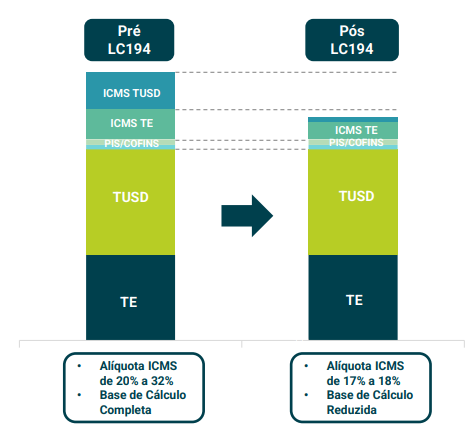

According to MME (Ministry of Mines and Energy), the states that implemented the changes foreseen in the Complementary Law No. 194/2022 are already benefiting their residents.

The norm reduced ICMS rates (Tax on Circulation of Goods and Services) on electricity, fuel, telecommunications and transport, considered essential and indispensable goods.

"A reduction in electricity bills has been, on average, 6.8%. And it could decrease another 6.5%, on average, when states regulate the ICMS calculation basis”, stated the MME in a note.

However, according to research by Greener, there was, in general, maintaining attractiveness in investments in DG (distributed generation), despite the reducing energy costs according to LCP 194.

O Strategic Study: Distributed Generation 2022 | Photovoltaic Market 1st Semester pointed out the factors that contributed positively to profitability. Are they:

- CAPEX reduction, in relation to values at the beginning of the year;

- Increase in energy tariffs due to adjustments made by distributors in the first half of the year.

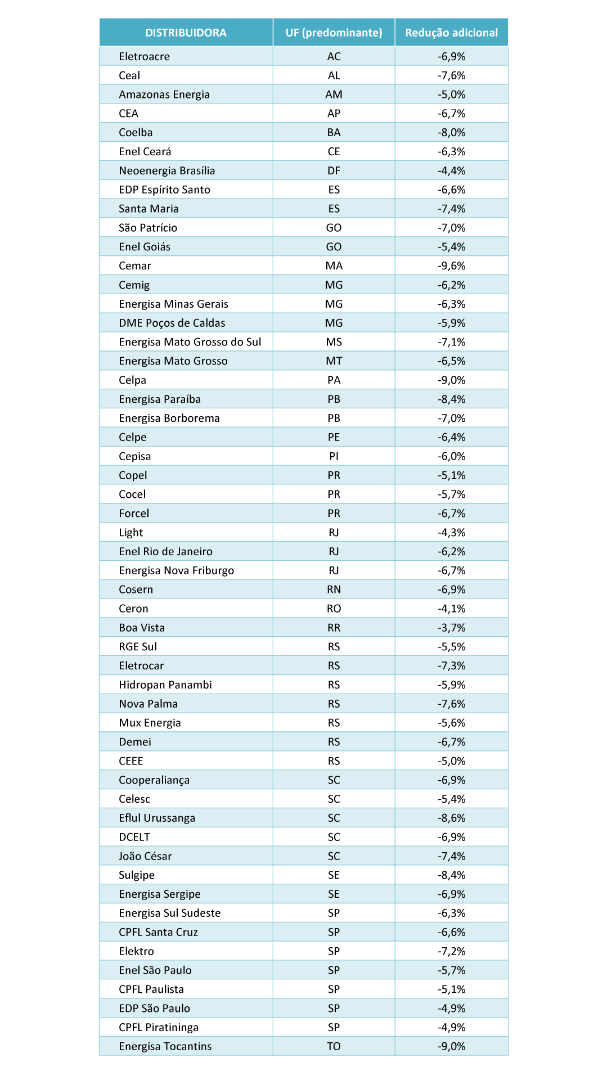

Bill reduction estimate

Below is a table developed by the MME that illustrates the estimated bill reduction with the new ICMS calculation basis, following LCP 194/2022:

According to Greener, for the 35 main distributors in Brazil analyzed, there was a average decrease of 19.1% in the value of the residential energy tariff (B1).

PV installations double

To give you an idea, according to the company report, the number of photovoltaic installations has doubled in the last 12 months, reaching 1.2 million units in the country.

O volume of new installations (2.8 GW) in the first half of 2022 it was 51% higher compared to the same period in 2021 (1.8 GW). GD's growth has been strongly driven by microgeneration (installations below 75 kW) which represents 85% of installed capacity.

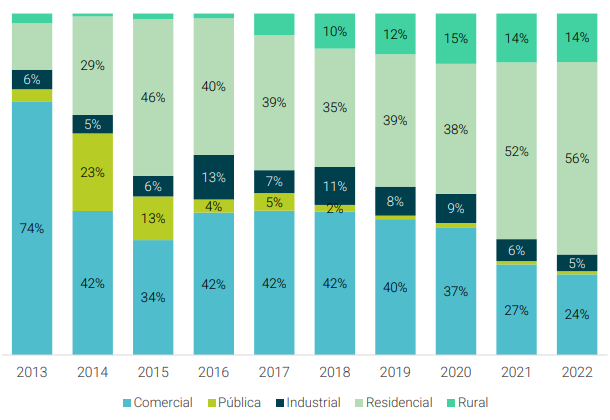

Residential systems lead GD ranking

Another point highlighted in the study is that the residential class continues to increase its participation in the volume of photovoltaic systems added, representing 56% of new facilities. The participation of commercial and industrial classes have been showing a decline, while public and rural remained stable.

How many PV systems were sold in 2021?

A average sales per company in the 1st half of the year was five per month, considering that: companies with less than two years of operation have an average of 2 sales per month, while those with more than two years have an average of seven sales per month. A average sales conversion rate was 13%, an increase compared to 10.1% in the same half of the previous year.

Sales expectation for the 2nd half

In all, 42% from integrators achieved sales above 100 kWp in the 1st half. The expectation for the last six months is that 60% of companies will generate revenues above 100 kWp. The consultancy's forecasts also indicate that one in five integrators expects to earn more than R$ 2.4 million in the 2nd half of the year 2022.