Updated March 16, 2022

Several changes within the international market, carried out at the end of last year, could mean that photovoltaic modules will no longer be exempt from IPI (Tax on Industrialized Products) and ICMS (Tax on Circulation of Goods and Services) from 1st April this year.

With this, the IPI rate would be 10% and the ICMS would have a rate between 12% and 18%, depending on the state. This change would result in an increase in the tax burden on imported solar panels.

Considering that the modules correspond to approximately 50% of the investment (Capex) of a photovoltaic system, this change could have a considerable impact on the solar sector.

After all, what changes were made?

Before we discuss the changes made, it is necessary to understand What is the SH (Harmonized System) and what is its role in international trade. The HS is established by the WCO (World Customs Organization) and the signatory countries of the International Convention on the Harmonized System, which is updated every five years, in order to meet the demands of international trade and its goods.

It is used on a global scale to guide the classification of products by each country, standardizing customs classification to the references defined by the WCO Harmonized System. Its objective is to expand and simplify the customs classification of goods, preventing new products and technologies from being classified in generic positions (Others), without the correct identification of their basic function and their constructive elements.

As the last update of the HS has been in force since 2017, this year the Harmonized System 2022 comes into force. As a consequence, the new TIPI (Tax Incidence Table on Industrialized Products), which is based on NCM (Common Mercosur Nomenclature), was also updated, presenting important changes to the components of photovoltaic systems.

And according to Decree 10,923/2021, published on December 30th last year by President Jair Bolsonaro (PL), this new table comes into effect from April 1st this year. It is important to highlight that the NCMs and the TEC (Common External Tariff) were also modified with the Gecex Resolution No. 272/2021, published in December last year, promoting changes to the NCMs of photovoltaic solar modules.

And what do all these changes mean in practice?

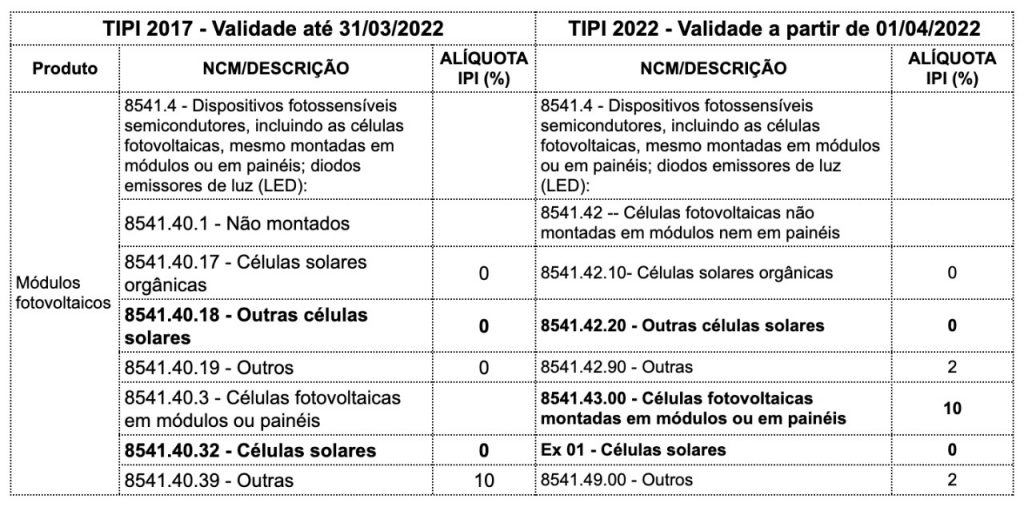

Aware of the changes made, the next step is to understand how they can impact the Brazilian photovoltaic solar energy market. The main change that the solar sector needs to understand is the structure of the codes used for solar cells and modules. Viewing the tables below it is possible to check the changes that will be implemented on April 1st.

As shown in the tables, the NCM of photovoltaic cells mounted in modules or panels changed from NCM 8541.40.32 to the new NCM 8541.43.00. Thus, the IPI for photovoltaic modules would no longer be exempt and would have a rate of 10%.

To the Solar Channel, Wladimir Janousek, Executive Director of JCS Consultoria, points out that when analyzing the structure of the new TIPI, the inclusion of “Ex 01- Solar cells” just below the NCM of cells assembled into modules, generating confusion in its interpretation.

It clarifies that the expression “Ex” means an exception and is used in the TIPI table to identify differences in the IPI rate or NCM rule, in relation to the taxation of a specific item. “TIPI's 'Ex-01' indicates an exception to the NCM code, that is, it would include the inclusion of additional parameters and/or specifications that constitute a differentiator for the subheading”, he explains.

Daniel Pansarella, coordinator of FT Logística at ABSOLAR (Brazilian Photovoltaic Solar Energy Association), has the same assessment. “Ex 01, which says solar cells, falls within the concept of modules, that is, the module with a mounted solar cell is also exempt. In my understanding, it is intrinsic that the module has the same IPI exemption”, he analyzes.

Janousek also adds that for a better understanding of the market, the NCM description should be Ex 01 – Photovoltaic Solar Cells Mounted in Modules or Panels. “This understanding needs to be expanded to the market and disseminated throughout the segment, so that photovoltaic solar modules are included in TIPI Exception 01, with IPI equal to 0%”.

Photovoltaic generators

In addition to changes in the NCM numbers of photovoltaic generators, changes also occurred in their descriptions, where the main change was the power range of direct current generators.

Previously, photovoltaic generators were positioned in the following NCMs:

- 8501.31.20 – Photovoltaic generator with a power not exceeding 750 W;

- 8501.32.20 – Photovoltaic generator with a power exceeding 750 W, but not exceeding 75 kW;

- 8501.33.20 – Photovoltaic generator with a power exceeding 75 kW, but not exceeding 375 kW; It is

- 8501.34.20 – Photovoltaic generator with a power exceeding 375 kW.

In the new classification, they are now listed as:

- 8501.71.00 – Direct current photovoltaic generators with a power not exceeding 50 W;

- 8501.72 – Direct current photovoltaic generators with a power exceeding 50 W;

- 8501.72.10 – Direct current photovoltaic generators with a power not exceeding 75 kW;

- 8501.72.90 – Others;

- 8501.80.00 – Alternating current photovoltaic generators.

In Janousek's understanding, direct current photovoltaic generators with a power greater than 75 kW “would be classified in subheading 8501.72.90 (Others), as the classification must always be made using the 8-digit code”.

In addition to the need for new NCMs to be adapted to the market, it is essential that all associated legislation is updated, including agreements, decrees, ordinances, regulations and other legal provisions that make reference to customs codes for solar cells and modules.

Among them is the ICMS Agreement No. 101/1997. Currently, the text exempts from ICMS the operations of the following products indicated and with their respective classification in the NCM:

[…]

IV – photovoltaic generator with a power not exceeding 750W – 8501.31.20;

V – photovoltaic generator with a power exceeding 750W but not exceeding 75kW – 8501.32.20;

VI – photovoltaic generator with a power exceeding 75kW but not exceeding 375kW – 8501.33.20;

VII – photovoltaic generator with a power exceeding 375Kw – 8501.34.20;

[..]

IX – unassembled solar cells – 8541.40.16;

X – solar cells in modules or panels – 8541.40.32.

