Second report from BNEF (BloombergNEF), O total value of carbon credits produced and sold to help companies and individuals meet their decarbonization goals could reach US$ 1 trillion in 2037.

However, they stated that the so-called voluntary carbon market — which allows the trading of verified emission reduction credits, each equivalent to 1 ton of carbon — is currently not structured for success.

“Stricter definitions of quality and a greater emphasis on carbon removal can increase market confidence, increase prices and boost demand”, they pointed out.

Affected by criticism from the media and investors, the offset market has not increased in 2022, according to BNEF's Long-Term Carbon Offsets Outlook. Companies purchased just 155 million offsets, down 4% from 2021, due to fears of reputational risk from purchasing low-quality credits.

The supply of these credits increased by just 2%, with 255 million offsets created by projects around the world. The supply of “avoided deforestation” credits decreased by a third from 2021 to 2022. Some companies have been accused of greenwashing after purchasing offsets from projects that had a questionable environmental impact.

“Today’s offsets market, created largely from bilateral transactions of cheap credits, is potentially digging its own grave,” said Kyle Harrison, head of sustainability research at BNEF and the report’s lead author.

“Buyers need transparency, clear definitions around quality and easy access to premium supply, or the next few years will look like what we saw in 2022. These changes will generate demand signals for the projects with the greatest decarbonization impact and with the greatest need for investment”, he added.

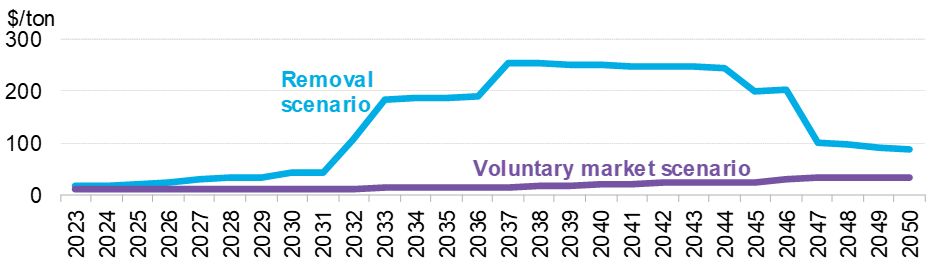

With an eye on 2050, BNEF modeled the supply, demand and prices of carbon offsets in three potential scenarios. Under each, demand would increase, but at substantially different margins. The prices are also drastically different.

Voluntary market scenario

In the first, the voluntary market scenario, companies could purchase any type of carbon offset to achieve their net zero targets and would need 5.4 billion annual offsets in 2050.

According to BloombergNEF, the market would remain constantly oversupplied and 8 billion offsets would be created annually by 2050, mainly to prevent deforestation.

Prices would rise to just US$ 12/ton by 2030 and US$ 35/ton by 2050, allowing companies to resort to cheap offsets of dubious environmental value to achieve their decarbonization goals. In this scenario, the sector would be valued at US$ 15 billion annually by 2030 — above current estimates of US$ 2 billion.

Removal scenario

In the removal scenario, the balance between supply and demand would be much tighter, as only compensation for projects that actually removed carbon from the atmosphere would be considered. Credits related to avoided deforestation or clean energy projects would be disregarded.

In this scenario, they reported that there would be a brief supply shortage in the market from 2037 onwards, as the carbon removal technology, direct air capture (DAC), remains expensive to build on a large scale. Carbon offset prices could skyrocket above US$250/ton, and the annual market would reach almost US$1 trillion.

“An offset market that only allows carbon removal could direct investment towards technologies like DAC, helping to reduce costs. Such high prices could also force some companies to invest in other decarbonization strategies with greater impact”, highlighted the research.

“However, there is a concern that these very expensive compensations in the following years could cause the majority of companies to opt out of this market. This could even lead them to completely abandon their net zero targets, as this would cost them too much,” they emphasized.

According to BNEF, defining what constitutes high-quality carbon offsetting is currently a contentious issue. Investors, companies and nonprofits increasingly recognize that the definition of quality encompasses factors that are difficult to quantify, such as permanence, additionality and benefits beyond decarbonization.

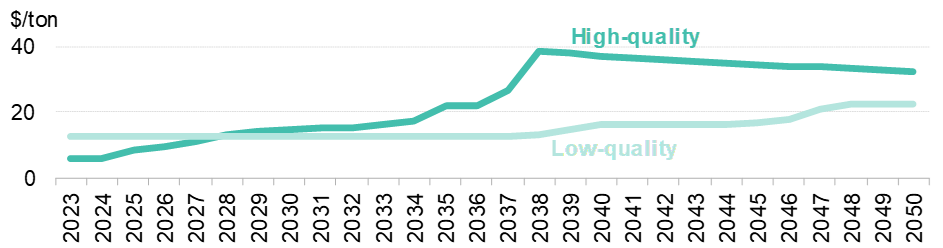

Fork scenario

A third scenario from the consultancy perspective, the bifurcation scenario, assumes that this debate divides the market in two. One is a smaller, less liquid market for high-quality offsets, including technology-based removal and nature-based solutions in Africa, North America and Oceania.

Demand for high-quality offsets only reaches 433 million in 2030 and 1.3 billion in 2050, but buyers face a smaller pool of supply compared to other scenarios in the report, of 1.4 and 3.2 billion in same years. Prices peak at US$ 38/ton in 2039 before falling to US$ 32/ton in 2050.

In this bifurcation scenario there is also, in BNEF's view, a larger market for all remaining low-quality offsets, including power generation and nature-based solutions in Asia and Latin America. Prices are initially higher due to higher demand for US$ 12/ton in 2025, but will only reach U$ 22/ton in 2050.

“Companies that take advantage of this low-quality market may have more conviction that their offsets will meet their net zero goals, but at the same time they may face much greater risk to their reputation than they currently face,” explained.

The outcome of the bifurcation scenario can change depending on what comprises high and low quality. Exchanges, futures products, technology providers and private initiatives like the Integrity Council on Voluntary Carbon Markets are working to standardize and simplify offset purchases by creating clear quality standards.

If these efforts are successful, the study highlighted that standards and quality settings can increase liquidity in the market and help companies and investors differentiate their compensation strategies. However, with so many groups dealing with this issue independently, buyers can become increasingly confused.

“Creating standardized standards is the most important thing for the carbon offset market strategy. Addressing these issues could grow the market by several orders of magnitude, but there is a risk of too many of these competing efforts happening at the same time, similar to what we have seen in adjacent areas such as ESG reporting and sustainable finance,” commented Harrison. “If we continue with this isolated approach, we will end up back at square one.”

2 Responses

It is a market that initially, in my opinion, was only with banks and without much expansion into the market. But with the expansion of clean energy, we must always have more information.

Seriousness is all that any market requires to consolidate itself and the carbon credit market is no exception. We are a country that offers, a priori, good conditions to be able to export this important credit and has the potential to contribute to our favorable financial balance, in dollars. Without a doubt, investment in technology to enable oneself should have a greater appreciation. However, I note that discarding or secondaryizing the importance of renewable energy sources is a myopia that is not justified. We hope that this thought does not spread and predominate.