The year of 2023 must be marked by extreme tariff repositioning, as has been the case over the last 10 years.

However, unlike what was observed in previous years, the market-weighted average repositioning of energy distribution concessionaires should be close to zero.

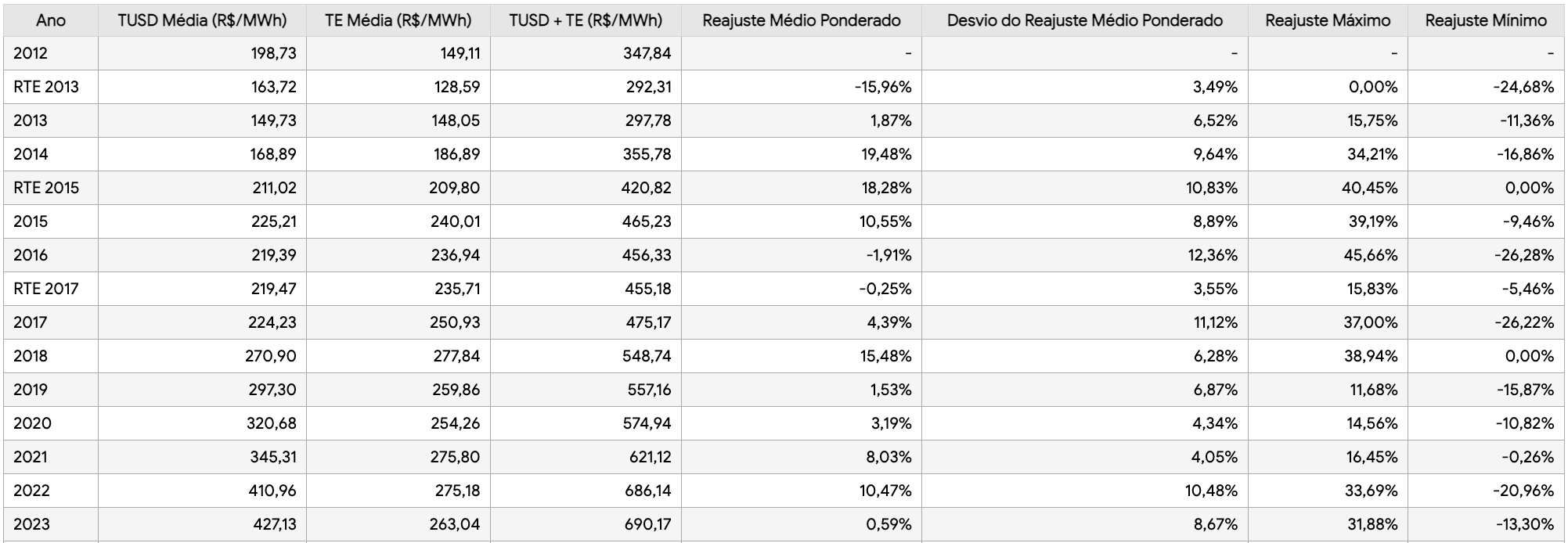

Table 1: Results* of tariff processes (average, maximum and minimum) and deviation from the weighted average adjustment for consumers in Subgroup B3