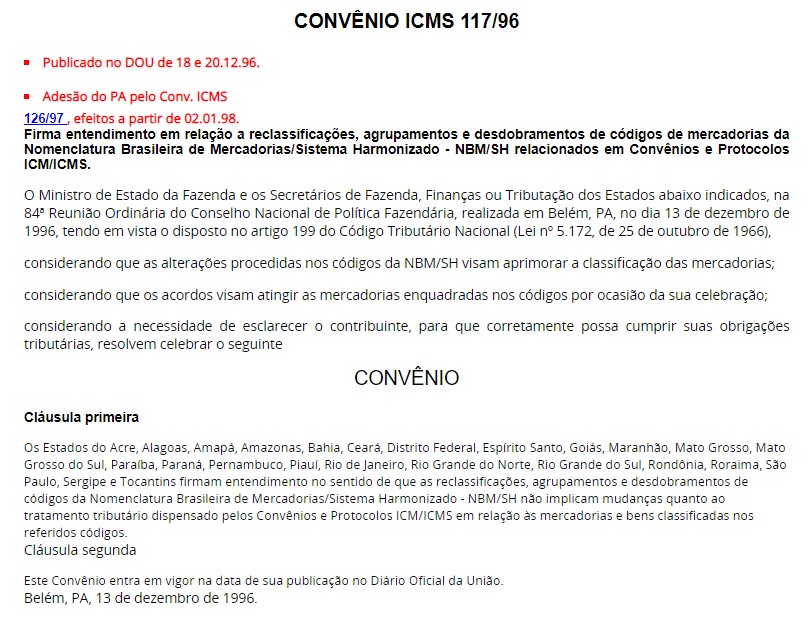

It is important to emphasize that the Agreement No. 117/96 guarantees the continuity of exemption from ICMS during the period of changes in Brazilian states, with the exception of Minas Gerais, Pará and Santa Catarina are not included in this agreement.

For states that are not included in the above agreement, ABSOLAR is evaluating file a writ of mandamus.

Furthermore, Pansarella informed that the association sent a letter to Camex (Chamber of Foreign Trade) on the subject on December 23rd of last year asking for clarification and questioning this publication.

“As soon as this matter began at the beginning of December last year, ABSOLAR produced a technical note for the Ministry of Economy, explaining all the impacts that the 10% increase in the IPI would bring to the market. The technical note, with suggestions on how to equalize the situation, is already in the hands of the Ministry at the moment and we are awaiting the scheduling of a meeting with representatives from the Executive Secretariat, Confaz and the Foreign Trade Secretariat”, he said.

“Despite being apprehensive, we are currently relatively calm, as it has only been a month since the information was sent, during the recess and end-of-year festivities. Confaz, for example, didn't even officially meet this year either, something that is only scheduled for February. There is also an effort to talk to state finance secretaries to ask for the migration of codes”, adds Pansarella.

According to him, Gecex (Management Committee of the Chamber of Foreign Commerce) has already responded to the letter sent that deals with the IPI and that the topic is already on the agenda for the committee's next meeting, which does not yet have a defined date.

“With the updating of the new nomenclatures in the drafting of the Agreement, there will be no room for different interpretations by the tax authorities”, adds Janousek. In Janousek's assessment, these changes make it urgent to update the text of Agreement 101/97 to ensure greater legal certainty.

“The market must monitor and encourage demonstrations and requests for appropriate adjustments to Confaz (National Council for Financial Policy), preventing the ICMS exemptions already incorporated into the commercial and tax mechanisms of the entire photovoltaic chain in Brazil from being impacted”, he highlights.

Fernando Castro, Country Manager at JA Solar, commented that he is following these points with some concern due to “this being an election year, where generally interactions and demands with the government take a little longer to be analyzed”.

Canal Solar is closely following the topic and will bring updates on the topic soon.

10 Responses

Once again I make available to entrepreneurs and the population the text of the Popular Action filed by me. I would appreciate the support from Canal Solar and Absolar in advance. Our intention is to remove the flawed exemption of 5 MW (five mega watts), contained in State Law 23,762/2021 of the State of Minas Gerais. You see, there is a real obstacle established by the law in question, in terms of exemption, according to art. 111 of the CTN, the interpretation is literal. Now, with the market expanding, such a low barrier is not justified. It is absolutely necessary to think big when it comes to renewable energy. The future of the country and the protection of the most vulnerable are at stake

Follow the text

EXM. MR. DOCTOR JUDGE OF LAW OF THE PUBLIC TAX COURT AND AUTARCHIES OF THE JUIZ DE FORA DISTRICT – STATE OF MINAS GERAIS.

Bruno Rezende Palmieri, Brazilian, married, National Treasury Attorney, elderly retiree, retired, practicing his own case, e-mail [email protected], holder of OAB/MG 66877, CPF 327353831 72, resident and domiciled at Rua Professor Vicente Mazini n. 321, apartment 302, CEP 36021 010, Bairro Bom Pastor, Juiz de Fora-MG, comes to the presence of Your Excellency to present this POPULAR ACTION, with a request for ANTICIPATORY GUARDIANSHIP, against an act issued by the Honorable Governor of the State of Minas Gerais, also by the Honorable President of the Legislative Assembly of Minas Gerais, with a summary of the facts, assumptions, jurisprudence and applicable legislation, listed below. Although State Law 23,762/2021 was published, the National Congress drafted LAW Nº 14,300, OF JANUARY 6, 2022, DULY SANCTIONED BY THE HEAD OF THE EXECUTIVE POWER OF THE UNION, THUS LOSING THE STATE EDICT ITS OBJECT. WE REQUEST NOW THAT THIS BE DECLARED IN AN INJUNCTION AND BY SENTENCE.

LAW No. 14,300, OF JANUARY 6, 2022

Establishes the legal framework for microgeneration and distributed minigeneration, the Electric Energy Compensation System (SCEE) and the Social Renewable Energy Program (PERS); amends Laws No. 10,848, of March 15, 2004, and 9,427, of December 26, 1996; and takes other measures.

IT IS SAID, EN PASSANT, IN THE LEGAL DIPLOMA OF THE STATE OF MINAS GERAIS, UNDER CONSIDERATION, THERE ARE NULLITIES MAKING IT ABSURDLY UNCONSTITUTIONAL, as will be proven later. Ab initio, it is worth noting that Precedents 346 and 473 drawn up by the EG.STF, verbis, are applicable to the present case.

Summary 346

“The Public Administration can declare the nullity of its own acts”

Summary 473

“the Administration can annul its own acts, when riddled with defects that make them illegal, because rights do not originate from them; or revoke them, for reasons of convenience or opportunity, respecting acquired rights, and subject, in all cases, to judicial assessment”.

THE FACTS

There are numerous initiatives on the part of the Legislative Branch, not only in our dear State of Minas Gerais, but in other states of the federation, in order to enact laws whose purpose is to establish the capture of solar energy as a triggering event for the collection and exemption of ICMS, through photovoltaic collection. For further clarification, I will reproduce an article I wrote published on the website Direitopublico.net

ICMS and Solar Energy

By Bruno Rezende Palmieri, retired National Treasury Attorney, Lawyer, OAB/MG 66877. Juiz de Fora, February 13, 2022.

In the preamble, we ask legal professionals at all levels: is it constitutional to charge ICMS when the taxpayer produces energy to be consumed in the domestic environment, from the capture of solar energy, without any competition from the structure of energy concessionaires? ? Now look, let's go back to the basics of Civil Law when the different types of goods are classified, movable, immovable, moving and things placed outside of commerce. It is laughable to forget the importance of such concepts, taught in the early years of the Law Course. Solar energy, the force of the wind, the coming and going of the tides, rain, how could they be classified from a civilist perspective? We must therefore examine the premise of art. 69 of the Civil Code of 1916 – (stressing that there is no correlation of this norm with any provision of the current Civil Statute), combine it with art.110 of the CTN, as well as with art. 146 of the Federal Constitution. It will also be up to the doctrine to clarify and improve EVERYTHING THAT THE ORDINARY LEGISLATOR DIDN'T SEE... AND DIDN'T SEE BECAUSE HE DIDN'T WANT TO...

