O MME (Ministry of Mines and Energy) published, this Tuesday (12), the potential impact of reducing taxes on electricity consumer bills, due to the Complementary Law (LCP) No. 194, of 2022.

According to the Authority, a potential reduction of 19% in the electricity bill is estimated, in relation to the values of April 2022, after the operationalization of all legislative measures in force.

A LCP nº 194 creates the condition for reducing tariffs, by considering electricity, along with natural gas, fuels, telecommunications and public transport services, as essential and indispensable goods.

In this case, a ceiling of 18% was established for the ICMS rates charged on invoices. Most Brazilian states charged ICMS rates on tariffs that varied between 25% and 30%.

ICMS on fuels and energy: what is the impact on the solar sector?

However, the effectiveness of the measure depends on regulation by the states. According to the MME, the good news is that most of them have already published regulations dealing with the new rates. In relation to Rio de Janeiro, consumer units in the residential, industrial and commercial classes, whose monthly consumption exceeds 300 kWh, will see a reduction of 13% in their electricity bill.

In Minas Gerais, residential consumers will be able to realize, on average, a 16% reduction. In the commercial class, this reduction could reach 9%. In the state of São Paulo, the Authority pointed out that the measure could have an average effect of 9% on residential class invoices.

Regarding Bahia, residential and commercial consumers will be able to see an average reduction of 10% in their bills. “However, not all consumers will have the same perception of this reduction, considering that states can charge different rates, depending on factors such as volume consumed, income, activity carried out, among others”, highlighted the MME in a note .

Furthermore, they highlighted that LCP nº 194, of 2022, determines that ICMS does not apply to transmission and distribution services and sectoral charges linked to electrical energy operations. “This means that the tax calculation base will be reduced, increasing the reduction in energy prices for consumers. However, this reduction depends on changes in state legislation”, they reported.

More factors contributing to the reduction

According to the Ministry of Mines and Energy, the amounts resulting from the Eletrobras capitalization process also contribute to the reduction of electricity bills, due to the Law No. 14,182/2021. On average, in 2022, this measure will reduce the bill by 2.5%.

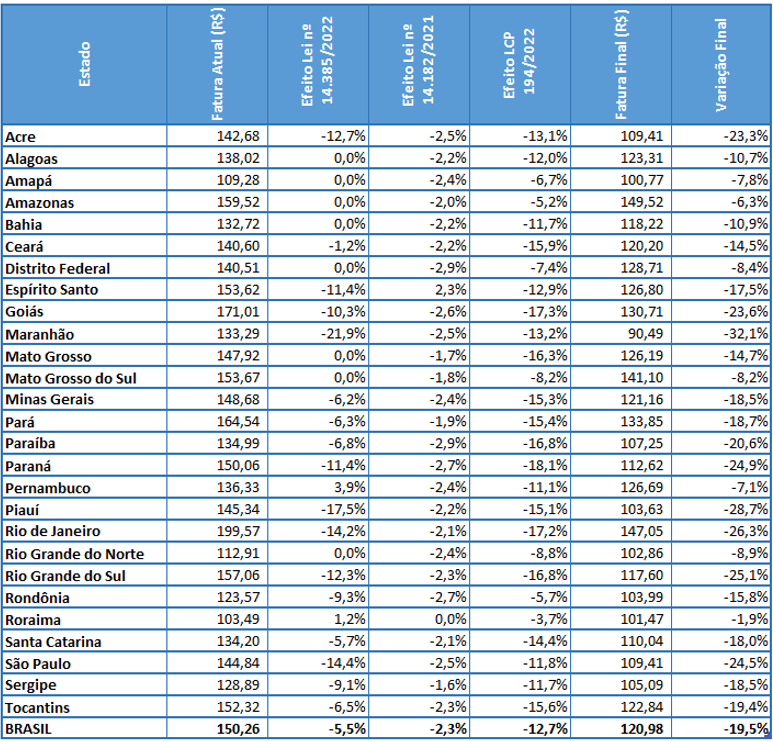

Another measure was the sanction of Law No. 14,385/2022 which returns PIS and COFINS credits to consumers, relieving, on average, an additional 5.50% on the electricity bill. Below is a table made by the MME that shows the impact in all states.