To the companies It is consumers in solar energy are finding many difficulties, at the beginning of the year, to approve financing of photovoltaic projects with the main banks in the country.

This fact is even pointed out by the market as one of the main bottlenecks which has limited the industry sales at the beginning of the year.

O problem occurs due to a series of socioeconomic factors which has left a large part of Financial Institution afraid to release credits for the acquisition of various service goods, including solar energy.

Part of this fear is directly related to the crisis experienced by Lojas Americanas – which, at the beginning of the year, suddenly – began to have billion-dollar debts with institutions such as Bradesco and Santander, two of the retail chain's main creditors.

In addition maintenance of the basic interest rate in the amount of 13,75% per year by Copom (Monetary Policy Committee) and the political instabilities caused by change of government also helped to make banks become more rigorous when it comes to approval of any type of financing.

According to Ayres Bernardes, operations director at Sol Agora, a fintech that offers credits for the solar sector, practically all banks in Brazil made specific adjustments so that the release of credits become more rigorous, for fear of default by its customers given the macroeconomic scenario.

The executive explains, for example, that one of the actions adopted to control the supply of credit in the market was the need for customers to present a higher score in their score – parameter that takes into account the customer's payment habits and based on which banks decide whether to grant a loan or financing.

Bernardes highlights, however, that – even with a good score – many consumers also began to be denied credit per some institutions due to a factor called income commitment.

“Imagine that a client with a good score has an income of R$ 2 thousand per month and that the value of the installment he wants to make is R$ 1 thousand. This means that it will compromise 50% of your income. If the limit imposed by the bank is 30%, the customer will not have credit approved even if they have a good score”, he explained.

“This is not the case with Sol Agora, but we know that some banks have even seen an increase in their default rates, including late payments from consumers who purchased solar energy systems”, commented Bernardes, justifying the banks’ fear of lending money as well. for consumers in the sector.

All of these problems brought immediate impacts on solar energy integrators. “It is very difficult, the banks are very bureaucratic, the fees charged are very high and our customers are out of options. These days I went to close a project at Banco do Brasil and, even though the client had a good score, we almost didn't get approval”, said Warley Motta, co-owner of MS Solar, in Nova Friburgo (RJ).

Interest rate

In recent years, the financing has been the most viable way out so that many people could have access to solar energy in their homes, businesses and the like.

However, the high interest rate growth in Brazil In the last two years, this possibility has been ruled out, which directly impacts the sales of the systems.

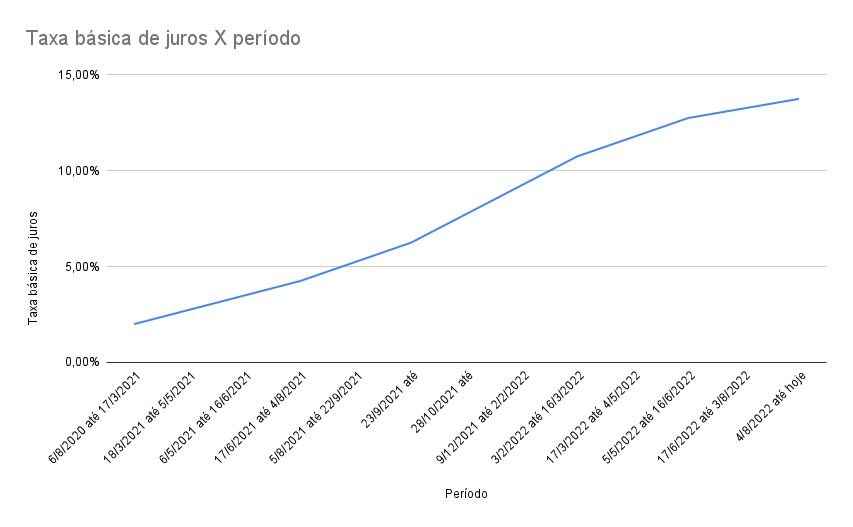

Data Copom show that the value of Selic increased from 2% per year, from March 2021 to the current 13,75% - O highest index since November 2016, when the basic interest rate charged was 14% per year, as shown in the image below:

For Eduardo Nicol, integrator and general director of operations at Renew Energia, the interest rate growth has been bringing, since last year, difficulties for companies that work with clients with lower purchasing power.

“The niche of high-income customers is not paying this interest rate to buy a solar energy system. They are paying in cash or using other methods, such as a credit card in 10 interest-free installments. Those who are working with clients from classes B, C and D are feeling an impact in relation to banking requirements”, he said.

Is interest rate the biggest problem?

May the highs interest rates disrupt the sector, there is no doubt. Directly impact the value of the installments and in final cost paid for the project and also, make the “competing” investments such as fixed income (Treasury, CDB, LCI, LCA, etc.) become more attractive, especially for more immediate investors.

However, for Nuno Verças, managing director of Sol Agora, even with the highest rates, the acquisition of Photovoltaic systems continue to be an extremely attractive investment.

“A year and a half ago we had a lower interest rate and the end consumer was able to have the value of the financing installment equal to the value of the electricity bill. Today, this has not changed, the customer can have the same situation, because despite the high interest rates, the price of the generator kit has decreased considerably. In the end, interest rates didn’t change much for the consumer.”

Nuno also highlights that There is no lack of liquidity in the market, and that the big question and the greater caution on the part of banks amidst the scenario of macroeconomic uncertainties.

Outlook for the 2nd semester

Alexandre Ferreira, CEO of Bluesun Serviços Financeiros, does not believe in a dramatic improvement in credit approval in the second half of the year by large banks. However, it highlights that the The scenario shouldn't be as bad as it was at the beginning of the year.

For him, the big banks, such as Santander, Itaú, Bradesco and Banco do Brasil, they are unlikely to change their operating policy in relation to credit for the solar energy sector, since they do not depend on this market.

“Large banks include solar financing within their offer menus in a complementary way. I say this with knowledge of the facts, because I have worked in large banks for more than a decade”, he highlighted.

Regarding the banks that make a living from financing services for systems solar energy, The situation will be different. “As this product is very relevant to the company’s final results, there tends to be greater creativity in approving credits”, he commented.

According to him, many of these companies will seek to be more assertive in choosing customers. “It's not a matter of being more flexible and accepting customers that you shouldn't be accepting, but being more precise with credit.

Along these lines, Bernardes reveals that Sol Agora, for example, is already studying the possibility of make credit release more flexible. “A lot of this is because we are realizing that our portfolio is stabilized.”

Verças adds that knowing the solar energy market makes all the difference. “We have a clear idea of what the needs of the integrator and the end consumer of solar energy are and we do not treat this financing in the same way as if we were financing a television or a car. In the second semester, we will begin to see a return of releases. It won't happen overnight, but we are optimistic that this will happen in the medium term.