On January 7, 2022, the President Jair Bolsonaro sanctioned Bill 5829/2020, giving rise to Law 14,300, which regulates DG (distributed generation) in the country. On one side, entities are celebrating the approval of the project, on the other, integrators are lamenting.

The fact is that many simply don't understand how to calculate the impact of Wire B in energy bills, which is fundamental to effectively understand the concepts and how these calculations are carried out, so that they can effectively position themselves and instruct their customers.

Law 14,300 does not only deal with Fio B, but deals with conditions for future tariffs and also other matters, covering not only photovoltaic solar energy, but also incorporating other forms of energy generation interconnected to the SIN (National Interconnected System).

However, effectively understanding what Fio B is and its concepts is a great step forward for entrepreneurs in the solar energy sector who want to be engaged with the future of the segment.

To understand what the so-called Fio B pricing is about, it is necessary to initially understand what Wire B is. It is worth highlighting that the Fio B deduction only impacts the amount of energy exported to the concessionaire's electrical grid, does not impact the energy generated and consumed instantly in the consumer unit.

Therefore, it is undoubtedly necessary to understand the concept of simultaneity, which will determine the amount that will not be compensated, and consequently, how viable a project connected to the local distributor's network will be after January 7, 2023.

After all, what is Wire B?

To understand what Wire B is, we need to understand everything that makes up an end customer's energy bill. For the purposes of evaluating this article, we are directing our attention only to energy bills from customers falling within the Group B.

One Energy bill is made up of the famous TE (Energy Tariff), referring to the energy consumption of the distribution system, and also by TUSD (Distribution System Usage Tariff). Finally, the tariff flag additional, the contribution to Public Lighting, the Tariff Subsidy (for rural properties) and others.

Wire B is inserted inside the TUSD sphere which is full of tariff components. However, within this article I mention the TUSD Wire A, which are the costs linked to the maintenance and operation of transmission lines, and I also highlight the TUSD Wire B, which are the costs linked to the use of the local concessionaire's distribution network infrastructure to homes, businesses, industries and rural properties.

When understanding what Fio B is, I will mention here article 27 of Law 14,300, which deals with the scaling of Fio B tariffs. The excerpt says:

“Art. 27. Energy billing for SCEE participating units not covered by art. 26 of this Law must consider the incidence on all compensated active electrical energy of the following percentages of the tariff components relating to the remuneration of distribution service assets, the regulatory reinstatement quota (depreciation) of distribution assets and the cost of operation and maintenance of the distribution service:

I – 15% (fifteen percent) from 2023;

II – 30% (thirty percent) from 2024;

III – 45% (forty-five percent) from 2025;

IV – 60% (sixty percent) from 2026;

V – 75% (seventy-five percent) from 2027;

VI – 90% (ninety percent) from 2028;

VII – the rule set out in art. 17 of this Law from 2029.”

In this section of the Law, the scheduling of the charging of Fio B is explained, always remembering that article 17 referred to in the VII year of the transition, deals with the delegation of power to ANEEL (National Electric Energy Agency) to determination of the tariff rules that will regulate the class from the year 2029, resulting from the so-called “meeting of accounts” for valuing GD’s costs and benefits.

This way, Anyone who starts their approval process from 1/7/2023 will already be subject to the new rules for non-compensation of Fio B. In other words, if your client connects the project to the distribution network in 2023, they will start paying Fio B on their energy bill in a staggered manner over the years, as per the example below:

- Access Request filed on 1/7/2023: you will pay 15% for Fio B in 2023, 30% for Fio B in 2024 and so on sequentially until the seventh year of transition where you will be paying 90% for Fio B plus the percentage that ANEEL determines or not after valuing GD benefits;

- Access Request filed on 1/7/2024 will pay 30% for Fio B in 2024, 45% for Fio B in 2025 and so on sequentially until the seventh year of transition where you will be paying 90% for Fio B plus the percentage that ANEEL determines or not after the valuation of the benefits of GD.

Does Wire B represent 28% of my energy bill?

