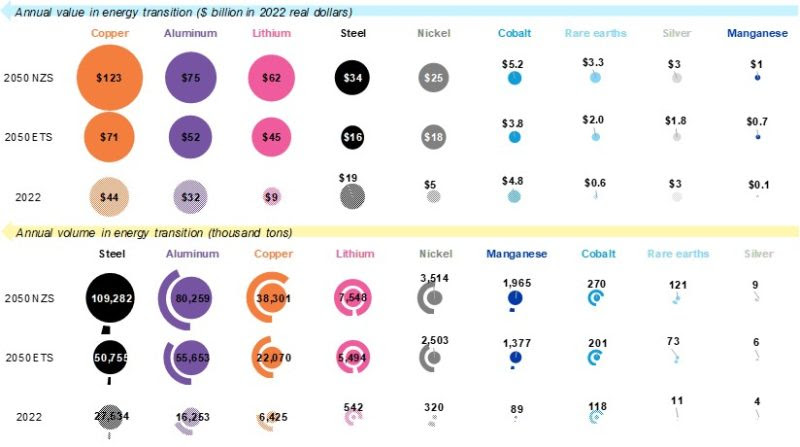

A demand for key metals necessary for the implementation of transition technologies energy, such as solar, wind, batteries and EVs (electric vehicles), will increase fivefold by 2050 - representing US$ 10 trillion in opportunities. This is what the BNEF (BloombergNEF).

Under the so-called NZS (Net Zero Scenario), the consultancy reported that supply, on the other hand, is limited due to a lack of investment, increased risk in countries in relation to mining and the depletion of reserves.

“Such risk remains the main obstacle to the development of new mining projects. The global economic slowdown and the need for countries to secure supplies of critical metals have led to a resurgence of resource nationalism and higher taxes on resources,” the company said.

In BNEF's view, these interventions delay investments in new mines. “Given the importance of these metals to the energy transition, governments must strike a balance between meeting the immediate needs of their local economies and the long-term ambition of a net-zero global future.”

Kwasi Ampofo, head of metals and mining at BNEF, and lead author of the report, emphasized that the energy transition has put raw materials in the spotlight. “This transition represents both an opportunity and a responsibility.”

“Responsible mining must be the pillar of extracting the resources necessary to meet this demand. Mining is the basis of the energy transition, therefore, the industry must lead the way, decarbonizing its own footprint”, he highlighted.

Decline of fossil fuels

Another point highlighted by BloombergNEF is that the energy transition will lead to a decline in materials used in energy generation technologies that use fossil fuels.

In 2050, the demand for metals from power plants based on such fuels (coal and gas) corresponds to less than 6% of the total demand in energy generation in the ETS (Economic Transition Scenario).

That's a drop from around 16% in 2022. Meanwhile, metal consumption in renewables and battery storage more than doubles over the same period.

“Despite the bearish outlook for metals used in fossil fuel technologies, the energy transition could lead to a super-cycle for the metallurgical and mining industry,” commented Yuchen Huo, metals and mining analyst at BNEF.

“This cycle will be driven by major expansions in clean energy technologies, which would drive demand growth for both critical minerals and traditional metals,” he explained.

Investments in the extraction of raw materials

According to the company, the energy transition requires significant investments in the extraction of raw materials. “This coincides with a period of reduced investor confidence in mining.”

This lack of confidence is the result of several interrelated factors that include recent market volatility and the complexity of new mine development.

BNEF pointed out that a promising way for companies to overcome the hurdle of raising capital is to improve their ESG performance. This will allow them to distinguish themselves in the capital markets.

“The mining industry has a triple challenge – increasing supply, keeping costs low and reducing its environmental and carbon footprint simultaneously. It's like having to find the solution to a Rubik's Cube. It’s not easy, but it’s not impossible either,” concluded Ashish Sethia, global head of commodities, energy markets and environment at BNEF.