It is worth remembering that the constituent legislator, back in 1988, included in the Charter of the Republic, in art. 7th, XXVII, the protection of workers in relation to automation (dead letter), however the constituent perceived or clearly understood the coming transformations, promoted by the advancement of science and technology. In fact, science has advanced a lot, jumped, so to speak, and the ordinary legislator was left at the mercy of verbiage, of empty speeches that were almost always monotonous, dealing with realities only glimpsed with powerful telescopes or microscopes, while the world was changing drastically, far below. of their noses. Let us carefully examine each of the legal provisions, with the aim of integrating them into a systematic interpretation.

Civil Code of 1916

Art. 69. Things outside of commerce are those that are incapable of appropriation and those that are legally inalienable. (Wording given by Legislative Power Decree No. 3,725, dated 1/15/1919).

National Tax Code

Art. 110. Tax law cannot change the definition, content and scope of institutes, concepts and forms of private law, used, expressly or implicitly, by the Federal Constitution, the Constitutions of the States, or the Organic Laws of the Federal District or Municipalities, to define or limit tax powers.

federal Constitution

Art. 146. The complementary law is responsible for:

I – deal with conflicts of jurisdiction, in tax matters, between the Union, the States, the Federal District and the Municipalities;

II – regulate constitutional limitations on the power to tax;

III – establish general rules on tax legislation, especially on:

a) definition of taxes and their types, as well as, in relation to the taxes detailed in this Constitution, the respective triggering events, calculation bases and taxpayers;

b) tax obligation, assessment, credit, prescription and expiry;

c) adequate tax treatment of the cooperative act carried out by cooperative societies.

Going deeper into the study, questions of Tax Law emerge that are not at all unknown to a Law student – where is the Complementary Law required by the Fundamental Charter to define the indispensable triggering event for the collection of the tax in question? Going further, would it be legally possible to establish a consistent taxable event in the use of solar energy, dispensing with state activity? Would it be possible to make a tax assessment with the triggering event being something placed outside of commerce, or legally inalienable, in the words of the Civil Code of 1916 – levying a tax on sunlight? Let's face it, teratology is too obvious and evident. This would result in the absolute eversion of the Democratic Rule of Law, the foundation, basis and presupposition of our country's normative structure. (you'll see, it's another jabuticaba...)_In a distant historical quadrant, Archimedes defended Syracuse with the use of mirrors, concentrating and converging solar rays, directing them towards the sails of Roman vessels, setting them on fire, during the various attempts to capture of that kingdom. It turns out that neither Archimedes nor any other scientist was able to store and conserve, for a long historical period, the energy coming from the star-king. However, today, Australian universities, schools and students have been developing research into this type of clean fuel, powering the batteries of vehicles competing in competitions, using solar energy in that country. Science and Technology have advanced by leaps and bounds, without a shadow of a doubt. Absurd, perhaps insurmountable, is the thought of taxing sunlight. Soon some kind of clumsy tribute would appear, burdening families by hanging clothes on the line to dry them. This would be absolutely RIDICULOUS… Archimedes says so!

We then have, in a rough examination, the possibility of imposing a tax that does not exhibit, not even due to strong myopia, the event generating the ICMS, whose tax design is well defined in art.155 of the CTN.

Art. 155. It is up to the States and the Federal District to impose taxes on: I – transmission causa mortis and donation, of any assets or rights; II – operations relating to the circulation of goods and the provision of interstate and intermunicipal transport and communication services, even if the operations and services begin abroad;

Can sunlight be classified as a commodity? This way, the beaches would be deserted, the jobs of street craft vendors would disappear, the kiosks where the much-loved coconut water is sold would also disappear, nor would the lifeguards be able to carry out their noble duties. And what about photosynthesis? What about Carbon credit?

The Fundamental Law of the Republic, in turn, in art. 155, II, provides a sufficient description of the event generating the ICMS, as is known, a tax that is the responsibility of the States and the Federal District.

Art. 155. It is up to the States and the Federal District to impose taxes on: (Wording given by Constitutional Amendment nº 3, of 1993)

II – operations relating to the circulation of goods and the provision of interstate and intermunicipal transport and communication services, even if the operations and services begin abroad; (Wording given by Constitutional Amendment nº 3, of 1993)

Now, after boring the reader with this tedious text, we should conclude it by leaving the fundamental question remaining: if any taxpayer is capable, as Australian students are, of producing electrical energy for their own consumption through sunlight, Which jurists would be willing to espouse reckless and lame theses, where this type of energy – except when produced without state support – could prefigure a generating event – circulation of goods, in operations that are neither remotely nor mercantile? Use or use this energy only for the operation of household appliances? Non-profit?

Bibliography

ATALIBA, Geraldo. Tax incidence hypothesis. 6th ed. São Paulo: Malheiros, 2012.

AMARO. Lucian. Brazilian Tax Law. 18th ed. São Paulo: Saraiva. 2012.

BALEEIRO, Aliomar; update from Mizabel Abreu Machado Derzi. Brazilian Tax Law. 15th ed. Rio de Janeiro: Forense, 2001.

CAMPOS, Djalma. Tax Procedural Law. 9th ed. São Paulo: Atlas, 2007.

CARRAZA, Roque Antonio. Constitutional Tax Law Course.29th ed. São Paulo: Malheiros, 2013.

HARADA, Kiyoshi. Financial and Tax Law. 22nd ed. São Paulo: Editora Atlas. 2013.

JARDIM, Eduardo M. Ferreira. Financial and Tax Law Manual. 12th ed. São Paulo: Saraiva, 2011.

MACHADO, Hugo de Brito. Tax Law Course. 34th ed. São Paulo: Malheiros, 2013.

MAXIMILIANO. Carlos. Hermeneutics and application of law. 193 ed. Rio de Janeiro: Forense, 2005.

SABBAG. Eduardo de Moraes. Tax Law Manual. 5 ed. São Paulo: Saraiva, 2013.

TORRES, Ricardo Lobo. Financial and Tax Law Course 18th edition. Rio de Janeiro: Renovar, 2011.

PRECISELY HERE, WITHIN THE FRAMEWORKS OF THIS DISPUTE, LET'S ACKNOWLEDGE, LET'S EMPHASIZE AND EMPHASIZE – THE ORDINARY STATE LEGISLATOR HAS OPINIONED AND PRODUCED AN EDICT ON A MATTER WHICH THEY SHOULD NOT EVEN APPEAR, MUCH LESS PRODUCE LEGISLATIVE DIPLOMA. OF COURSE, WE ARE NOT TALKING ABOUT TEMPERATURE, BUT ABOUT A CONCEPT THAT IS BEYOND THE STATE'S LEGAL ORDER, VERY RELEVANT TO THE SCIENTIFIC SCOPE AND RESPONSIBILITY OF THE FEDERAL UNION. IN OTHER WORDS, IN THE DICTION OF LEX MAGNA THE MISTER WOULD BE UP TO THE FEDERAL UNION, AS CAN BE EXTRAINED FROM READING ITS ARTS. 21, XII, B, E 22, IV IN TEST.

Art. 21. The Union is responsible for:

XII – explore, directly or through authorization, concession or permission:

b) electrical energy services and installations and the energy use of watercourses, in conjunction with the States where hydroenergetic potentials are located;

Art. 22. The Union is exclusively responsible for legislating on:

IV – water, energy, IT, telecommunications and broadcasting;

SURVIVING THE EDITION OF FEDERAL LAW No. 14,300, OF JANUARY 6, 2022, THERE ARE NO DOUBTS ABOUT THE UNOFFECTIVE UNCONSTITUTIONALITY OF THE STATE LAW IN IT.

