large share in this percentage, as the growth in installations on top of homes was 193% when compared to the previous year, according to SolarPower Europe.

On the other hand, the first months of 2023 were challenging for the market. In addition to regulatory changes that modified the way credits are offset, high interest rates and credit restrictions impacted new businesses. “With the drop in the price of the main input used in the manufacture of modules, the market expects a future recovery”, projected Greener.

Expectations of market recovery in Brazil?

In the company's view, it is possible to see the importance of photovoltaic solar generation as a pillar that will assist the energy transition process internationally and in Brazil, and is also an important vector of investment.

“In Brazil, faced with a market that is going through a period of change, understanding the behavior observed in the first half of 2023 by those who work directly in it is fundamental,” they emphasized.

Therefore, Greener is inviting photovoltaic integrators to participate in the GD Survey, which will be launched in the first week of July. “Market recovery involves the need to obtain updated and realistic data that will guide increasingly assertive decision-making”, concluded Greener.