As the DG (distributed generation) market is aware, the state of Rio de Janeiro published Law No. 8,922/2020 in July last year, granting ICMS exemption for microgeneration solar photovoltaic energy generating plants, whose installed power must be less than or equal to 75 kW, and for minigeneration, which must have an installed power greater than 75 kW and less than or equal to 5 MW.

Furthermore, this exemption also applies to shared generation projects and projects with multiple consumer units.

But, after all, is the exemption already valid or not?

The exemption in question derives from the adhesion of the state of Rio de Janeiro to the exemption from ICMS in operations related to the circulation of electrical energy granted by the state of Minas Gerais, based on Law No. 22,549/2017.

Although the exemption granted by the state of Rio de Janeiro has already been published, to be effective it is necessary to comply with the provisions of Complementary Law No. 160/2017, and the Confaz Agreement (National Council for Financial Policy) No. 190/2017. That's what the State of Rio de Janeiro did.

Under the terms of Clause Thirteen of Confaz Agreement No. 190/2017, Rio de Janeiro would have until December 31, 2020 to file the act of adhesion to a tax benefit granted by another state in the same region – in this case, the tax benefit granted by the state of Minas Gerais for micro and minigeneration projects using photovoltaic solar sources, as well as for shared generation and for enterprises with multiple consumer units, in a broader manner than Confaz Agreement No. 16/2015, aligned with the power limit and with models permitted by REN 482 (Normative Resolution no. 482/2012) of ANEEL (National Electric Energy Agency) and its respective updates.

Thus, on October 9, 2020, with correction on November 11, 2020, the state of Rio de Janeiro carried out the protocol of tax benefits established without the authorization of Confaz, according to the Deposit Registration Certificate — SE/Confaz n. 147/2020.

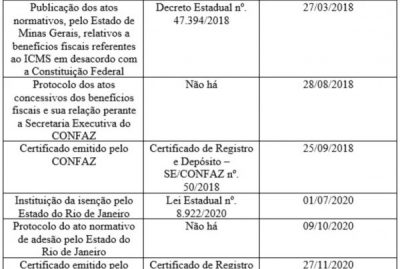

Therefore, the exemption granted by the state of Rio de Janeiro is in force, that is, able to produce its effects. In order to clarify the chronology of the rules that support this exemption, the table below is included:

Therefore, it is concluded that the ICMS exemption granted by the State of Rio de Janeiro through Law No. 8,922/2020 has been in force since November 27, 2020 and valid until December 31, 2022, which is the date of validity of the same benefit already granted by the state of Minas Gerais for generation distributed by photovoltaic solar sources.

6 Responses

Simple, you only receive it if you activate the Light. She never pays and never backs down on anything. She only pays when she is convicted. I can tell you that I have already activated the Light nine times, and at nine it lost.

There is no point in charging rights to some CIA in Brazil if you do not have legal advice.

A tip, Light itself and other companies already invest heavily in Legal, which is why they live with lack of integrity and corruption.

Just read the law, in art. 4th, the law leaves infrastructure out. The exemption only relieves the energy tariff, folks.

“Art. 4 The exemption provided for in this Law does not apply to the cost of availability, reactive energy, power demand, connection charges and any other amounts charged by the distributor.”

The article fails to clarify whether the ICMS exemption also includes TUSD. It would be interesting for the author to clarify this issue at least in the comments of the article.

Does this exemption apply to TE and TUSD? Because here in Rio, they are charging TUSD.

Does this exemption apply to TE and TUSD?

Because what we see here in RJ (Light) is that the ICMS on TUSD is still being charged.

Good afternoon! If this exemption is in effect, why aren't the customers I installed the generator benefiting from? They are still paying for ICMS in TUSD.