The answer is no, Wire B does not represent 28% of the energy bill pricing. Fio B is an absolute value, calculated annually by the concessionaire and validated by ANEEL. The percentage of 28% was adopted as an average value for some analyzes by sector entities, however, it is essential that everyone understands how to value in absolute monetary units in R$.

After all, there are large variations from concessionaire to concessionaire as the value of TUSD Fio B depends on an analysis of the population density of each concession network (calculated by the concessionaire). The more optimized the UCs (Consumer Units) x Concession Area relationship, the cheaper the TUSD Fio B value should be.

For example: CPFL Paulista has a large volume of consumer units within its concession area, meaning that the total cost of TUSD Fio B is diluted across many units, thus reducing the final cost of using the infrastructure of the distribution system between all consumers in this region.

Equatorial Pará has a very comprehensive Consumer Units x Concession Area relationship, meaning there is a smaller number of consumer units (compared to CPFL Paulista) for a concession area spread over a very large territorial area. This impacts the final costs of using the structure, with this same cost being divided by few consumer units, therefore increasing the final value of the TUSD Fio B.

For comparative purposes we have (data from January 10, 2022):

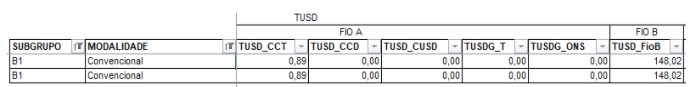

CPFL Paulista: (State of São Paulo)

- Residential tariff B1 Conventional: R$ 0.82

- Tusd Wire B: R$ 0.1480

- Percentage of TUSD Fio B over the Tariff: 18%

Equatorial Pará: (State of Pará)

- Residential tariff B1 Conventional: R$ 0.76

- Tusd Wire B: R$ 0.3768

- Percentage of TUSD Fio B over the Tariff: 50 %

According to the data above, in the comparison between the state of São Paulo in the CPFL Paulista concession area and the state of Pará in the Equatorial Pará concession area, it is possible to note that TUSD Fio B impacts very differently in the different states and concession areas of the country, and it is up to each one to individually assess this impact according to the concession area of their clients.

To find the TUSD Fio B value, it is necessary to consult the results of ANEEL's distribution tariff processes and download the tariff structure of the distributor in the concession area subject to consultation. Using an Excel spreadsheet in the TA Application tab, it will be possible to find the TUSD Fio B.

Simultaneity and its role in Fio B pricing

When any company is called upon to provide a quote for a photovoltaic system, various data are taken into consideration to determine the sizing and proposal to the end customer. However, the most used method, in a simple and objective way, is the sizing of the system based on the potential customer's historical consumption data.

When a photovoltaic system is designed, the simultaneity factor is rarely taken into consideration by the company that quotes the system. But this scenario changes a lot and it is necessary to understand and analyze simultaneity in a post-Law vacancy scenario.

But anyway, what is simultaneity?

Let's create a hypothetical scenario by creating the characters José, Maria and family.

Imagine that Mr. José is a family man, married to Mrs. Maria and they have 2 children. Every day of the week, Mr. José, Ms. Maria and their family wake up at 6 am, have their coffee, and at 7 am everyone leaves the house. Mr. José and Mrs. Maria go to work, where they stay until 6pm and their children go to full-time school where they stay until 5:30pm.

During the day, while no one is home, the home's energy consumption is very low, limited to the television, water cooler and refrigerator connected to the sockets. From 5:30 pm onwards, when the children arrive from school, consumption starts to increase.

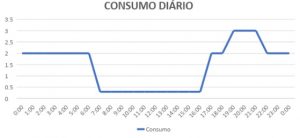

Baths in electric showers began and more constant use of other equipment began. The air conditioning units in the living room and children's bedrooms are turned on, and this consumption pattern remains until 6 am. The graph below expresses the energy consumption of Mr. José and Mrs. Maria's family over 24 hours on a normal weekday.

After several increases in the family's energy bill, they decide to purchase a photovoltaic solar energy system. The solar energy system designed to meet its consumption was a 4.5 kWp system with two 1.5 kW micro inverters, totaling a nominal power of 3 kW.