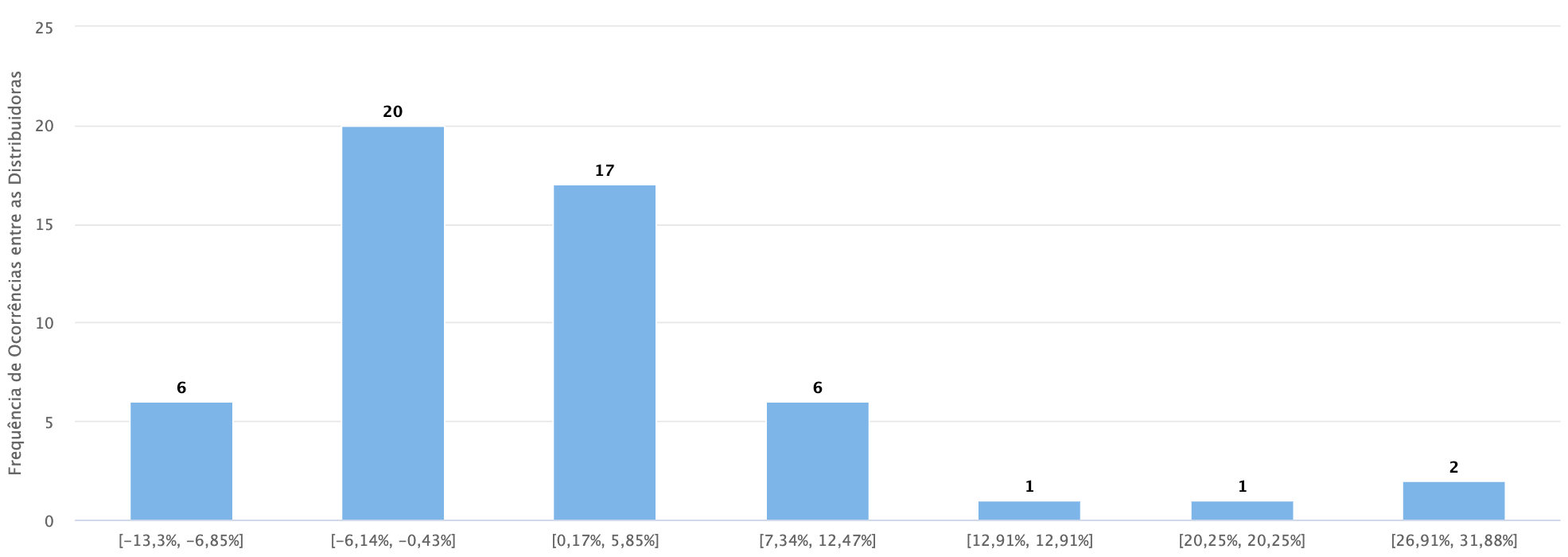

Considering, specifically, the industrial and commercial consumers connected at low voltage, TR Soluções projections show that 95% from distributors will present repositionings between drops of -8.08% and highs of 9.26%.

It is also worth highlighting the fact that the maximum variation should be an increase of 31.9%, while the smallest variation to be observed should be a drop of 13.30%.

The projection observation frequencies, by number of dealerships and projection intervals, are presented in the following graph.

Considering the history of tariff variations over the last ten years, highlighting the results observed in 2015, when values were pressured by the end of contributions from the National Treasury to the CDE (Energy Development Account) and by the costs of contractual exposure to which distributors were subjected in the previous year.

On average, that year a repositioning of 31.7% was observed, while the deviation from the weighted average adjustment considering 95% of occurrences was 13.5%.

It is important to note that these indicators combine the effects of extraordinary tariff reviews (RTE) and ordinary events carried out after them, throughout 2015.

That year, the maximum variation, of 58%, occurred in the former CPFL Jaguari. The second biggest variation, in turn, was observed by consumers in the metropolitan region of São Paulo, served by Enel SP, whose tariff increase was 55.1%.

The minimum variation, of -9.5%, occurred in Amapá, which was the only distributor to record a negative variation. Then, the smallest variation observed was 8.3%, in Piauí.