HOWEVER, THE FUNDAMENTAL LAW MADE PROVISIONS ABOUT THE CAPTURE OF SOLAR ENERGY – ENERGY – AND ITS SUBSEQUENT TRANSFORMATION INTO ELECTRICITY. LET US REMAIN, THEREFORE, MUST AWESOME AT SUCH SUCH PRETENSION AND ABSOLUTE DISPARATION CARRIED OUT BY THE ORDINARY STATE LEGISLATORS, WRAPPED UP AND HIGHLIGHTED THE ALWAYS HONORABLE EXCEPTIONS.

FEDERAL CONSTITUTION

TITLE II

About fundamental rights and guarantees

CHAPTER I

INDIVIDUAL AND COLLECTIVE RIGHTS AND DUTIES

Art. 5 Everyone is equal before the law, without distinction of any kind, guaranteeing Brazilians and foreigners residing in the country the inviolability of the right to life, liberty, equality, security and property, under the following terms:

II – no one will be obliged to do or not do anything except by virtue of law;

X - The privacy, private life, honor and image of people are inviolable, ensuring the right to compensation for material or moral damage arising from their violation;

XXIII – the property will fulfill its social function;

XXXII – the State will promote, in accordance with the law, consumer protection;

XXXV – the law will not exclude injury or threat to rights from the Judiciary’s assessment;

XXXVI – the law will not harm acquired rights, perfect legal acts and res judicata;

XXXVII – there will be no court or tribunal of exception;

XLI – the law will punish any discrimination that violates fundamental rights and freedoms;

LIV – no one will be deprived of their freedom or their property without due legal process;

LV – litigants, in judicial or administrative proceedings, and defendants in general are guaranteed contradictory and full defense, with the means and resources inherent to it;

LVI – evidence obtained by illegal means is inadmissible in the process;

LXXIII – any citizen is a legitimate party to propose popular action aimed at annulling an act harmful to public property or entity in which the State participates, to administrative morality, to the environment and to historical and cultural heritage, with the author remaining, unless proven bad -faith, exempt from legal costs and the burden of succumbing; (our highlights)

LAW No. 4,717, OF JUNE 29, 1965.

Art. 1 Any citizen will be a legitimate party to claim the annulment or declaration of nullity of acts harmful to the assets of the Union, the Federal District, the States, the Municipalities, autonomous entities, mixed-capital companies (Constitution, art. 141 , § 38), of mutual insurance companies in which the Union represents the absent policyholders, of public companies, of autonomous social services, of institutions or foundations for the creation or funding of which the public treasury has contributed or competes with more than fifty percent of assets or annual revenue, of companies incorporated into the assets of the Union, the Federal District, States and Municipalities, and any legal entities or entities subsidized by public coffers.

In this aspect, the article I wrote above would be enough to highlight the threat to the rights that looms over all miners, especially those less fortunate. It cannot be admitted, not even by a clumsy exercise of imagination, that the State of Minas Gerais mobilizes its political body to, in a misguided, Frankeinsteinian attempt, produce an authentic legal aberration, consisting of taxing a response outside of commerce and legally inalienable, in accordance with art. of art. 69 of the Civil Code of 1916 – (stressing that there is no correlation of this norm with any provision of the current Civil Statute), as previously highlighted.

It doesn't make any sense - challenging at this point - the great and renowned tax experts in our country - to take forward a legislative initiative to produce this kind of monster, a generating fact whose only holder, creator, producer and possessor is the ruler of the universe, in terms Masonic, GADU However, we are ONLY dealing with solar energy captured through photovoltaic panels, without any competition from state activity. Furthermore, the purpose of this action is to implement, through established constitutional principles, the capture and use of solar energy, ONLY FOR DOMESTIC USE AND DISTRIBUTION TO PHILANTHROPIC ENTITIES – IT CANNOT BE EMPHASIZED TOO MUCH – CIVIL SOCIETY ENTITIES BENEFICIAL WITHOUT PROFIT PURPOSES. OUR OBJECTIVES ARE VERY CLEAR – TO RAISE THE PURCHASING CAPACITY OF THE MOST IMPOOVERTED SECTION OF THE POPULATION. THIS WOULD BE WITHIN THE COMMON COMPETENCE OF THE FEDERATED ENTITIES, AS CAN BE DEFERRED FROM READING ARTICLE 23, I and X OF THE CURRENT POLITICAL LETTER, VERBIS.

Art. 23. It is the common competence of the Union, the States, the Federal District and the Municipalities:

I – ensure the protection of the Constitution, laws and democratic institutions and conserve public assets;

X – combat the causes of poverty and factors of marginalization, promoting the social integration of disadvantaged sectors; (He stood out)

It is worth asking: could the strange limit of 5 Mega Watts somehow combat the causes of poverty? Furthermore, this passage of State Law 23,762/2021 is also unconstitutional. While the Federal Law did not definitively establish such a limit, establishing in its art. 1st, sole paragraph, that the value of the power in focus will persist until the year 2045, verbis.

Art. 1 For the purposes and effects of this Law, the following definitions are adopted:

Single paragraph. For all units referred to in the caput of art. 26 of this Law, the installed power limit referred to in item XIII of the caput of this article is 5 MW (five megawatts) until December 31, 2045.

Below we present arguments raised by Excelso Pretorio regarding the appropriateness of the popular action.

STF/AO 859 QO / AP – Judgment on 10/11/2001:

SUMMARY:

ORIGINAL ACTION. QUESTION OF ORDER. POPULAR ACTION. ORIGINAL JURISDICTION OF THE FEDERAL SUPREME COURT: NON-OCCURENCE. PRECEDENTS.

1. The competence to judge popular action against an act of any authority, even the President of the Republic, lies, as a rule, with the competent court of first instance. Precedents.

2. Having judged the case in the first instance, if more than half of the judges are unable to assess the voluntary appeal or the mandatory referral, the jurisdiction of the Federal Supreme Court will occur, based on letter n of section I, second part, of article 102 of the Federal Constitution.

3. Resolved the Point of Order to establish the jurisdiction of one of the first-degree judges of the State of Amapá. (emphasis added)

ARE 824781 RG

General Repercussion – Merit (Theme 836)

Judging body: Full Court

Rapporteur: Min. DIAS TOFFOLI

Judgment: 08/27/2015

Published: 10/09/2015

Menu

SUMMARY Constitutional and Civil Procedural Law. Popular action. Action conditions. Filing to combat an act harmful to administrative morality. Possibility. Judgment that maintained a sentence that deemed the case to be terminated, without resolving the merits, as it understood that the demonstration of concomitant damage to material public assets is a condition of popular action. Unnecessity. Content of the art. 5th, item LXXIII, of the Federal Constitution. Reaffirmation of jurisprudence. Recognized general repercussion. 1. The understanding adopted in the judgment under appeal that, in order for a popular action to be filed, mention in the exordial and proof of material damage to the public coffers is required, differs from the understanding adopted by the Federal Supreme Court. 2. The challenged decision violates art. 5th, item LXXIII, of the Federal Constitution, which has as objects to be defended by the citizen, separately, any act harmful to the public material heritage or entity in which the State participates, to the moral, cultural and historical heritage. 3. Appeal and extraordinary appeal granted. 4. General repercussion recognized with reaffirmation of jurisprudence.

Theme

836 – Requirement to prove material damage to public coffers as a condition for filing a class action.

Thesis

It is not a condition for the popular action to demonstrate material damage to public coffers, given that art. 5th, item LXXIII, of the Federal Constitution establishes that any citizen is a legitimate party to propose popular action and challenge, even if separately, an act harmful to the material, moral, cultural or historical heritage of the State or entity in which he participates. Note: Writing of the thesis approved under the terms of item 2 of the Minutes of the 12th Administrative Session of the STF, held on 12/09/2015.