On a cloudless day in spring, Senhor João's solar energy system begins operations at 6 am, reaching peak power at 9:45 am. It remains in this operating state until 2 pm and ends its operating cycle at 6 pm. The energy generation by the system acquired by Mr. José is shown in the graph below:

To understand what simultaneous consumption or simultaneity is, we need to analyze the graphical representation of daily consumption X generation as follows:

The graph above has three important regions that need to be highlighted, which are:

- Region of active consumption outside the moment of generation;

- Injected energy region;

- Concurrency Region.

The graph below serves to illustrate and facilitate understanding of what each area represents.

In the area shaded by the red pen we have the active consumption of the network. In the scenario evaluated, the family has a large consumption during the period in which they are at home. This consumption represents the period in which the family is continuously using the electricity distributor's network.

In the area shaded by the green pen we have the Injected energy. In the conventional logic of a residential system, what happens is the generation of excess energy during the day to accumulate credits that will be deducted from consumption during periods of little solar generation (beginning of the day and at night). In this way, this area represents the energy that is “left over” during the day and is injected into the electricity distribution network, which will be consumed instantly by someone in the neighborhood.

In the area shaded by the blue pen we have simultaneous consumption (Simultaneity). This area represents the energy that is consumed simultaneously during the generation period, that is, the unit generates energy and consumes it simultaneously. This energy does not pass through the energy meter, therefore, Wire B will not be charged for this portion.

The area shaded in blue is the main point of need for understanding to quantify the impacts of Fio B on consumers' energy bills, as simultaneous consumption is not subject to charging so far, as it does not require use of the local network. energy distributor and also does not provide energy on the local grid.

In the understanding of the defenders of Law 14,300, the use of the local concessionaire's infrastructure in periods where there is no energy injection (area hatched in red pen) must be charged in the Fio B payment method for this period of consumption.

A very conflicting point of Law 14,300 is that the energy injected into the grid (area shaded in green) also relieves the distribution system and the consumer does not benefit from providing this relief, he will only have the obligation to pay Wire B, not being a two-way street between energy consumer and distributor.

Therefore, the calculation of the percentages of Fio B will be determined based on the injection of active energy into the local energy distributor's electrical network.

Calculating Wire B in practice

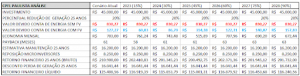

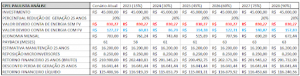

We finally arrive at the central point of this article, which is discovering how to effectively calculate the impact of Wire B on the energy bills of a B1 residential customer. We are also considering that the TUSD Fio B and the supply tariff will not change over the years to facilitate understanding. For calculation purposes, we did not isolate the ICMS deduction in TUSD compensation, so that the scenario is as close to the real one.

Also for calculation purposes, we will simulate the impacts on an energy bill in the state of São Paulo (CPFL Paulista) and the same impact on an energy bill in the state of Pará (Equatorial Pará).

- Simulation data: B1 Conventional three-phase residence

- Family consumption profile: For this study, we will adopt the same consumption as that of the family of Mr. José and Mrs. Maria, mentioned above.

- Average monthly consumption: 1000 kWh;

- Average simultaneous consumption: 200 kWh;

- Average consumption distribution network: 800 kWh;

- Standard B Wire: corresponds to Fio B collected on January 10th on the ANEEL website;

- Proportional fee: corresponds to the value in reais of Fio B multiplied by the charging percentage corresponding to the reference year;

- Distribution network consumption: corresponds to the minimum three-phase tariff of 100 kWh multiplied by the energy tariff with taxes;

- Account Law 14,300: corresponds to the simulated average consumption of the distributor's network (800 kWh) multiplied by the proportional value of wire B to be paid.

In the simulation, the year 2029 was not considered, because the additional tariff (or not) that will be determined by ANEEL until the month of June 2023 has not yet been defined, the date on which the 18 months for valuing the benefits and GD costs.

Many doubts still exist regarding the cost of availability. The example above is not quantified for new entrants after the expiration of the law's vacancy period. Therefore, I will mention Article 16 of Law 14,300 in a commented way to exemplify why the availability cost no longer exists:

“Art. 16. For compensation purposes, the injected energy, surplus energy or energy credit must be used up to the limit in which the value in currency related to the billing of the consumer unit is greater than or equal to the minimum billable value of energy established in current regulations.”

