According to a report published by BNEF (BloombergNEF), the global carbon capture capacity he must increase six times by 2030, reaching 279 million tons of CO2 captured per year.

The study points out that the drastic growth of the market led to a 44% increase in capacity expected eight years from now, compared to last year's outlook.

Carbon capture, utilization and storage (CCUS) is an essential technology needed to decarbonize hard-to-abate sectors such as petrochemicals and cement, and provide clean energy 24 hours a day through gas plants equipped with capture equipment.

Still, in the consultancy's understanding, even with more than US$ 3 billion invested so far in 2022 and significant acceleration in the sector in the last two years, the world's carbon capture capacity is not being deployed quickly enough to meet climate goals in the future. end of the decade.

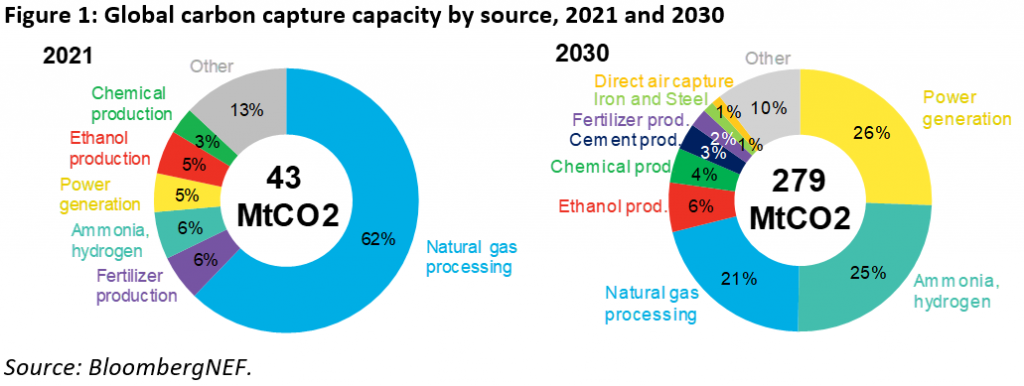

Currently, most capture capacity is used to collect carbon dioxide (CO2) from natural gas processing plants and used for enhanced oil recovery.

According to research, by 2030, most of the capacity will be used for the energy sector, for the manufacture of low-carbon hydrogen and ammonia or to reduce emissions from industrial sources.

The amount of CO2 captured today is 43 million tons, or 0.1% of global emissions. If all of the likely projects that have been announced come into operation, there would be 279 million tonnes of CO2 captured every year by 2030, representing 0.6% of current emissions.

Compost destination

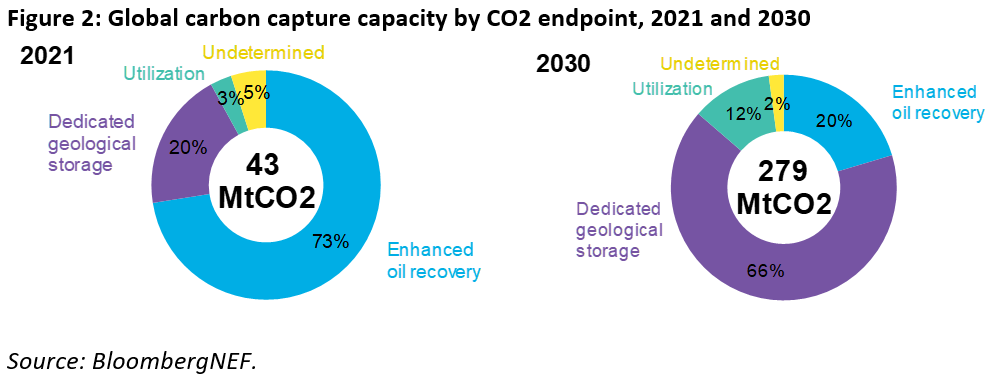

Another point emphasized by BNEF is the destination of the compound. In 2021, around 73% of captured CO2 went to enhanced oil recovery operations. For the next eight years, underground CO2 storage will overtake oil recovery as the top destination, with 66% going to dedicated storage sites.

This change, in BloombergNEF's view, is being driven by legislation that encourages storage over the use of CO2, and by projects that aim to use carbon capture and storage (CCS) as a decarbonization route.

“CCS is starting to overcome its bad reputation. It is now being deployed as a decarbonization tool, which means the CO2 needs to be stored,” said David Lluis Madrid, BNEF CCUS analyst and lead author of the report.

“The lack of CO2 transport and storage sites close to industrial or power generation point sources can be a major bottleneck for CCS development. But we are already seeing a huge increase in these projects to meet this need,” he said.

In the quest for net zero

Despite the rapid growth in announcements of capture projects, the industry is still far from affecting global emissions. To be on track for net zero and less than 2 degrees Celsius of warming by 2050, between one and two billion tonnes of CO2 would need to be captured by 2030.

“This is an order of magnitude greater than current plans. Lawmakers have recognized this incompatibility and are increasing their support for the industry,” BNEF pointed out.

The Inflation Reduction Act passed in the United States increased tax credits for CCUS by 70%, making a viable business case for the technology in petrochemicals, steel, cement and, in some regions, energy.

Half of the installed capacity in 2021 was solar, points out BNEF

“Incentives like these mean that countries, like the US, will remain global leaders for CCUS. The country's tax credits are now very generous, and the law should supercharge project announcements in the ethanol and petrochemical sectors, as well as direct air capture, to provide high-quality carbon offsets for the voluntary market,” explained the study.

Julia Attwood, head of sustainable materials at BNEF, commented that this capacity of 279 million tonnes in 2030 is just the tip of the iceberg. “We have not yet seen the full impact of these credits, making this outlook a very conservative view of the future of carbon capture and storage.”

“We expect to see another jump in announcements in 2022, especially in the US, as developers race to ensure they meet the 2032 deadline for credits,” he concluded.