Other occurrences

Note (1)

AO 859 QO

Judging body: Full Court

Rapporteur: Min. ELLEN GRACIE

Editor of the judgment: Min. MAURÍCIO CORRÊA

Judgment: 10/11/2001

Published: 01/08/2003

Menu

SUMMARY: ORIGINAL ACTION. QUESTION OF ORDER. POPULAR ACTION. ORIGINAL JURISDICTION OF THE FEDERAL SUPREME COURT: NON-OCCURRENCE. PRECEDENTS. 1. The competence to judge popular action against an act of any authority, even the President of the Republic, lies, as a rule, with the competent court of first instance. Precedents. 2. Having judged the case in the first instance, if more than half of the judges are unable to assess the voluntary appeal or the mandatory referral, the jurisdiction of the Federal Supreme Court will occur, based on letter n of section I, second part, of article 102 of the Federal Constitution. 3. Resolved the Point of Order to establish the jurisdiction of one of the first-degree judges of the State of Amapá.

Decision

The Court, by majority, resolving a point of order, established the jurisdiction of the local Court of First Instance to judge the popular action, with the defeat of Ministers Ellen Gracie, Rapporteur, Carlos Velloso and Sepúlveda Pertence. The President, Minister Marco Aurélio, voted. Minister Maurício Corrêa will write the ruling. Justifiably absent from this trial was Minister Nelson Jobim. Plenary, 10/11/2001.

Indexing

– QUESTION OF ORDER: JURISDICTION, NATURAL COURT, FIRST DEGREE, LOCAL COURT, JUDGMENT, CLASS ACTION, ADVERTISEMENT, ACT, AUTHORITY, APPOINTMENT, JUDGE, COURT OF JUSTICE, (AP), COMPLIANCE, LOCAL LAW. – QUESTION OF ORDER: VOTE WON, MIN. ELLEN GRACIE, MIN. CARLOS VELLOSO AND

Other occurrences

Indexing (1), Doctrine (1)

Pet 8753 AgR

Judging body: Full Court

Rapporteur: Min. CÁRMEN LÚCIA

Judgment: 12/07/2020

Published: 02/04/2021

Menu

SUMMARY: REGIMENTAL APPEAL IN THE PETITION. CONSTITUTIONAL. THE FEDERAL SUPREME COURT IS INCOMPETENT TO PROSECUTE AND JUDGE CLASS ACTIONS. PRECEDENTS. REGIMENTAL APPEAL WHICH IS DISMISSED.

Observation

PERFORMANCE, STF) ACO 359 QO (1st Q). (ABSENCE, COMPETENCE, STF, POPULAR ACTION) Rcl 2769 AgR (TP), Pet 3152 AgR (TP), ACO 622 QO (TP), Pet 6381 AgR (TP), Pet 8504 AgR (TP). – Monocratic decisions cited: (ABSENCE, COMPETENCE, STF, POPULAR ACTION) Pet 1546 MC, Pet 3710. Number of pages: 16. Analysis: 01/10/2022

Indexing

– DISMISSAL, CLASS ACTION, CONCRETE CASE. ABSENCE, PROOF, INITIAL PETITION, INTRINSIC ASSUMPTION, ACTION, STF.

Rcl 424

Judging body: Full Court

Rapporteur: Min. SEPÚLVEDA BELONGS

Judgment: 05/05/1994

Published: 09/06/1996

Menu

SUMMARY: Popular action: nature of the citizen's legitimization in their own name, but in defense of public assets: unique case of procedural replacement. II. STF: jurisdiction: conflict between the Union and the State: characterization in the popular action in which the authors, intending to act in the interests of a Member State, postulate the annulment of a decree by the President of the Republic and, therefore, an act attributable to the Union.

Decision

By majority vote, the Court judged the complaint to be valid, to recall the records of the popular action, revoking the injunction granted by the 1st Degree Judge and, as a consequence, jeopardizing the writ of mandamus filed against the decision by the defendant, now to a degree of ordinary appeal to the Superior Court of Justice. Ministers Carlos Velloso, Celso de Mello, Néri da Silveira and the President (Minister Octavio Gallotti), who judged it unfounded, were defeated. Plenary, 05/05/1994.

Indexing

PC0512, JURISDICTIONAL COMPETENCE (CIVIL), POPULAR ACTION, CONFLICT, FEDERAL UNION, MEMBER STATE, ANNULMENT, DECREE, PRESIDENT OF THE REPUBLIC. PC0952, POPULAR ACTION, ACTIVE LEGITIMACY, CITIZEN, FIRST NAME, DEFENSE, PUBLIC ASSET, PROCEDURAL REPLACEMENT

Other occurrences

Doctrine (1)

Pet 5859 AgR

Judging body: Full Court

Rapporteur: Min. CELSO DE MELLO

Judgment: 11/25/2015

Published: 12/15/2015

Menu

SUMMARY: POPULAR ACTION – FILE AGAINST THE PRESIDENT OF THE REPUBLIC – LACK OF ORIGINAL JURISDICTION OF THE FEDERAL SUPREME COURT – STRICT REGIME OF LAW TO WHICH THE CONSTITUTIONAL DEFINITION OF THE JURISDICTION OF THE SUPREME COURT IS SUBJECT – DOCTRINE – PRECEDENTS – POPULAR ACTION NOT KNOWN – APPEAL APPEAL IMPROVED. – It is not the responsibility of the Federal Supreme Court to process and judge, originally, a popular action filed against the President of the Republic. Precedents. – Popular action does not qualify as a substitute for concentrated constitutionality control instruments nor does it enable the “in abstracto” examination of legal situations formed under the aegis of current legislation.

Observation

– Judgment(s) cited: (ORIGINAL JURISDICTION, STF, POPULAR ACTION) Pet 1738 AgR, Pet 2018 AgR (2nd Q), Pet 3087 AgR (TP), Pet 3152 AgR (TP), Pet 3422 AgR (TP) , Pet 4089 AgR (TP), AO 772 QO (TP), AO 859 QO (TP), Pet 5191 AgR (2ªT), RTJ 121/17 (PET 194 AGR), 141/344 (PET 546), RDA 35/ 48, RDA 68/218, RDA

Doctrine

Administrative. 3rd ed. Malheiros, 1998. p. 91. MANCUSO, Rodolfo de Camargo. Popular Action. Courts Magazine. 1994. p. 129/130. MAZZILLI, Hugo Nigro. The Civil Inquiry. Saraiva, 1999. p. 83/84. MEIRELLES, Hely Lopes. Writ of Mandamus, Public Civil Action, Writ of Injunction and Habeas Data. 19. ed. Updated

Other occurrences

Note (1)

AO 506 QO

Judging body: Full Court

Rapporteur: Min. SYDNEY SANCHES

Judgment: 05/06/1998

Published: 12/04/1998

Menu

SUMMARY: – CONSTITUTIONAL, ADMINISTRATIVE AND CIVIL PROCEDURE LAW. POPULAR ACTION AGAINST ALL MAGISTRATES IN THE STATE OF ACRE. ORIGINAL JURISDICTION OF THE FEDERAL SUPREME COURT (ART. 102, I, “N”, OF THE CF). FITNESS FOR THE ACTION. INLIMINARY MEASURE. UNIVERSITY LEVEL GRATIFICATION TO MAGISTRATES OF THE STATE OF ACRE: ACT No. 143/89, OF 20.07.1989, DOWNLOADED BY THE PRESIDENT OF THE COURT OF JUSTICE. ART. 326 OF THE STATE JUDICIAL ORGANIZATION CODE (LC N 47, OF 22.11.1995). QUESTIONS OF ORDER. 1. The original jurisdiction of the Federal Supreme Court must be recognized, in view of the provisions of art. 102, I, “n”, of the Federal Constitution, as the Action is filed against all Judges of the State of Acre, including the Judges of the Court of Justice. 2. The Popular Action is appropriate, as it aims to definitively suspend payment of the Higher Level Bonus and the consequent condemnation of the beneficiaries to return all amounts received, duly corrected. In effect, the Popular Action, as regulated by Law No. 4,717, of 06/29/1965, aims to declare the nullity or annulment of administrative acts, when harmful to public property, as provided for in its articles 1, 2 and 4. But it is not necessary to wait for the harmful acts to occur and produce their full effects, for it to be proposed only then. 3. In the present case, the Popular Action, as proposed, has a preventive and repressive or corrective nature, at the same time. It is intended to suspend future payments (preventive nature) and refund amounts that have been paid in the last five years, in view of the statute of limitations provided for in art. 21 of the Popular Action Law (repressive nature). 4. The Action, as proposed, is therefore appropriate. 5. The request for an injunction is then examined, as provided for in § 4 of art. 5th of LAP 6. The current normative basis for the payment of the University Level Bonus to Magistrates of the State of Acre is Act No. 143/89, of July 20, 1989, issued by the then President of the Court of Justice. 7. The normative character of this Act is indisputable, as it reinstitutes the old and already extinct University Level Bonus for all Magistrates in Acre, and it is not a purely administrative act, carried out in the assessment of an application from any interested party.

