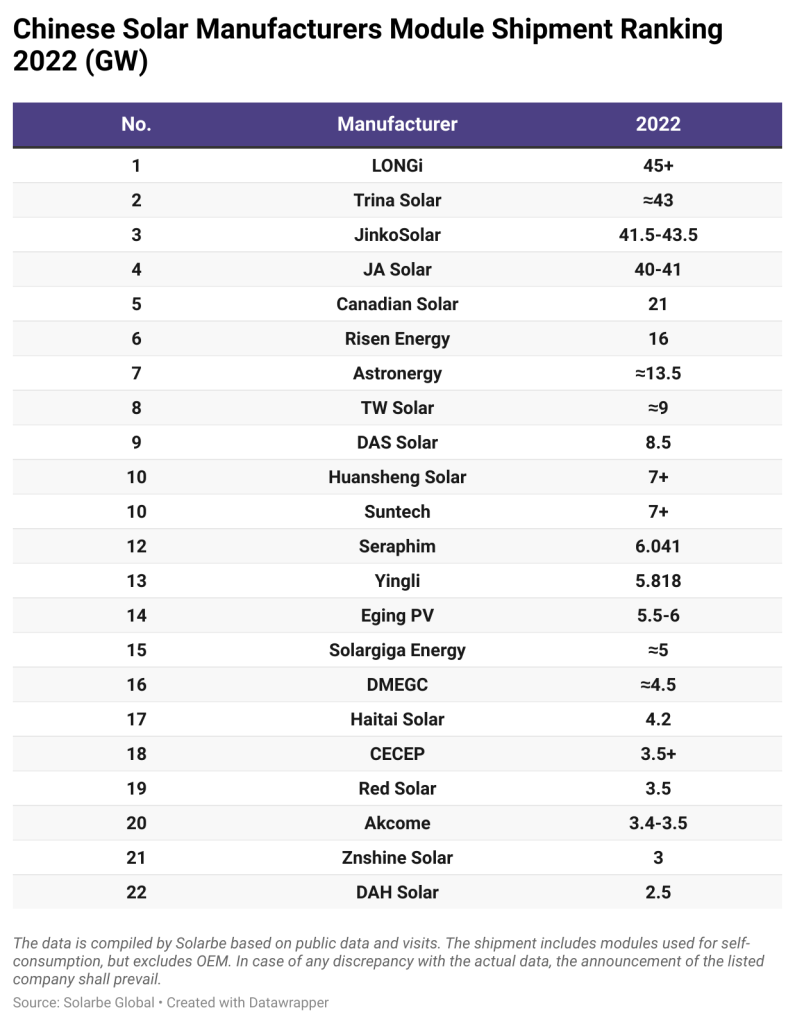

According to a study published by Solarbe Global, in 2022, the Top 10 Chinese Manufacturers of photovoltaic modules sent more than 240 GW worldwide, with an increase of 60% and occupying more than Global Demand 90%.

The annual ranking found that LONGi, Trina Solar, Jinko Solar and JA Solar continued to be the top four manufacturers, shipping a total of around 170 GW, representing two-thirds of the newly added installations.

“The 'heavyweights' have remained in their leading positions in the market and in technological innovations. Its products have been considered by developers and investors in China and around the world and are widely acclaimed by owners and financial institutions,” said the consultancy.

“Most companies shipped more solar panels in the first three quarters of 2022 than in all of 2021. As many manufacturers made ambitious expansion plans, their shipment targets for 2023 also saw a substantial increase,” he highlighted. the search.

Data from Solarbe Consulting shows that China's 10 largest module producers intend to ship a total of 400 GW in 2023. “This far exceeds panel requirements worldwide, implying increased competition in the market.”

Sending modules by company

From January to November last year, the export volume of photovoltaic products reached US$ 47.75 billion. “Canadian Solar and Risen Energy, for example, have already shipped more than 60% of their modules abroad. The ratios reached 80% and 90% for Znshine Solar and DAH Solar.”

With the advent of N-type technology, they stated that the shipment volume of TOPCon and HJT modules has exceeded 20 GW. Jinko Solar alone has delivered more than 10 GW of N-type TOPCon panels.

“As the price difference narrows between N-type and P-type, N-type panels are predicted to become more cost-effective in 2023. Their shipment volume may witness massive expansion to reach 60-70 GW” , they emphasized.

According to Solarbe, with the exception of LONGi, which focuses on developing HPBC technology, the majority of new production capacities have adopted N-type technology.

Trina Solar said its N-type capacity will reach 30 GW, sending more than 20 GW globally. Jinko also revealed that N-type products will account for more than 50% of its production and shipping capacity in 2023.

“Risen Energy intends to improve the production capacity of HJT cells and modules to 15 GW. DAH Solar also planned a capacity of 60 GW for N-type cells and panels”, they concluded.