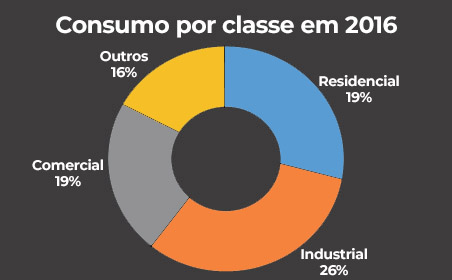

The history of organizations has shown us, over time, how important cost management is so that a given company can, in addition to surviving, prove itself competitive and establish differences in relation to its competitors. It doesn't matter if you are a fan of more classic management theories such as those of Fayol or Taylor, or if you are familiar with and apply the latest in management, such as blue and red ocean theories, exponential organizations and design thinking. A common point of any of these theories is: just as our nails need to be constantly cut, so do the costs and expenses of our companies. If we don't constantly trim and take care of them, this can cause serious problems. In line with all this, it is undeniable that for a company to carry out adequate cost management, electrical energy must be a constant priority. In a survey carried out in March 2016 by the CNI (National Confederation of Industries), in a report published by the Industry Portal, electrical energy is an important input for industry: almost 80% of industrial companies use it as their main source of energy. Also according to this study, 93% of companies that mainly use electricity in the production process noticed an increase in energy costs, of which 35% stated that the impact of the increase in energy tariffs on the total cost was high. Despite the overwhelming majority noticing these increases, only 52%, just over half of the companies, took any action to address the cost of energy. Delving a little deeper into the data, it is possible to identify that, of the 52% of companies that took some action to deal with the problem, only 10% invested in self-generation and 6% replaced the energy source. The overwhelming majority (71%) only implemented energy efficiency actions or programs to a greater or lesser extent. This proves the market potential still to be developed with solar energy, promoting both self-generation and replacement of energy sources, especially in distributed generation. Due to the many different ways of producing a good, the current complex production chains, as well as the most diverse goods to be produced, each industry has its degree of dependence and a representation of electrical energy in costs. However, they corroborate the data above and the importance of electrical energy in the costs of companies, especially industries. Data published by EPE (Energy Research Company) in January 2017, consolidating the 2016 figures, show that, of the 460,380 GWh consumed in the country, industry alone represented 36% of the total (the largest portion, equivalent to 164,254 GWh), followed by by residences, with 29% (132,893 GWh) and the commercial sector with 19% (88,185 GWh). Companies (industries and commerce) represent almost half of total consumption, with a share of 45%.

In addition to the importance of electrical energy in the costs of companies, especially industries, but without forgetting those involved in commercial activities, it is necessary to analyze how this cost varies over time, as well as evaluate how solar energy can help entrepreneurs protect themselves . In addition to inflation, common to any market, but especially sensitive in Brazil, it is necessary to point out that the energy matrix in the country is known to be composed, for the most part, of water sources.

