A tax reform (PEC 45/2019) was approved in Senate on November 8th without recognizing the essential nature of electrical energy.

With this question open, the electricity sector remains concerned that the change in taxation will increase the electricity bills of more than 89 million Brazilian consumers, he assessed. Claudio Elias, Director of Tariffs at Volt Robotics.

The reform aims to simplify the tax system, making it more efficient, transparent and equitable. The idea is that simplifying taxes will make it easier for taxpayers to understand and comply with tax obligations and create a more favorable environment for business and investment, stimulating economic growth and job creation.

With the reform, the Dual VAT (Value Added Tax). The replacement of current taxes will be done as follows: CBS (Contribution on Goods and Services), which falls under the Union's jurisdiction, will replace the IPI, PIS and Cofins; and IBS (Goods and Services Tax), under the jurisdiction of the states, Federal District and municipalities, will consolidate the ICMS and ISS.

According to Elias, an issue that is at the heart of tax reform on consumption is the essentiality of certain activities, which has implications for the rates of new taxes.

If electricity is not included in the concept of essentiality, there is a risk that states will increase energy tax rates, in order to compensate for revenue losses.

Recognition of essentiality would be a way to limit the power of states to increase taxes on energy. “It is not known how the rates will be calculated, but the expectation is that with the recognition of essentiality, at least there will not be an increase in the situation we have today”, said the director.

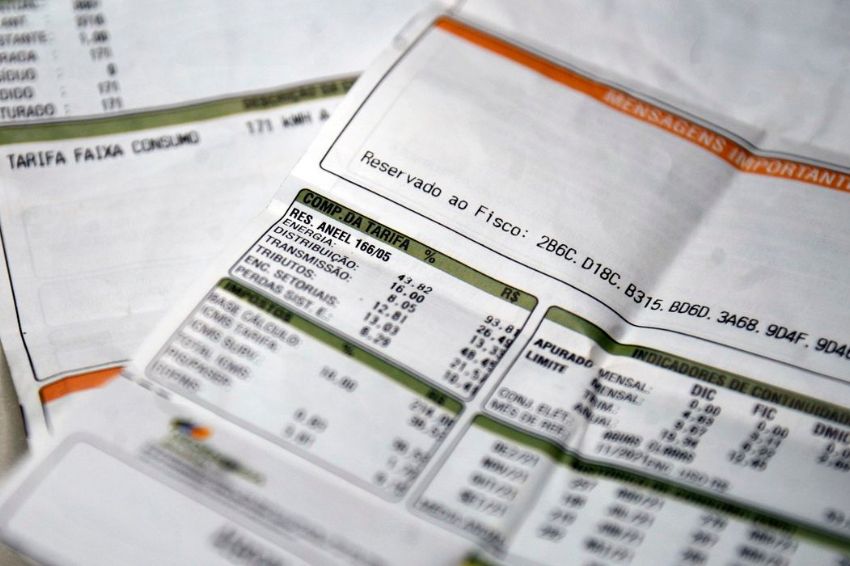

The energy tariff includes ICMS, PIS/Cofins and CIP (Public Lighting Contribution). According to consultancy Volt Robotics, taxes represent 27% of the electricity bill, with 18% representing ICMS and 9% representing PIS/Cofins.

Elias explains that the ICMS on electricity, in some states, is one of the biggest revenues, as it has a high collection and low default rates.

Last year, the National Congress and the STF (Supreme Federal Court) recognized the essentiality of electrical energy at Complementary Law No. 194/22, limiting the ICMS rate on energy to 18% in all states (although some states have obtained court decisions to increase the tax above this ceiling). Previously, each state defined its ICMS rate.

Cashback for low income

Another concern surrounding the reform is how the tax treatment will be for certain classes of consumers who are tax-exempt, such as low-income consumer.

“The reform as it was being considered would end these exemptions,” said Elias. “This is a very relevant point because it could generate an increase of more than 30% for low-income consumers”, he added.

To resolve the issue, a cashback system, where the consumer would pay taxes, but would later receive that money back. The measure applies to low-income families and includes the consumption of gas, electricity and other products.

“There is a big complication because cashback assumes that the consumer pays and receives it later. You give him an increase and then he receives it. It is a system that is bound to cause problems in implementation and will end up costing the consumer”, argues the director of Volt Robotics.

One of the proposals from electricity sector associations is to recognize tax exemption for this class. But if the idea of cashback remains, the money must be returned simultaneously, in such a way that the consumer pays and receives at the same time, so as not to generate a flow of payments.

Selective Tax

The PEC also provides for the creation of IS (Selective Tax), with the aim of taxing products that are harmful to health and the environment, such as cigarettes and drinks.

The final text of the reform excluded electrical energy from the IS, as it was understood that the electrical sector could not be penalized despite part of the energy generation coming from thermoelectric plants powered by coal, oil and natural gas. “This was an achievement for the sector,” said Elias.

The tax reform returned to the Chamber of Deputies, where the original text came from, because it was modified in the Senate.