The company Brasil Solar Plants (BRS) announced, this Friday (03), that it connected the Avelar 1 and 2 solar plants, located in the municipality of Avelar, 135 km from the capital of Rio de Janeiro.

A Light, an energy distributor in the region, has already made the connection to the energy grid, with only activation required to begin operation. According to the company, the idea with the complex is facilitate access to new investors in projects in Minas Gerais and the Northeast.

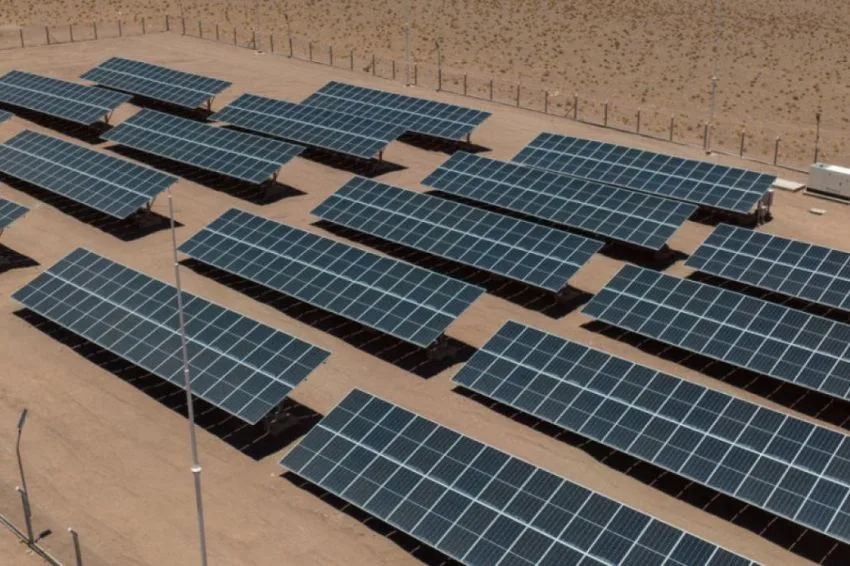

The systems have 2,560 photovoltaic modules, a power of 1382.40 kWp (kWac: 1000 kW) and will have an average monthly generation of 169,760 kWh/month (2,037.12 kWh/year).

According to Ludfor's environmental compensation calculation, the plants will avoid the emission of around 250 tons of CO2 per year, equivalent to 25,590 tree seedlings preserved for 25 years.

In total, R$ 6 million was invested by BRS to put the project into operation, which already has 11 investors, made up of condominiums, law firms, food services and sports centers.

The commercialization of the company lots in the Avelar complex was carried out by the company Desperta Energia. The equipment for the entire system was purchased and transported by MTR Solar.

BRS pipeline

Currently, BRS has a pipeline of more than 40 MW of projects and new ones are being developed. In addition to Avelar, the most advanced plants are Consolação 1 and 2 (1 MW each at Energisa MG).

The Avelar plants are already ready, with connection expected this March, and UFV Consolação 1 and 2 will be activated by June/2023. In the first quarter, the company will also implement another 13.5 MW of projects divided into RJ, MG and BA.

In the Northeast region, Usinas Brasil Solar stated that it is prospecting new areas and projects for the construction and activation of UFVs in Ceará, Pernambuco and Bahia.

According to Rafael D'Angelo, director of BRS, the payback time for a solar farm is between 4-6 years, depending on the project and the region where it is located. “Our operation was designed to allow different quota sizes per plant.”

“In this way, even a large plant can be accessible to investors who wish to invest in just one share of it. Once the investor fills out our registration form and provides the necessary documentation, he or she is eligible to become a Brasil Solar customer,” he reported.

“Currently, the minimum contribution to be part of a BRS plant is R$ 100,000, and our objective is to reduce this minimum amount to R$ 50,000 in 2023, facilitating access for new investors,” he said.

According to the executive, amid so much uncertainty linked to the new government's economic policies and the expectation of recession in the American economy, it naturally leads investors to be a little more conservative in their investment choices.

“Especially at times like this, the importance of having a diversified investment portfolio is highlighted, aiming to reduce the risk of your portfolio as a whole, and in this aspect, the solar farm fits very well”, he highlighted.

“Comparing the projected average rate of return of our projects (something between IPCA+12% to IPCA + 15%) with the performance of major indicators in 2022 such as: IFIX 2.22% in the year; Ibovespa 4.69%; CDI 12.38%; NTNB IPCA+7%; We can confirm that the investment in solar plants presents a differentiated performance in the current market, with a very predictable profitability”, he highlighted.