According to a report released by Allianz Trade, you next years will be fundamentals to determine the success of global transition for the net-zero and will define the scenario of the future green economy.

O ClimateTech: the missing piece in the net zero puzzle, developed by the company's economists in partnership with UVC Partners, Allianz X and UnternehmerTUM, pointed out that European energy autonomy and the 55% target for reducing greenhouse gas emissions by 2030 require a competitive climate technology sector.

Experts explained that this would create benefits not only in mitigating emissions, but also for economic growth, as the clean energy technologies sector manufactured in mass should reach an annual value of €600 billion by 2030 – triple its current value.

However, the survey reported that Europe's position in this emerging market cannot be taken for granted – without further efforts, Europe will likely lose the race against the US and China.

Currently, China is already leading investment in clean energy, spending almost €500 billion in 2022, while the US has turbocharged its funding in ClimateTech by providing hundreds of billions of dollars for energy and climate-related projects.

Allianz economists pointed out that the discrepancy between reality and expectations is alarming. To achieve its own climate goals, Europe needs to increase its annual climate technology contributions worth €140 billion in the public sector and €560 billion in the private sector, compared to the last decade.

The current investment deficit in the European energy sector alone is EUR 200 billion per year, with EUR 40 billion and EUR 160 billion of public and private financing respectively.

“In addition to substantial investments in existing clean energy technologies and overall clean energy infrastructure, increased financial, technological and regulatory support for 'made in Europe' ClimateTech innovation is essential if the European Union is to maintain its leading role climate change”, said Felipe Tanus, Credit Director at Allianz Trade Brasil.

Technological gaps

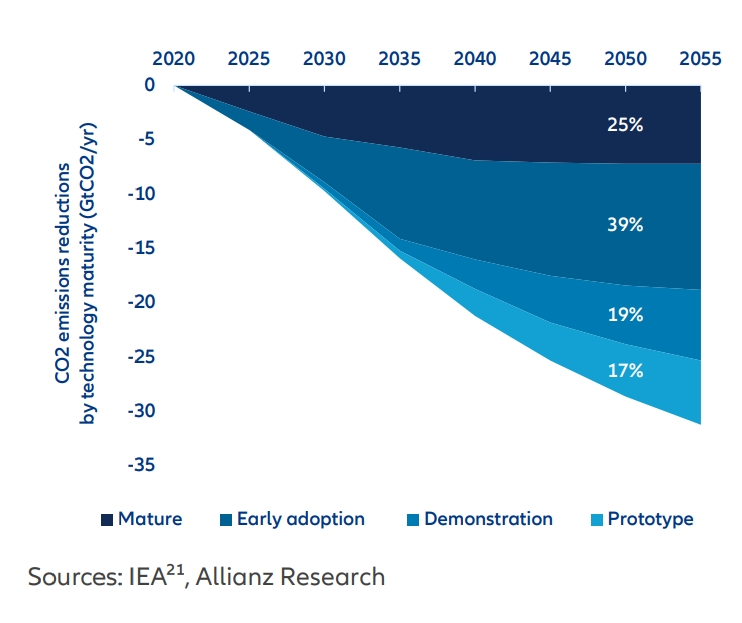

The report also emphasized that investment is not the only thing that is missing, but also more innovative technologies. The graph reveals that today's mature technologies will only contribute 25% of the additional CO2 emissions reduction needed, following the implementation of stated policies to achieve the IEA (International Energy Agency) sustainable development scenario.

Consequently, more than 75% of the achievable long-term emissions reduction needs innovative new technologies that are currently in the prototype, demonstration or “early adoption” phases.

“Early adoption” refers to technologies for which some projects have already reached the markets. Examples are offshore wind energy, grid batteries and industrial heat pumps.

“Demonstration” examples are carbon capture in cement kilns, hydrogen-based electrolytic ammonia, methanol, and large long-distance battery-electric ships. Large “prototypes” include ammonia-powered vessels, electrolytic hydrogen-based steel production, and direct air capture.

Call to Action: What is needed?

According to Allianz Trade, although the financing of ClimateTech start-ups and companies has enabled great advances in recent years, the construction of a globally competitive industry, and, above all, the ClimateTech sector requires even more efforts, both from the sector public and private sector in Europe.

Although money is fundamental, economists believe that other equally important improvements must be put into practice – from reducing bureaucracy to updating regulations:

- Streamlining financing (making it easier and less bureaucratic). Time-consuming applications as well as extensive documentation after the same is granted for start-up development;

- Creation of a common EU platform to access public funding from EU and national sources (easier navigation through the multitude of different schemes), including the possibility of extending coverage to private funding initiatives. The platform should present best practices, guidelines, mutual exchange of experiences and advice to navigate the EU financing landscape. In turn, this platform will gather insights into the needs and challenges of start-ups to inform policy development;

- Improve long-term financing through financing similar to what is already done in the case of hydrogen;

- Mandate the acquisition of new ClimateTech and utility solutions and services, as they can take greater risks and are early adopters of the first systems of their kind. Tenders could be designed specifically to attract next-generation ClimateTech companies.

- Requirements must be able to be met by startups/at scale: for example, taking into account specialization and newness, as well as financial stability and experience. Proposals can also be divided into shares to allow companies with less capacity to participate. They could allow systems that are still being tested or in the pilot phase;

- Integrate more start-ups and new technology companies into the policy-making process to shape the regulatory and financing environment.