Decision

point of order raised by the Rapporteur, (a) recognized, based on art. 102, item I, paragraph n, of the Constitution, its original competence to assess this case, knowing, as a result, of the popular action promoted against all magistrates, active and inactive, in the State of Acre; (b) understood that the popular action now promoted by the author was procedurally appropriate, under the terms and for the purposes with which it was filed; (c) granted the request for precautionary measure formulated therein, to suspend the higher education or university bonus that is being paid to active and inactive magistrates,

Indexing

– QUESTION OF ORDER: ORIGINAL JURISDICTION, (STF), JUDGMENT, POPULAR ACTION, TOTALITY, MAGISTRATE, ACTIVE, INACTIVE. DEFERMENT, PRECAUTIONARY MEASURE, SUSPENSION, PAYMENT, HIGHER LEVEL GRATIIFICATION, UNIVERSITY LEVEL.

Other occurrences

Syllabus (2), Doctrine (1)

AO 170

Judging body: Full Court

Rapporteur: Min. CARLOS VELLOSO

Judgment: 02/08/1996

Published: 04/04/1997

Menu

SUMMARY: CONSTITUTIONAL. CIVIL PROCEDURE. POPULAR ACTION. DEPUTIES and MAGISTRATES OF THE STATE OF GOIÁS: REMUNERATION. LIMIT OF EC nº 1/92: SEVENTY-FIVE PERCENT OF THE REMUNERATION OF FEDERAL DEPUTIES. PRELIMINARY OF PASSIVE ILLEGALITY “AD CAUSAM” RAISED BY THE MAGISTRATES: IMPRESSIONAL. LEGISLATURE: CF, art. 44, para. single. I. – Passive legitimacy “ad causa” of judges in Goiás: Law nº 4,717/65, art. 6th. II. – Applicability, to Judges, due to the principle of equivalence (CF, art. 37, XI), of the remuneration limit set out in EC nº 1/92. III. – Inapplicability, in the legislature in which EC No. 1/92 was promulgated, of the remuneration limit stated therein, given that EC 1/92 establishes that the remuneration of State Deputies will be fixed, in each legislature, for the subsequent one, in, at most, seventy-five percent of the remuneration of Federal Deputies. Once EC nº 1/92 was promulgated during the legislature, given that each legislature lasts four years (CF, art. 44, sole paragraph), the rule contained therein will be in force in the legislature beginning in 1995. IV. – The unsuccessful plaintiff is exempt from costs and the burden of succumbing (CF, art. 5, LXXIII). V. – Popular action dismissed as unfounded.

Decision

By unanimous vote, the Court dismissed the popular action, leaving the author exempt from costs and the burden of succumbing. The President voted. Plenary, 02/08/96.

Indexing

PC0999, POPULAR ACTION, PASSIVE LEGITIMACY, MAGISTRATE, DIRECT BENEFICIARY, REMUNERATION, FIXATION, STATE DEPUTY, BINDING CT0574, LEGISLATIVE POWER, CONSTITUTIONAL AMENDMENT, REMUNERATION, STATE DEPUTY, LIMIT, FIXATION, EQUIVALENCE, JUDICIAL POWER, APPLICABILITY

Pet 5856 AgR

Judging body: Full Court

Rapporteur: Min. CELSO DE MELLO

Judgment: 11/25/2015

Published: 12/15/2015

Menu

SUMMARY: POPULAR ACTION – FILE AGAINST THE PRESIDENT OF THE REPUBLIC – INTENDED TO DECREE THE LOSS OF THE PRESIDENTIAL MANDATE AND THE DEPRIVATION OF POLITICAL RIGHTS – LACK OF ORIGINAL COMPETENCE OF THE FEDERAL SUPREME COURT – STRICT LAW REGIME TO WHICH THE CONSTITUTIONAL DEFINITION OF THE JURISDICTION OF THE COURT SUPREME – DOCTRINE – PRECEDENTS – POPULAR ACTION UNKNOWN – APPEAL FOR AN IMPROVED APPEAL. – The jurisprudence of the Federal Supreme Court – whether under the aegis of the current republican Constitution, or under the domain of the previous Political Charter – was established in the sense of recognizing that the process and judgment do not fall within the sphere of original jurisdiction of the Supreme Court of constitutional popular actions, even if filed against acts and/or omissions of the President of the Republic. Doctrine. Precedents.

Observation

– Judgment(s) cited: (JUDICE, STF, POPULAR ACTION) Pet 2018 AgR (2nd Q), Pet 3152 AgR (TP), Pet 3422 AgR (TP), AO 772 QO (TP), AO 859 QO ( TP), Pet 5191 AgR (2ndT), RTJ 121/17 (PET 194 AGR), RTJ 141/344 (PET 546). (COMPETENCY, STF, TAXATION ROLE) Pet 1738 AgR, Pet 3087 AgR (TP), Pet 4089 AgR (TP)

Indexing

FEDERAL COURT (STF), DECISION, JURISDICTION PREROGATIVE, CRIMINAL SCOPE, PURPOSE, CHARACTERIZATION, JURISDICTION, CONSTITUTIONAL COURT, JUDGMENT, POPULAR ACTION. NEED, INHIBITION, EXPANSION, ATTRIBUTION, FEDERAL SUPREME COURT (STF).

Other occurrences

Observation (1), Doctrine (1)

Pet 3674 QO

Judging body: Full Court

Rapporteur: Min. SEPÚLVEDA BELONGS

Judgment: 10/04/2006

Published: 12/19/2006

Menu

SUMMARY: Original jurisdiction of the Supreme Court for actions against the National Council of Justice and the National Council of the Public Ministry (CF, art. 102, I, r, with the wording of EC 45/04): intelligence: non-inclusion of popular action, even when it seeks to declare the nullity of the act of any of the councils referred to in it. 1. In the case of popular action, the Federal Supreme Court – with the only reservations regarding the incidence of paragraph n of art. 102. imposes responsibility for the questioned act on an individual dignitary – such as the President of the Republic – or on a member or members of a collegiate body of any of the powers of the State whose acts, in the civil sphere – as occurs in the writ of mandamus – or in the criminal sphere – as occurs in the original criminal action or in habeas corpus – are directly subject to its jurisdiction. 2. This is not the hypothesis of the members of the National Council of Justice or the National Council of the Public Ministry: what the Constitution, with EC 45/04, inserted into the original jurisdiction of the Supreme Court were the actions against the respective collegiate, and no, those in which the personal responsibility of one or more of the counselors is questioned, as would be the case in a popular action.