This section of the law eliminates the duplicate availability cost, which has always been questioned, and implements such elimination immediately for all those referred to in article 26.

This deals with consumers who already have solar energy projects or who are going to submit an access opinion up to the vacancy limit, therefore, the doubling of the availability cost that was previously charged in monetary units and also in credits is immediately eliminated. compensation. Now you will only be charged in monetary units.

However, we must also understand another section that is a paragraph within Art. 16.

“§ 1 For consumer units participating in the SCEE not covered by the caput of art. 26 of this Law, the minimum billable value of energy must be applied if the consumption measured in the consumer unit, disregarding compensation from the SCEE, is lower than the minimum billable consumption established in current regulations.”

This paragraph of article 16 is fundamental to understanding what new accounts look like. To understand it, I'll break it down:

“§ 1 For consumer units participating in the SCEE not covered by the caput of art. 26 of this Law”

This section refers to all those who are not beneficiaries of the acquired right under the current rules, that is, those who requested their access opinion after the vacancy.

“the minimum billable value of energy must be applied if the consumption measured in the consumer unit, disregarding compensation from the SCEE, is lower than the minimum billable consumption established in current regulations.”

In a simplified way, this text says that, when defining whether there will be a minimum tariff or not, the active consumption registered will be observed. I will give a practical example.

Examples of a three-phase residence, whose minimum billable value is calculated based on 100 kWh.

- Residence consumed 80 kWh from the grid

Regardless of the quantity injected, the amount corresponding to 100 kWh must be invoiced. This is because 80 kWh is less than the minimum billable quantity.

- Residence consumed 200 kWh from the grid and injected 200 kWh into the grid

As the amount consumed is greater than the minimum billable amount, there will be no minimum tariff charge, therefore, payment of 200 kWh multiplied by Fio B, multiplied by the percentage proportional to the year of project access request, is due.

Therefore, this section of the law is essential for everyone to understand, as it eliminates the charging of the availability cost as long as the consumer unit has consumed from the network at least the minimum billable consumption of the classification class, being 30 kWh for single-phase installations, 50 kWh for two-phase installations and 100 kWh for three-phase installations.

As we can see in the previous analysis, in the case of CPFL Paulista where there is greater density, Law 14,300 starts to be harmful to the consumer's Payback only from the fifth year onwards. It is always worth mentioning that this calculation only considers Fio B, depending on the decision of the meeting of accounts, the result could be much worse even for places with less population density.

In the case of the state of Pará, the reversal of accounts already occurs in the second year of the law's transition, harming consumers' payback and meaning that in the sixth year of transition the amount paid by Fio B is 3.57 times greater than the amount that would be paid for the minimum tariff.

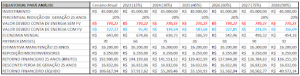

In the context of payback, much was said about increasing consumers' return on investment by just one year. In this context, we will also carry out a financial analysis of the investment, considering the current scenario and the future scenario. For valuation and technical analysis, the following data were taken into account:

- Simulation data: Project for 1000 kWh hour;

- Investment: R$ 45,000.00;

- Analysis period: 25 years;

- CPFL energy tariff: 0.82 cents;

- Equatorial Pará energy tariff: 0.76 cents;

- Generation reduction percentage: 20% in 25 years;

- Maintenance cost estimate: 1.5% of investment value per year;

- Microinverter replacement: Value for purchasing 4 new microinverters for this system;

- Gross Financial Return: Amount saved over 300 months or 25 years;

- Generation loss discount 25 years: Monetary value proportional to the generation reduction of 20% in 25 years;

- Net Financial Return: Total amount saved in 300 months by subtracting all costs in the same period;

- Relevant Note: For comparison and understanding purposes, annual inflation and monetary adjustments to the tariff were not considered, considering that, with small variations, monetary corrections to the tariff occur in the same proportion as inflation. Variations in the acquisition costs of this same photovoltaic system over the years were also not considered.

