As the distributed generation market knows, Minas Gerais published on July 1, 2017 the Law 22,549/2017, granting exemption from ICMS in a broader manner than established by ICMS Agreement 16/2015.

The legislation published by Minas Gerais exceeded the authorization granted by ICMS Agreement 16/2015, which provides for exemption for plants generating renewable sources or qualified cogeneration of power up to 1 MW, as long as they are for the same holder.

In this way, it is clear that Minas Gerais legislation, by going beyond the limits set in Agreement 16/2015, proved to be unconstitutional, since it grants exemption without authorization from the Confaz (National Council for Financial Policy).

However, in an attempt to resolve the fiscal war or at least mitigate its effects, the Federal Government enacted the Complementary Law 160/2017, authorizing the reinstitution of tax benefits established in non-compliance with the Federal Constitution, as well as setting a deadline for them, granting the authority for the Confaz Agreement to be published to address the matter in more detail.

Thus, the ICMS Agreement 190/2017, providing the necessary procedures for the refund of tax benefits granted without authorization from Confaz, as well as presenting a deadline for their enjoyment.

And the state of Minas Gerais complied with this, publishing the exemption standard and registering and depositing at the Confaz Executive Secretariat the documentation proving the acts granting tax benefits established in dissonance with constitutional determinations.

Recently, on January 6th of this year, the government of Minas Gerais again innovated and once again exempted the electricity sector, through the Law 23,762/2021, by expanding the exemption to distributed microgeneration and minigeneration from other renewable sources, and not just photovoltaic solar, in addition to qualified cogeneration.

The doubts that remain in the market regarding the benefit granted by Minas Gerais are still:

- Until when will the aforementioned Minas Gerais exemptions be in force and for what types of plants and business models?

- What can be done to extend it?

The purpose of this article is to provide an opinion on the possible answers to these questions.

Validity of ICMS exemption in GD in Minas Gerais

With the new exemption granted for other sources, other than just solar photovoltaics, and as long as they are provided for in REN 482 (Normative Resolution No. 482/2012) of ANEEL (National Electric Energy Agency), it is now up to the state of Minas Gerais to comply with the registration and deposit requirements with Confaz, so that the exemption can be submitted for consideration and approved by a simple majority of the council.

And the same rite for the registration of the law that, among other matters, expanded the ICMS exemption previously granted to micro and mini generation distributed from qualified cogeneration or the use of renewable sources, through the inclusion of art. 8-And to State Law No. 6,763/1975, it also occurred when Law 22,549/2017 was published, and it must be classified when registering with Confaz which type of sector the said exemption benefits, and which will guide its term of validity:

- until December 31, 2032, regarding those intended to promote agricultural and industrial activities, including agro-industrial, and investment in road, waterway, railway, port, airport and urban transport infrastructure;

- until December 31, 2025, regarding those intended for the maintenance or increase of port and airport activities linked to international trade, including the operation subsequent to the import, carried out by the importing taxpayer;

- until December 31, 2022, for those intended for the maintenance or increase of commercial activities, as long as the beneficiary is the actual sender of the merchandise;

- until December 31, 2020, regarding those intended for interstate operations and services with fresh agricultural and plant extractive products;

- until December 31, 2018 for others;

And now we can answer the first of the questions: the exemption granted by Minas Gerais in 2017 for generation distributed by photovoltaic solar sources is valid until December 31, 2022, as at the time it was classified as an increase in commercial activities.

For other sources, Confaz will have to wait for approval of Law 23,762/2021 and, in the meantime, incur the cost of ICMS on the amount of compensated energy.

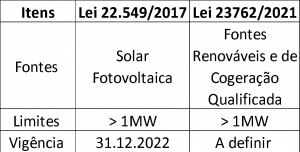

Below is a summary table to facilitate understanding:

Alternative for extending the ICMS exemption granted unilaterally by the state of Minas Gerais

The state of Minas Gerais published State Law 22,549/2017, granting exemption from ICMS in the compensation of electrical energy injected into the distributor's network by the same consumer unit, restricted only to distributed microgeneration and minigeneration of photovoltaic solar energy.

In addition, it regularized the tax benefit granted, under the terms of Complementary Law 160/2017 and ICMS Agreement 190/2017, according to Certificate of Registration and Deposit – SE/Confaz No. 50/2018.

It turns out that the benefit granted was classified as promoting the commerce sector – which, in turn, binds the validity period for its enjoyment until December 31, 2022.

However, we disagree with this classification. This is because in distributed generation activity there is no commercial, “merchant” relationship. The sale of energy is prohibited by REN 482. This market operates through the acquisition of generating systems that allow for own generation of energy or the leasing of an asset.

Thus, the granting of the ICMS exemption granted by Minas Gerais for distributed generation is actually a promotion for the industry which, given the market incentive, can sell more equipment that allows its own energy generation.

Conclusion

Therefore, in order to be able to extend the exemption granted by State Law 22,549/2017, the aforementioned standard should be reclassified to promote industrial activity, and thus come into force until December 31, 2032.

With regard to the exemption in Minas Gerais for other sources, the understanding is the same - if it is classified as promoting industrial activity, it will be valid until December 31, 2032, as long as it is approved within the scope of the Confaz.

Finally, the validity of the exemption granted by Confaz Agreement 16/2015, applicable nationwide, does not have an end date, but may be canceled or withdrawn in some states.

2 Responses

Excellent content, congratulations to Canal Solar and the author of the text. Now, April 2022, has CONFAZ already authorized the effects of this law that expands the ICMS exemption to other generation sources? What is being done to “stretch” the exemption until 2032? Thank you in advance for your attention.

Great content congratulations. I liked the website. 679609656