In collaboration with João Paulo Marçal

At the end of 2021, the Executive Committee of GECEX (Management of the Foreign Trade Chamber) implemented changes to the NCM (Common Mercosur Nomenclature), making some changes to the classifications of goods used to generate electrical energy from solar sources.

Despite being part of our daily lives, not everyone knows the origin of the NCM code, the main identifier of goods. This comes from the SH (Harmonized System) established by the WCO (World Customs Organization).

The HS is updated through the OMA every five years. Its latest update began to be prepared in 2020, with the aim of changing the NCMs to make the classification more specific, as well as reaching a greater number of products, which will only begin to take effect from April 1st of this year.

The NCM assigns an eight-digit code to each item, the first six of which are based on the HS classification, which are distributed as follows:

- i) the first two digits refer to the chapter, that is, the characteristics of the product;

- ii) the first four digits present the position, which is the breakdown of the characteristic of the item identified in the chapter;

- iii) the first six digits are the subheading, consisting of the in-depth breakdown of the characteristic identified in the Chapter;

- iv) the seven digits of the item is the NCM product classification;

- v) the eight digits are the most detailed description and classification of the merchandise.

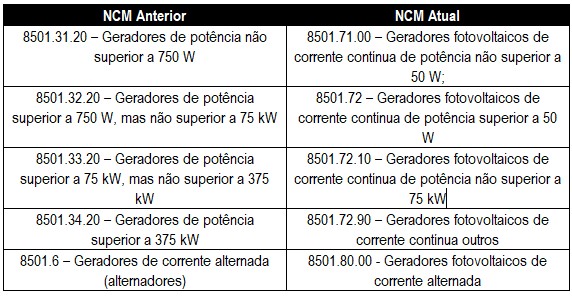

With regard to equipment in the solar sector, the new HS resulted in a change in the classification of generators, which left position 8501.3 which dealt with “other direct current motors; direct current generators” and now have a specific classification, dividing them according to power and type of current, whether direct or alternating:

The modification in the SH, in addition to inserting photovoltaic generators in specific positions, ended up modifying the power for classification purposes, as well as specifically creating the NCM for alternating current photovoltaic generators, which did not previously exist, and which seems assertive, given that there are some pronouncements by the Federal Revenue of Brazil that photovoltaic generators could not be classified under items 8501.31.20, 8501.32.20, 8501.33.20 and 8501.34.20, as they refer to direct current motors/generators .

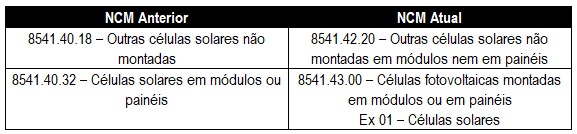

Despite the change in the classification of photovoltaic generators, another good used by this sector that also suffered the effects of the reclassification were solar cells:

When introducing and using the new HS classification, Decree no. 10,932/2021 approved the new TIPI Incidence Table (Tax on Industrialized Products), which establishes the rate of 10% for “Photovoltaic cells assembled in modules or panels”, classified in NCM 8541.43.00, taking effect from the 1st April 2022.

Although at first the change gives the impression that photovoltaic modules will be taxed without distinction, it is important to highlight that the TIPI Table presents an exception just below NCM 8541.43.00, (“Ex 01”) for solar cells, maintaining the zero IPI rate.

However, such differentiation is strange, even more so with different IPI rates, because according to the NESH (Explanatory Note of the Harmonized System) for position 85.41, solar cells and photovoltaic cells have the same purpose, that is, to directly transform sunlight into electrical energy.

It turns out that the new classification also impacts the incidence and collection of ICMS. This is because ICMS Agreement no. 101/97, which grants exemption from the aforementioned tax to photovoltaic generators, as well as solar cells, uses the old NCM classification, which will no longer be in force from April 1, 2022.

Therefore, considering that the National Tax Code, a general law on tax matters, determines that the tax legislation that provides for exemption must be interpreted literally, the conclusion is inevitably reached that if there is no change in the aforementioned agreement, the generators and cells solar panels may no longer benefit from the ICMS exemption, with the risk of state tax authorities interpreting that as of April 1st, the sale of photovoltaic generators and photovoltaic modules are subject to ICMS, whose rates vary depending on the State, but which vary around 18%.

Therefore, all these changes are worrying, because with regard to the exemption institute, the National Superior Courts have already expressed in a resounding manner that it is not possible to carry out an expansive or isonomic interpretation, leaving, therefore, the solar sector at the mercy of the will of the heads of the State Executive Power, especially to modify the ICMS Agreement 101/97 in order to adapt it to the new NCM classifications.

The exchange rate, the increase in the cost of capital, added to the possible increase in taxes on equipment are worrying in a year in which the sector promises growth never before experienced in the country.

One Response

I don't understand how it would be taxed, since generators are exempt. The fee would be on top of the photovoltaic cell mounted on a module, however a photovoltaic cell is a solar cell and the solar cell is an exception. The supplier buys and sells module (set of cells)

So if the fee is for a cell, in a module of 144 cells would the cost of each cell have to be included in the cost?