Indexing

- ISSUE OF ORDER: INCOMPETENCE, FEDERAL SUPREME COURT, JUDGMENT, ACTION, POPULAR, ACT, MEMBER, NATIONAL COUNCIL OF THE FEDERAL PUBLIC PROSECUTION.

Legislation

LEG-FED LAW-004417 YEAR-1965 ART-00006 PAR-00003 ART-00011 POPULAR ACTION LAW ORDINARY LAW

ACO 622 QO

Judging body: Full Court

Rapporteur: Min. ILMAR GALVÃO

Judgment writer: Min. RICARDO LEWANDOWSKI

Judgment: 11/07/2007

Published: 02/15/2008

Menu

SUMMARY: POPULAR ACTION. SHIFTING JURISDICTION TO THE STF. FEDERATIVE CONFLICT ESTABLISHED BETWEEN THE UNION AND MEMBER STATE. ARTICLE 102, I, F, OF THE CONSTITUTION. I – Considering the potential of the federative conflict established between the Union and the Member State, the competence of the Federal Supreme Court to process and judge the popular action emerges, in accordance with the provisions of art. 102, I, f, of the Constitution. II – Point of order resolved in favor of the jurisdiction of the STF.

Decision

Justifiably absent were Ministers Celso de Mello and Marco Aurélio. Presidency of Minister Ellen Gracie. Plenary, 03/08/2007. Decision: The Court, by majority, resolving a point of order, admitted the jurisdiction of the Federal Supreme Court to judge the action, defeating Minister Cármen Lúcia and Minister Marco Aurélio, who did not admit it. Voted for President, Minister Ellen Gracie. Minister Ricardo Lewandowski will deliver the ruling. Upon the retirement of Minister Ilmar Galvão (Rapporteur), the achievement will go to his successor

Indexing

PROCEDURE SUBSTITUTION, USE, POPULAR ACTION, INSTITUTE, DIRECT DEMOCRACY, ENVIRONMENT, CITIZEN, DEFENSE, OWN RIGHT, LAW, SOCIETY, ORIGIN, POPULAR SOVEREIGNTY. POSSIBILITY, USE, POPULAR ACTION, DEFENSE, ADMINISTRATIVE MORALITY. INCORRENCE, OBJECT, POPULAR ACTION, DEFENSE, STATE LAW. SETTINGS

The governing legislative diploma, in turn, explains the acts void of nullity, carried out by public authorities.

Art. 2 Any acts harmful to the assets of the entities mentioned in the previous article are null and void, in the cases of:

a) incompetence;

b) form defects;

c) illegality of the object;

d) lack of reasons;

e) misuse of purpose.

Single paragraph. For the conceptualization of cases of nullity, the following rules will be observed:

a) incompetence is characterized when the act does not fall within the legal responsibilities of the agent who carried it out;

b) the formal defect consists of the omission or incomplete or irregular observance of formalities essential to the existence or seriousness of the act;

c) the illegality of the object occurs when the result of the act results in violation of a law, regulation or other normative act;

d) the non-existence of reasons occurs when the matter of fact or law, on which the act is based, is materially non-existent or legally inappropriate for the result obtained;

e) deviation of purpose occurs when the agent performs the act aiming for a purpose other than that foreseen, explicitly or implicitly, in the rule of jurisdiction.

CONCLUSIONS

Unquestionably, the legislative initiative, in this case State Law 23,762/2021, violates several important clauses of the Charter of the Republic, especially those transcribed below:

FEDERAL CONSTITUTION

TITLE II

About fundamental rights and guarantees

CHAPTER I

INDIVIDUAL AND COLLECTIVE RIGHTS AND DUTIES

Art. 5 Everyone is equal before the law, without distinction of any kind, guaranteeing Brazilians and foreigners residing in the country the inviolability of the right to life, liberty, equality, security and property, under the following terms:

XXIII – the property will fulfill its social function;

XXXII – the State will promote, in accordance with the law, consumer protection;

XXXV – the law will not exclude injury or threat to rights from the Judiciary’s assessment;

XXXVI – the law will not harm acquired rights, perfect legal acts and res judicata;

XXXVII – there will be no court or tribunal of exception;

XLI – the law will punish any discrimination that violates fundamental rights and freedoms;

LIV – no one will be deprived of their freedom or their property without due legal process;

LV – litigants, in judicial or administrative proceedings, and defendants in general are guaranteed contradictory and full defense, with the means and resources inherent to it;

LVI – evidence obtained by illegal means is inadmissible in the process;

LXIX – a writ of mandamus will be granted to protect a clear and certain right, not supported by habeas corpus or habeas data, when the person responsible for the illegality or abuse of power is a public authority or an agent of a legal entity exercising public authority duties ;

LXXIII – any citizen is a legitimate party to propose popular action aimed at annulling an act harmful to public property or entity in which the State participates, to administrative morality, to the environment and to historical and cultural heritage, with the author remaining, unless proven bad -faith, exempt from legal costs and the burden of succumbing; (highlights from us) (highlight from the subscriber of the piece)

Furthermore, and without further ado, the established norm of art remains violated. 60, § 4 of the Charter of the Republic, due to the limited power limit stated. Excerpt transcribed below.

Subsection II

From the Amendment to the Constitution

Art. 60. The Constitution may be amended upon proposal:

§ 4 The proposed amendment to abolish:

IV – individual rights and guarantees.

PREQUESTION OF CONSTITUTIONAL MATTER

FAILURE TO COMPLY WITH FEDERAL LAWS

It is appropriate to highlight – it should be emphasized – in the context and limits of this action – the precise purpose of illicit, spurious, immoral and illegal enrichment, on the part of the federated entity, if it dares to practice such enormous recklessness AND WORSE, DOING IT AT THE EXPENSE OF OTHERS POOR! THIS IS BECAUSE THE 5MW POWER MARK IS EXTREMELY SPECIAL, CAPABLE OF BEING EXCEEDED BY SMALL, MICROCONTRIBUTORS AND COOPERATIVES COMBINING THEIR EFFORTS AND PURPOSES.

DIRECTLY AND BRAZENTLY OFFENDING LEX MAXIMA, there is, however, another tax obstacle to the aforementioned 5MW limit – the well-known art. 111 of the CTN, with due respect, brought up immediately afterwards.

Art. 111. Tax legislation that provides for:

I – suspension or exclusion of tax credit;

II – granting exemption;

III – exemption from compliance with additional tax obligations. (emphasis added)

Therefore, when the universe of taxpayers referred to in the scope of this dispute exceeds the limit established in Frankenstein State Law 23762/2021 – 5MW – ICMS will be levied without restrictions.

OF THE DEMANDS

Considering that the National Congress, drafted LAW No. 14,300, OF JANUARY 6, 2022, DULY SANCTIONED BY THE HEAD OF THE EXECUTIVE POWER OF THE UNION, THE STATE EDICT HAS THUS LOST ITS OBJECT. WE REQUEST AS A COROLLARY AND HEREBY THAT IT BE DECLARED, IN INJUNCTION AND BY SENTENCE.

The Governor of the State and the President of the Legislative Assembly of the State of Minas Gerais are ordered to remove the aforementioned Law 23,762/2021 from the body of state laws, to prevent the processing of a Bill or Amendment Bill to the State Constitution with the aim of establishing the capture of solar energy, through photovoltaic panels, for domestic use, without any competition from state activity and under these terms to distribute the input to non-profit civil society philanthropic entities. This is required because art. 60, § 4 of the Federal Constitution highlights the obstacle to this type of initiative. An injunction is therefore requested, given the periculum in mora and the fumus boni juris. SCIENCE AND TECHNOLOGY ADVANCE AT LARGE STEPS.

5 (FIVE) MW? WHAT IS THIS ABOUT FIGHTING THE CAUSES OF POVERTY? IN A CONTINENTAL COUNTRY LIKE BRAZIL?

