A Law 14,300/2022, which creates the Legal Framework for GD (distributed generation), was published last Friday (07) in the DOU (Official Gazette of the Union), after sanction, with vetoes, by President Jair Bolsonaro (PL).

Despite having come into force on this date, the legislation provides for a transition period for projects requested within 12 months from the publication of the Law.

In other words, all projects in GD, already installed or whose access request occurs until January 7, 2023, will be valid under the current compensation rules provided for in Resolution 482 (Normative Resolution No. 482/2012), until the December 31, 2045. This is the so-called vacancy period.

Amid this scenario, many doubts are arising about the GD Legal Framework. What are the main changes? What do you need to pay attention to? What was it like before and what will it be like with the new Law?

O Solar Channel carried out a webinar, this Tuesday (11), with Pedro Dante, partner in the energy and infrastructure area at Lefosse Advogados, who spoke about all the points to be highlighted in the new Law.

Vetoes

Firstly, before commenting on the main changes, Dante discussed the published vetoes. In total, there were two:

Withdrawal of the possibility of subdivision of a floating solar plant

“The floating photovoltaic plant is a great idea. It is a type of hybrid plant, and the tendency is for it to be used in Brazil. However, it was understood that not considering this subdivision would be a way of circumventing the legal limit on the size of the plants. So, based on this basis, consequently, such a device was vetoed”, he said.

Removal from the inclusion of micro and mini DG projects in programs such as REIDI (Special Incentive Regime for Infrastructure Development), FIP (Participation Investment Funds) and incentivized debentures

“We have a problem, are the projects not going to be financed? No, the market has evolved a lot. Distributed generation projects are safe from the point of view of contract structuring. There is an attractiveness, profitability of them”, pointed out the expert.

According to him, behind-the-scenes information indicates that associations in the solar energy sector will try to overturn this veto in order to return to the framework.

Law 14,300 deals with tax issues?

According to Dante, Law 14,300 is a federal law that deals with the Legal Framework of GD, tariff components, transition, acquired rights and how these components will have to be valued by ANEEL (National Electric Energy Agency).

“Therefore, it does not specifically deal with tax issues, mainly ICMS (Tax on Circulation of Goods and Services), which is the state tax. It is essential to keep this in mind so that doubts and questions do not arise that are not applied in practice”, he reported.

“In other words, this law talks about some concepts, attributes, mainly the transition rule to change the new energy compensation model”, highlighted the lawyer.

In his view, it is essential that everyone who works with energy, who wants to explore this DG business model, pay attention as this transition rule is already in effect. “So, it is very important to have knowledge about the main points of the legislation.”

Read too

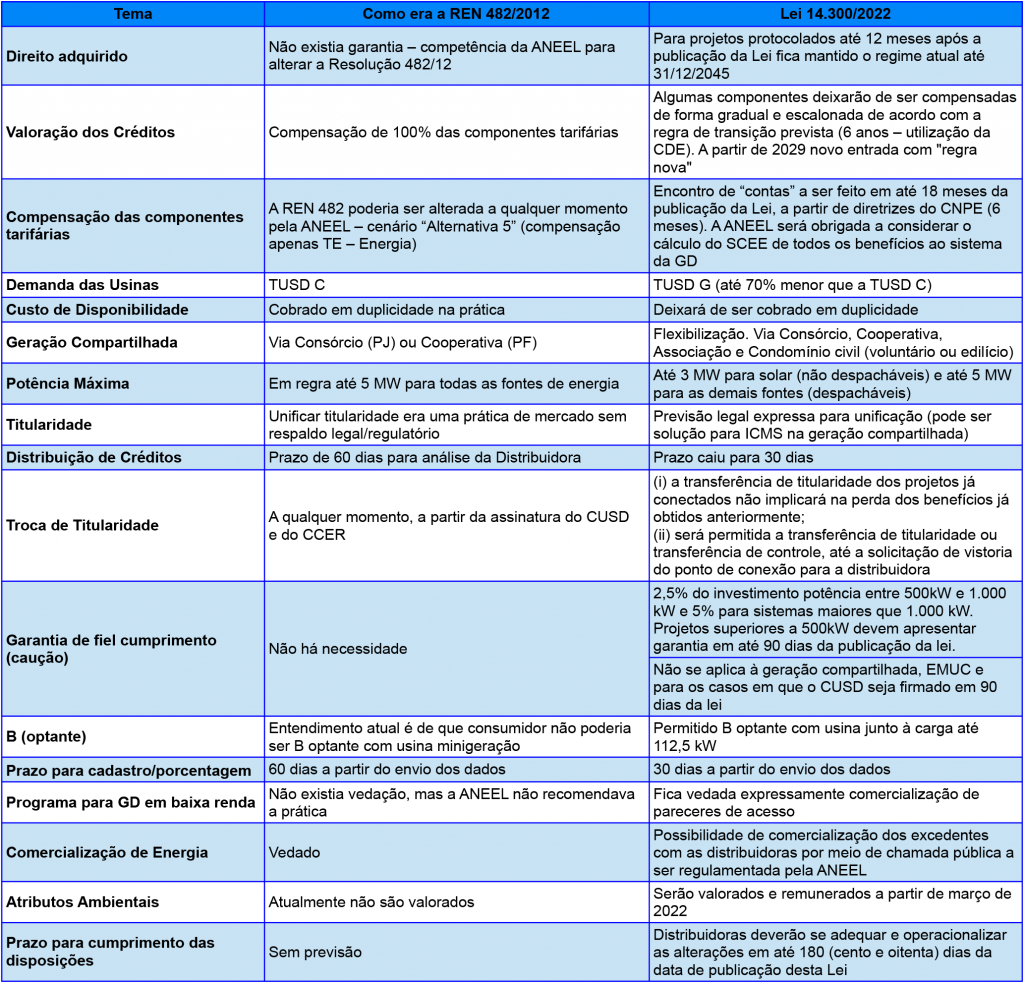

Comparison between REN 482 and Law 14,300

Below is a summary of the main changes to the GD Legal Framework. A comparison was drawn, showing what REN 482/2021 was like and what Law 14,300/2022 deals with.

