After two weeks since latest release of its weekly newsletter, the InfoLink Consulting updated the international photovoltaic market this Thursday (22). How was expected, market prices remained stable after the end of Chinese New Year.

The consultancy predict although modules, wafers, and polysilicon must continue in this vein next week. However, P-Type cells are expected to see price growth.

Check out the main points raised by the research and consultancy company's new study regarding the price of products and inputs that make up the global photovoltaic chain:

Polysilicon

Demand for the input rose after the Chinese holiday, due to stable use this month in the ingot segment. Including the holiday period, in addition to the creation of stocks in the period before New Year. Polysilicon currently sells for US$ 21.5/kg.

Due to current market dynamics, polysilicon sellers and buyers will be at an impasse regarding input prices. Furthermore, the price may vary depending on operations in the silicon market, sales price and production.

Wafer

N-Type wafers have increasingly grown on the international market. The volume of these wafers will reach 43 GW in February, which represents 73% of the market. This affected the supply and demand of p-type wafers.

Therefore, prices will vary in relation to different formats. While n-type M10 wafers should continue to have reduced prices, those with p-type M10 technology may experience small increases in value, amid the technological transition.

Cells

The price of cells rebounded shortly after the drastic reduction in production. Manufacturers are looking to increase prices, but this depends on the economic viability of module producers.

PERC p-type technology cells continued to sell for US$ 0.052/W. The consultancy predicts an increase of up to 3% next week. Meanwhile, TOPCon cells are coming out at US$ 0.062/W.

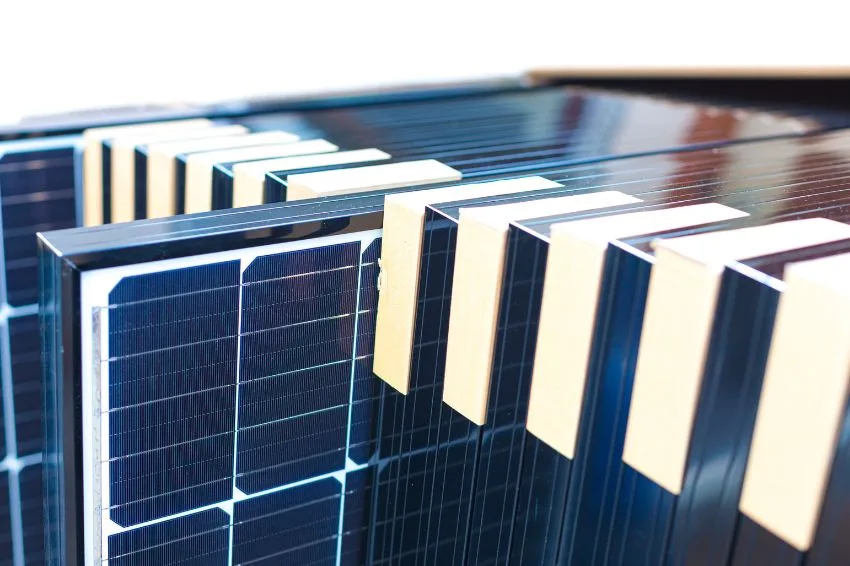

Modules

The effect of the holiday reverberated in the modules market, with fewer deliveries this week. The component had stable prices, with PERC technology modules sold at US$ 0.115/W for monofacials and bifacials at US$ 0.12/W.

Those with greater efficiency, such as HJT (heterojunction) technology, had a value of US$ 0.15/W. Modules with TOPCon technology stabilized at a value of US$ 0.13/W.

All content on Canal Solar is protected by copyright law, and partial or total reproduction of this site in any medium is expressly prohibited. If you are interested in collaborating or reusing some of our material, we ask that you contact us via email: [email protected].