THE CALCULATIONS CARRIED OUT IN THE PREVIOUS REQUEST TO ANEEL, THE BODY RESPONSIBLE FOR THE COUNTRY'S ENERGY MANAGEMENT, ARE REQUIRED TO PROVIDE THE EXACT VALUES, I.E., THE CORRELATION BETWEEN POWER PRODUCED AND THE NUMBER OF HOUSES SUPPLIED BY THE COLLECTION SYSTEM VOLTAIC PHOTO. IDENTICAL PROVIDENCE IS REQUIRED AT LABSOLAR – UFJF’S PHOTO VOLTAIC SOLAR LABORATORY.

Any acts tending to produce legal diplomas with the scope of – within the terms and limits of this action – establishing an ICMS taxable event capable of promoting tax assessments covering the production and domestic use of energy captured by photo voltaic panels, be declared VOID BY FULL LAW, without the purpose of profit, in addition to complying with the governing precepts of cooperatives – non-incidence of ICMS on the cooperative act – provision contained in art. 79, sole § of Law 5764/71 and the provisions of art. 150, VI, c, § 2 of the CF, listed below, the second to define the tax immunities of philanthropic entities.

LAW No. 5,764, OF DECEMBER 16, 1971.

Art. 79. Cooperative acts are those carried out between cooperatives and their members, between these and those and by cooperatives among themselves when associated, to achieve social objectives.

Single paragraph. The cooperative act does not imply a market operation, nor a contract for the purchase and sale of a product or merchandise. (the emphasis is on the subscriber of the exordial)

Section II

LIMITATIONS OF THE POWER TO TAX

Art. 150. Without prejudice to other guarantees guaranteed to the taxpayer, the Union, the States, the Federal District and the Municipalities are prohibited from:

VI – institute taxes on:

c) assets, income or services of political parties, including their foundations, workers' unions, non-profit educational and social assistance institutions, in compliance with the requirements of the law.

§ 2 The prohibition of item VI, “a”, extends to local authorities and foundations established and maintained by the Public Power, with regard to assets, income and services, linked to their essential purposes or those resulting from them.

The State of Minas Gerais, represented by its legal representatives, may be cited to contest the proposed action.

The illustrious representative of the Public Ministry is summoned, in accordance with the law.

A daily coercive pecuniary fine (astreintes) is imposed, in the amount of R $ 50,000.00 (fifty million reais), in case of non-compliance with a court order – injunction, sentence or ruling.

Protests and fights for the production of all evidence permitted in Law, especially expert evidence.

The author expressly waives the succumbing fees, in case the claim is successful, preferring, instead, the edition of a legal diploma beneficial to the purposes outlined in the present action, e.g., the increase of the ICMS exemption limit to 20 MW (corrected as indicated nullities ) or else, through a Conduct Adjustment Term, TAC, containing the signature of this lawyer, supported, eg, in art. 23, I and X, of the Federal Constitution, transcribed below.

Art. 23. It is the common competence of the Union, the States, the Federal District and the Municipalities:

I – ensure the protection of the Constitution, laws and democratic institutions and conserve public assets;

X – combat the causes of poverty and factors of marginalization, promoting the social integration of disadvantaged sectors; (He stood out)

It does so because it has the utmost conviction that the use of solar energy could bring incalculable benefits to the state, the country and above all to the poorest sections of the Brazilian people.

THE VALUE ATTRIBUTED TO THE CAUSE

The case is attributed the value of R$ 1,000,000,000.00, one billion reais, plus the values and corrections contained in the law.

Waiting for approval.

Juiz de Fora, February 22, 2022

Bruno Rezende Palmieri

OAB/MG 66877

SUMMARY OF ATTACHED DOCUMENTS

Doc. – 1. Text of State Law 23762/2021.

Doc. – 2. Text of Federal Law 14,300/2022.

Doc. 3. Report on cooperatives in difficult times.

Doc. 4. Report on the world's first solar-powered refrigerator.

Doc. 5. Report on the first solar energy cooperative in a favela in RJ.

Doc. 6. Report on the raising of US$ 120 million (around R$ 600 million) for solar energy capture cooperatives.

Doc. 7. Text obtained from the Aneel website on shared energy generation, through the capture of solar energy.

Doc. 8. Report on a solar-powered vehicle, breaking a record for consumption savings.

Doc. 9. Report on the inauguration of the largest solar capture plant in the world, in Kamuthi, India.

Doc. 10. Voter ID of the sponsor of the case, no. 0872 1236 0264, 349th Electoral Zone, 31st Section, with biometric identification.

Wow, it’s going to be totally unfeasible, goodbye solar energy…

How much unemployment and how much bankruptcy!!!

The article is not well written, it is terrifying for nothing, to stop being an Ex, it would have to stop being a BK or BIT, which is not happening, so the Ex already granted and those renewed, (today until 2025) will all be reverted to the new NCM. CONFAZ was already in the old wording in generators of chapter 8501, before this change, so it is likely that nothing will change in ICMS, as for IPI, there is already an Ex01 in 8541.43.00, and according to the rules if the cell has zero IPI, the module that is assembled with the cell will also have it, the order of precedence is not the other way around. The only taxes that we are unable to adjust are PIS and COFINS, because in the wording of the CTN, “National Tax Code”, it is determined that an Ordinary Law will be necessary to modify it, that is, 2/3 of the national congress approving, the remaining, Ex Tariff for BK and BIT, maintains, IPI for BK and BIT, the Senate and CONFAZ can modify, they have the power to do so, recently the Federal Government lowered the IPI for household appliances, automobiles and auto parts, as well as They have already occurred on other occasions, when popular cars and white goods had IPI reset (remember?).

Unfortunately, after reading this article, and at this point, many people must be holding back their investments in solar plants in Brazil, with imported modules, so I even think that this benefits someone with other interests in this market, it would be the same company that obstructed the Ex tariffs of almost 300 requests in the last 12 months? That one, without having the capacity to meet even the 5% of our market (according to the Bloomberg report, this company is in 29th in the matrix in China, here in Brazil so forget this player...)

Eng. Lauro de Almeida Neto.

Has there been any definition or progress on this issue?

The title of the article is very biased, the ICMS varies from 12 to 18% and the IPI is 10% and is this value what makes the product more expensive? Frankly, there are dishonest people reporting and advertising!

Hello, since the product is currently tax exempt, the increase will be considerable as the module will have a higher cost. Our goal is to inform impartially.

Eloi Holz's note above is well posted. A counter census of tax experts. A shortage of energy, a high cost, an indisputable importance, the incentive is created and before the program is consolidated, it is withdrawn.

It's like taking the fuel out of the plane while it's about to gain speed and cruise height. Crazy or irresponsible? Far from reality and the classical theory of economic development.

Great article Ericka! It is worth mentioning that there was a change to the NCMS of the generators as well.

What about law 14,300, which states that everything remains as it is for a year?

This demonstrates bad faith and greed in dealing with services and products from tax and commercial legislation regulators in the country. When a service product is created that can benefit the consumer and the payer of the absurd taxes that already exist, these UNSCRUPULOUS CROWS OR BUTCHERS appear TO PUT THE KNIFE IN AND IMPOBERATE THE POPULATION. THAT'S WHY THIS COUNTRY IS AN ETERNAL MISERABLE AND THE HALLOWES ABATICATE THEIR BASES AND TAKE WHAT IS PRODUCED HERE TO OTHER ECONOMIES. These exploitative companies that drain revenue from our work must be closed. We work, produce and pay taxes and these half a dozen vultures take everything and 99.8% become more impoverished every day. You have to deny all these requests for TAX increases. WHERE ARE OUR REPRESENTATIVE COUNCILORS, DEPUTIES AND SENATORS? ALL SOLD FOR A BRIBE. COUNTRY OF THIEVES……