5 Responses

Anyone who has a PHOTOVOLTAIC SYSTEM before 2023, with remote consumers BENEFICIARIES, can CHANGE (FREE) THE “QUANTITY” of UCs (INCLUDE NEW ones with the same CPF/CNPJ OR REMOVE EXISTING UCs) AND CHANGE THE % PRORATION OF THE BENEFICIARIES, after 07/ 01/2023, when does the new ANEEL resolution come into force?

Very good text, congratulations.

Another article from us, for the reading of our dear friends

Who is a contributor to the ICMS charged on energy produced through photovoltaic collection?

It will be a simple article, indeed. For work, of course, the definition established through Complementary Law is essential, as a constitutional requirement. But could it be that in a very peculiar and specific situation we could not obtain the answer immediately?

Through common sense or through pure logic? Let's see - if someone, any person is capable of collecting the sun's energy and converting it into electrical energy for their own use, using an exclusion criterion (pure logic) THEY CANNOT BE INCLUDED AS A TAXPAYER OF THE TAX IN APPLICATION - PERHAPS OF ANY OTHER , MINUS THE TAX IN FOCUS…

Explaining – me, you and every human being on the face of the earth building our own photo voltaic capture plant, with our own resources and materials: poles, wires, circuit breakers, converters, in short, all the components of a generation and power network. electrical distribution – mainly, in the latter case, by joining cooperatives, we cannot be classified as taxpayers of the exaction.

Well, pure logic. This is to say, the state competition has been removed, under the umbrella of the Cooperatives Law, Law LAW No. 5,764, OF DECEMBER 16, 1971.

Defines the National Cooperative Policy, establishes the legal regime for cooperative societies, and provides other measures

Well, that's it, in the very near future we may not depend on the supply of electrical energy made available by the concessionaires of this type of state activity. Maybe they will subject us to paying some “colonial” tax, just to say that the state is “inspecting” the new economic sector. This would be legally possible, according to the provisions of articles 77 to 80 of the CTN, but the Tax in question NEVER!

TITLE IV

Fees

Art. 77. The fees charged by the Union, the States, the Federal District or the Municipalities, within the scope of their respective attributions, have as their triggering event the regular exercise of police power, or the actual or potential use of public service specific and divisible, provided to the taxpayer or made available to him.

Single paragraph. The rate cannot have a calculation basis or taxable event identical to those that correspond to tax nor be calculated based on the companies' capital.

Art. 78. Police power is considered an activity of the public administration that, by limiting or disciplining right, interest or freedom, regulates the practice of an act or abstention in fact, due to public interest concerning security, hygiene, order, to customs, production and market discipline, the exercise of economic activities dependent on concession or authorization from the Public Power, public tranquility or respect for property and individual or collective rights.

Single paragraph. The exercise of police power is considered regular when carried out by the competent body within the limits of the applicable law, in compliance with the legal process and, in the case of an activity that the law considers discretionary, without abuse or misuse of power.

Art. 79. The public services referred to in article 77 are considered:

I – used by the taxpayer: a) effectively, when enjoyed by him in any capacity; b) potentially, when, being of compulsory use, they are made available through administrative activity in effective operation;

II – specific, when they can be highlighted in autonomous intervention units, units, or public needs;

III – divisible, when capable of being used separately by each of its users.

Art. 80. For the purpose of establishing and charging fees, those that, according to the Federal Constitution, the Constitutions of the States, the Organic Laws of the Federal District and Municipalities and the legislation compatible with them, are the responsibility of each of these people under public law.

The standards established in the Supreme Law, in its article 145, II, must be observed with all diligence. And please, do not go any further, nor exceed the limits established in LEX MAXIMA itself!

Art. 145. The Union, the States, the Federal District and the Municipalities may impose the following taxes:

II – fees, due to the exercise of police power or the actual or potential use of specific and divisible public services, provided to the taxpayer or made available to him;

Epitomizing, apart from state activity regarding the production of the input, obtained through the reception of solar energy with the use of photovoltaic panels, for own use, subsequent distribution and consumption within the framework of the Cooperatives Law, don't come to me with any "story of the Vigário” in constitutional and tax terms. In the table described above, ICMS taxpayers, THERE SIMPLY ARE NOT THEM!

Bruno Rezende Palmieri, National Treasury Attorney, retired. Lawyer in Juiz de Fora-MG, OAB/MG 66877.

You invest in a project that doesn't have a low cost and then a man comes to charge the fee for using the sun (amazingly)… And a lot of blah blah blah and later dates that no one understands and the concessionaires making a big deal out of the monthly invoices. In my case it increased by 100% from one month (January) to the next (February) like a prilimpimpim magic trick…. take. BRAZIL ABOVE ALL, okay!!!

SOON THE GOVERNMENT WILL CHARGE TAXES EVEN ON THE AIR WE BREATHE.