Brazilian energy matrix

In order for us to properly investigate the evolution of tariffs, it is necessary to understand the energy matrix in Brazil. According to the report of the Meeting of the Energy Industry Chamber of FIEMG (Federation of Industries of the State of Minas Gerais), published by ANEEL (National Electric Energy Agency) in 2016, 65% of the installed capacity in Brazil comes from these sources. When there is any type of restriction on the raw material for this energy, seen over time in several water crises, there is a need to put into operation other more expensive sources, such as thermoelectric plants, which according to the same report represent 27% of the energy capacity. generation of the country. When these sources are used, an operating cost is added, which turns into an increase in tariffs for consumers. Graph 2: Sum of average supply tariff We analyzed the last 13 years and, according to ANEEL data, the sum of the average supply tariff increased by 230% from 2003 to 2016. It is interesting to analyze that the IPC (Consumer Price Index), calculated by USP/FIPE (University of São Paulo ) – one of the most used and reliable indexes for measuring inflation in the country – accumulated, in the same period, an increase of 80.01%. The electricity tariff showed a difference of approximately 150 percentage points in relation to the accumulated inflation in the period analyzed. It is worth noting that, despite the clear trend line of increase over the years, observed by the red line in Graph 2, there were periods of stability (as can be seen between 2006 and 2007, with a variation of 0.08%), periods of decline (for example between 2012 and 2013, which recorded a drop of approximately 19%), and periods of sudden increases (observed, among others, in 2014 and 2015, recording approximately 42% of increases). This lack of synchronization and the difficulty in forecasting tariffs over the years are a crucial factor of concern in businesspeople's projections. It is known that the price of energy will increase over the years, but it is not known how much or when. Equally important in the evolution of tariffs, in addition to the dependence on rain, the certainty of increases and the lack of timing in these increases, is the large portion of taxes within these tariffs. The current needs for fiscal readjustments in the country by the government bring another factor: it is not possible to have any type of prediction about the role that these taxes will have in tariffs, as well as the government's role in tariff control. An illusory control of tariffs or a fiscal scenario without predictability would not be unprecedented. What can be expected from the market in the coming years (and which could already be observed in a timid way in 2017), is a recovery of the economy in general, which includes industries, which have accumulated years of decline. This improvement will certainly bring about the need for more electrical energy and, consequently, due to the law of supply and demand, possible price increases. But how can solar energy help industries protect themselves in this hostile scenario? It is worth using Porter's strategic analysis here. In 1979, Michael Porter published in the form of an article in the Harvard Business Review the conception of five competitive forces that shape strategies: rivalry between competitors, bargaining power of customers, bargaining power of suppliers, threat of new competitors and substitute products. Generally speaking, Porter's theory states that a given company must analyze, for each of these forces, whether or not it has a competitive advantage.

We draw attention to the force where solar energy can really work in favor of the entrepreneur: negotiating power of suppliers. In general, the power to negotiate with electricity suppliers is practically zero for most companies. It is not possible to negotiate the rate, change dealerships or negotiate conditions in most companies. For those who choose to purchase on the free market, there is still no negotiation as would occur when purchasing inputs and services, for example. Negotiation power is almost completely out of the hands of the companies that consume electricity. Solar energy in Brazil is at a time of notable growth. Normative resolutions 482 and, more recently, 687 of 2015, give entrepreneurs greater confidence in investing in this type of solution. We will not even go into the merits of all the good that this businessman will also be doing to the planet and how, by using this source, he can obtain gains by adding value to his products. By using solar energy, with the company being responsible for its own generation, it is possible to reverse the game, becoming practically immune to tariff increases. Using Porter again, when a certain company invests in solar energy, becoming immune to increases, and its competitors do not do so, by having a new (and certain) increase in electricity, the company that invested has an important strategic competitive advantage over the Marketplace. Obviously, there are barriers to overcome. In a growing but new market in Brazil, especially for high voltage customers, discussions about peak hours, contracted demand and generation limits, tariff value and financing sources, among other things, are questions that we must work to resolve . Even so, when using on-grid systems it is not necessary to invest in battery infrastructure, which reduces the capital required for implementation, in addition to the possibility of some technologies allowing the gradual implementation of plants. For the purpose of protecting against increased costs, a company that is currently 100% uncovered in relation to electricity costs can, for example, implement 20% or 50% as needed and, with the amount saved, gradually continue the process of switching sources , until reaching the desired index. In general, the average payback time for a solar energy system for companies is five to seven years, which can extend to ten to 12 years, depending on the value of kWh paid by a given company. Still, it proves to be a highly viable business, as the system is designed to last over 25 years. Due to the culture of immediacy present in our country, an investment that pays for itself within a period that varies from a fifth to half of the system's lifetime may seem like a lot, but it is our role to show the way and continue to develop the market so that the solar energy becomes increasingly representative in the national territory. Solar energy contributes to the energy matrix, improves distribution efficiency and helps business owners have greater control over the costs of such an important factor, electricity.

One Response

There is an error in graph 1, the sum is not 100%. There is also an error in the paragraph preceding the graph, regarding the numbers.