In a simulation at CPFL Paulista, the project currently (with current rules) has a payback of 61 months. Those who install a photovoltaic system at the beginning of 2023 will have a payback of 58 months. Those who install their projects from 2024 onwards will already have payback similar to the current one, and then the payback increases, year by year, at the rate of approximately one month per year.

In cases like CPFL Paulista, where Fio B is relatively cheap in proportion to the total energy tariff, the impacts of the new Law are not so drastic.

The big problem is that those who acquire their systems from the year 2025 onwards may already have a drastic variation in their payback depending on ANEEL's decision regarding the matching of accounts, which may only maintain the TUSD Fio B pricing, or you can also implement alternative 5, where the consumer will not compensate all tariff components of an energy bill.

Pará Equatorial Simulation

In a simulation scenario in Equatorial Pará, the scenario can be considered disastrous and catastrophic. Consumers who purchase the photovoltaic system in 2023 will already have a payback increased by 9 months, considering only the Fio B tariff.

Conclusions

The old Bill 5829/2019 was actually approved and became Law 14,300/2022. The topic continues to spark controversies and discussions among entities representing the sector. It is essential that the integrator understands how the project impacts their reality in order to know how to position themselves.

There are several inconsistencies in the discourses in the political sphere and in the sphere of representation of the Photovoltaic Solar Energy class. A great incongruity is associated with the democratization of clean energy, where there are several speeches mentioning that the law helps and facilitates the acquisition of photovoltaic systems from the consumer's point of view, and also encourages the integrator.

However, what we actually see is that the North and Northeast are being heavily penalized with the charging of Fio B. States such as Pará, Maranhão and Piauí will first suffer the impacts of the new form of pricing, therefore the discourse that Fio B favors the poorer and democratizes the sector falls apart when we analyze that the state of Pará, for example, is in 23rd place in the poverty index with a staggering 19.2% of poverty.

The State of Maranhão, heavily affected by Law 14,300, is in last place in the country's poverty ranking, with 26.3% of poverty. Therefore, the poorest are being most impacted. This is an example of incongruity.

The time is for study, training and union of those who truly defend the solar energy market. Study to be able to draw your own conclusions about the law and the national scenario, training to be able to provide consultative service to customers who need more technical solutions, and, finally, bringing together those who really represent the solar energy market. This union will be essential to try to limit the negative impact of the project on energy bills.

As a final conclusion, my personal recommendation is that we fully focus our attention on the criteria and valuation studies that ANEEL will carry out in relation to the benefits and costs of distributed generation.

The result of this study could even completely sink the solar energy market. If we do not engage in demanding representation in the analysis, if we do not get involved in public consultations, we can expect the worst.

19 Responses

hello.

Whoever has a plant to sell energy, then what will be sold to the customer will be discounted from the customer and then there will be a minimum loss.

Good content Ricardo. Do you have the current Aneel standard factor that breaks down how much of the TUSD is the FIO-B portion by state?

I know that today Aneel is reviewing this value, but the current one on the Aneel website is no longer available. Suddenly Aneel's link disappeared, I'm looking for this history for future comparison.

If you have it and can share it, it will be of great value so that we can all evaluate what they will do in terms of the evolution of FIO-B in the coming years!

Hugs!

Good content.

But depending on the State, the values are totally different.

In addition to this new taxation which will be on top of the TUSD wire B, here in the state of Rio de Janeiro the State Government authorized the charging of 32% of ICMS on top of the TUSD which gives an approximate value of R$ 0.22 per kWh injected ( used as compensated credit) … With just this value of ICMS for a customer who injects 1000kwh into the network and uses these 1000kwh as compensation, he will pay approximately R$220.00 per month + minimum tariff + public lighting + tariff flag on top of GD . As a customer with a two-phase connection, they will pay around R$ 360.00 reais per month with the new rule, in addition to the 32% ICMS, there will be another 15% in 2023... Only in this situation here in the state of Rio de Janeiro, using the same In the example above, the bill would still have an increase of approximately R$ 90 reais on top of R$ 360.00. Reaching a total of approximately R$ 450.00. For large customers, the increase in electricity bills may be even greater.