Tax credits and energy from Itaipu

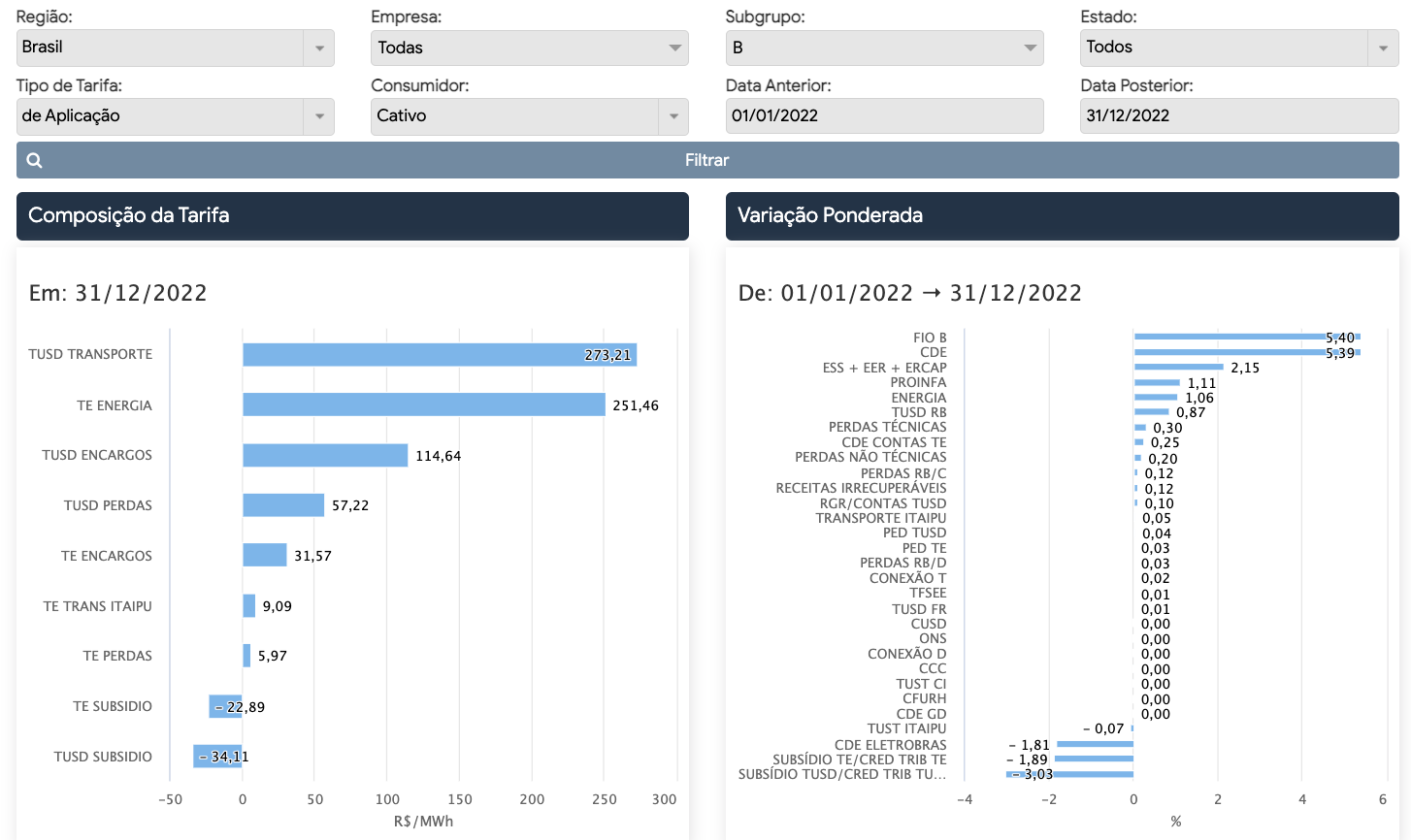

For the year 2023, the reversal of PIS/Cofins credits and the end of payment of construction costs for the Itaipu plant should be the main factors in containing adjustments.

The expectation is that the amount of credits to be reversed in all tariff processes amounts to R$ 13.6 billion, which corresponds to an average relief of almost R$ 0.045/kWh or 6.3%.

As for Itaipu, last December ANEEL (National Electric Energy Agency) published Homologatory Resolution 3,168 establishing a reduction of 34.53% in the Itaipu power transfer tariff for this year.

This reduction is mainly the result of the reduction in CUSE (Unit Cost of Electricity Services) due to the end of the amortization of the loan for the construction of the plant and should result in an average decrease of 4.5 percentage points in the variation in the tariffs of the quota distributors.

Another highlight favorable to consumers concerns the amount to be contributed to the CDE by the new Eletrobras controllers.

This is because, although a contribution of only R$ 575 million is expected for the year – much lower than the R$ 5 billion in 2022 –, the average effect for the consumer should correspond to a greater contribution.

This is because the portion of the R$ 5 billion for 2022 relating to distributors with tariff processes carried out until the beginning of May has not yet been recognized in the tariffs and, therefore, must be considered in the 2023 tariff processes.

On average, Eletrobras' resources in the CDE should represent a relief of around R$ 0.011/kWh (which represents something around 1.5%).

Distributors whose tariff processes take place in the first half of the year should also be impacted by the increase in transmission costs.

This is because the RAP (Allowed Annual Revenue) of concessionaires increased by 31.29% for the consumption segment in the current tariff cycle (from 1/7/2022 to 30/6/2023), mainly due to the resumption of charging related to the Basic Network of Existing Systems (RBSE), whose payment flow was affected by the re-profiling promoted by Aneel as one of the measures to mitigate the variations expected in the year of the pandemic, 2020, in addition to the expansion of the system and authorized improvements.

Encumbrance factors

Other factors that may affect the invoice are:

- Streaming: with a certain increase for companies with an event in the first half of the year, since the transmission fee that will be applied to these distributors (with an event in the 1st half of the year) came into effect from July 1, 2022;

- CDE Accounts: as the 2023 tariff processes begin to amortize the Water Scarcity Account, a loan taken by distributors to alleviate the effects of the 2021 water crisis;

- Reserve Power Charge: due to the fact that fixed revenue has increased, with the inclusion of PCS plants (emergency auction) and the fact that the PLD should remain close to the floor throughout the year. Reserve energy is settled in the short-term market and receives PLD. The difference between the cost of the plant and the revenue from energy priced at the PLD is covered by the charge. This associated with financial effects corrected by the Selic (at the level it has been), represents a small increase compared to 2022.

To obtain the numbers, TR Soluções used SETE, a market intelligence platform for monitoring and projecting electricity distribution and generation tariffs that reproduces tariff calculations in accordance with the procedures defined by the regulator.

The tool allows the user, based on their own assumptions, to interact with periodic tariff reviews and annual adjustments and thus establish their tariff scenarios.

As it is continually updated, users of this system can also carry out simulations of the tariff impacts of any measure adopted by the government or regulator. Click here to access and learn more about the platform.

The opinions and information expressed are the sole responsibility of the author and do not necessarily represent the official position of Canal Solar.

One Response

Hello Paulo Steele.

Excellent publication, very well prepared and complete with important information for consumers and companies in the Photovoltaic sector.

Congratulations! Much success and prosperity in your life.