A saving of approximately 55% only. Taking into account the amount invested, it may not be very interesting for the client to make a large investment with a low medium and long-term return…

The best solution to be free from these tariffs is to develop off grid systems... the future needs to become present as soon as possible...

Ricardo, I was looking for something like what you did an hour ago, a practical explanation, demonstrations. Your article is simply PERFECT, congratulations and thank you very much!

Hi Ricardo,

Congratulations on the explanation, clear and objective.

I thought they were going to explain

Can you help me with this doubt.

Will this rate be based on the total injected, or the surplus that remains?

You injected during the day and used it at night, will you be charged on top of what you used at night in this case?

It's difficult to understand.

Will this minimum consumption tax no longer pay?

From what I could understand from reading law 14,300/22, the intention of regulating the renewable energy sector, although positive to provide greater legal certainty, obviously came under great pressure from concessionaires/permissioners, who defend tooth and nail their “rights”. ” and privileges, the great danger in my opinion is that the time has come for “valuation” and “accounting” which still depends on Aneel regulation and just like a judge’s head and a child’s bottom, no one knows what can come out, the The time is now, let's encourage our customers to rush to close their orders as the only way to guarantee the current conditions until 12/31/2045. As for the other latecomers, we can only pray that their sentences are at least bearable.

Best explanation I've ever read, very detailed. But we should raise this discussion exactly as this text mentions. Residential solar power producers do not use the B wire!!! Considering that the energy injected by the residential producer goes to the next closest connected consumer, it often does not even pass through the network traffic. It must be noted that in this case the local concessionaire invoiced this energy for itself and stopped purchasing energy, reducing the need for thermal generation and relieving hydroelectric plants. This invoiced value of residential solar generation is not taken into account, which I understand to be a penalty applied to the producer.

Ricardo, your dissertation was “surgical” from a practical point of view for understanding the Law.

The fact is, that we once again observe the strength of the Lobby of large energy distribution companies over the legislative branch.

When it comes to “business”, electric energy concessionaires and licensees NEVER, I repeat NEVER, suffer any loss…

Losses in distribution (the further the generation/plant from the point of consumption, the greater the loss)? this value is shared with all consumers;

“Cats/energy theft”? idem;

Do you need to connect thermoelectric plants with a higher cost 60%? Idem.

Any and all occurrences that directly or indirectly negatively affect the financial results of these companies, this “loss” is paid in the form of a distribution among millions of consumers…

As “Tom Cruise” would say in the character of Jerry Maguire from the film of the same name: Show me the Money…

Congratulations Ricardo Marques,

The article is excellent for anyone looking for information about the future scenario of the PV sector.

The training and professionalism of those involved in the follow-up will really make all the difference in the market.

The important thing is for the sector to come together and increase representation to actively participate in the activities assigned to Aneel for the 18 months described in Law 14,300/2022.

Always count on me.

Célio Nascimento (Enerpplan Energia – Sorocaba/SP)

Congratulations Ricardo Marques! Excellent explanation! A real class!

Quite complex for laymen to understand, but really, anyone who at least reads it will come out ahead.

Congratulations on the explanation

Very good article!

Ricardo is a beast.

Matter without mi-mi-mi.

Slap in the face of many!

Excellent material, almost a master's thesis. Few will take the trouble to dedicate a few minutes to its complex reading, but those who do will be ahead.

And what's more, whoever does this will not sell something that they cannot deliver due to lack of knowledge, bad faith or negligence and will avoid a possible failure of the company.

And the scenario could be worse if ICMs and all tariff components are considered. In a scenario where microgeneration along with the load contributes too much to the local distribution network, the consumer should even be rewarded. We should divide this valuation by micro generation and mini generation and we will have something more real because while micro can have up to 63% in rates, plants will have a reduction of up to 60% with tusd-g demand. That doesn't make any sense.

Hello, I believe that the solution to this problem is the adoption of hybrid systems with battery storage, thus avoiding sending excess energy to the grid and consequently not paying wire B and other aggregate fees. I believe that economic analyzes should be carried out considering this new component in the systems.