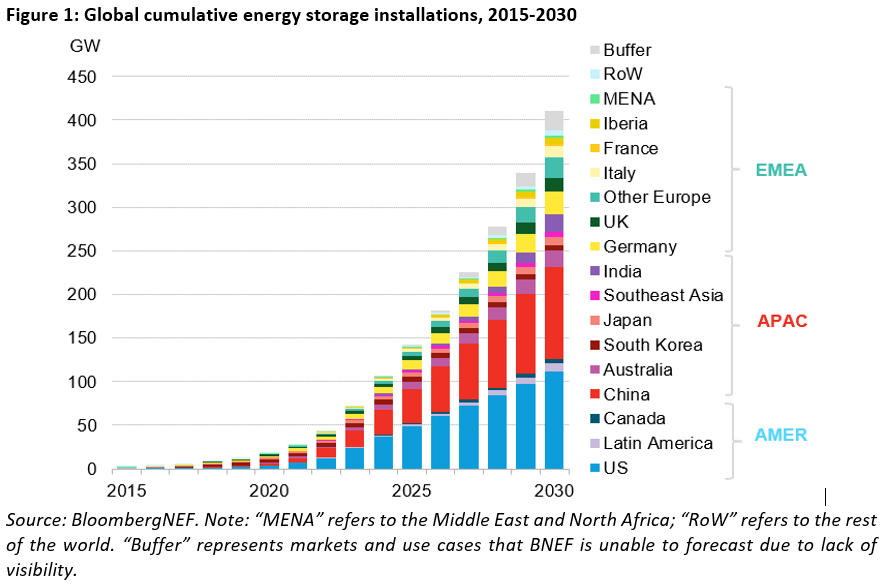

The installations of energy storage around the world must achieve a accumulated 411 GW until the end of 2030, according to the latest forecast from BNEF (BloombergNEF). That's 15 times the 27 GW that were online at the end of 2021.

The company's prospects foresee a 13% additional capacity relative to previously estimated, driven mainly by recent policy developments.

“This is equal to an extra 46 GW. The most notable new policies include the US Inflation Reduction Act, a landmark legislation that provides more than US$$369 billion in funding for clean technologies, and the European Union's REPowerEU plan, which sets ambitious goals to reduce dependence on the gas from Russia”, reported the company.

In total, an estimated 387 GW of new energy storage capacity will be added globally from 2022 to 2030 – more than Japan's entire power generation capacity in 2020.

The US and China are expected to remain the two largest markets, accounting for more than half of global installations by the end of the decade. Europe, however, is achieving a significant increase in capacity fueled by the current energy crisis.

“The anticipated acceleration in the US follows the passage of the Inflation Reduction Act in August 2022, with large volumes of funds allocated for wind, solar and storage tax credits. The law will boost approximately 30 GW of energy storage built from 2022 to 2030,” BNEF pointed out.

However, they stated that while the new tax credit policy supports further growth based on BloombergNEF's long-term forecast, the supply chain constrains cloud deployment expectations until 2024.

Russia's invasion of Ukraine has had a clear impact on energy storage deployments in Europe. According to the company, record electricity prices are forcing consumers to consider new ways of supplying energy, boosting the residential storage market in the near term.

The significant additions of utility-scale storage expected from 2025 align with the ambitious renewables targets outlined in the REPowerEU plan and a renewed focus on energy security in the UK.

In this case, BNEF has more than doubled its estimates for energy storage deployments from 2025 to 2030 across Europe from previous forecasts.

Chain restrictions can slow expansion

While expansion of global storage capacity is imminent, supply chain constraints could slow additions. In addition to pandemic-related issues, inflation, high transportation costs and raw material prices have made battery cells more expensive over the past year.

Meanwhile, projects face long financing, development and commissioning timelines. In 2022, supply chain disruptions have resulted in lower utility-scale storage additions, and even though many of these pressures may ease next year, expansion into a market that is expected to add nearly 11 times more GWh in 2030 than in 2021 will come with challenges.

“The energy storage industry is experiencing growing pains. However, despite the higher prices of the battery system, the demand is clear. There will be more than 1 TWh of energy capacity by 2030,” said Helen Kou, energy storage associate at BNEF.

“The world's largest markets, such as China, the US, India and the EU, have passed laws that encourage storage deployments,” highlighted Helen, who is also the report's lead author.

Asia-Pacific will lead growth

Regionally, Asia Pacific will lead growth in the MW storage market through 2030, driven by China. But, the Americas will add more capacity on a MWh basis, as plants in the US generally have more storage hours. Europe – even with additional benefits from recent policy advances – the Middle East and Africa are expected to lag behind.

BNEF's forecast suggests that the majority of energy storage built by 2030, equivalent to 61% of MW, will be to provide so-called power shifting – in other words, advancing or delaying electricity dispatch times. Co-located renewables plus storage projects, in particular solar plus storage, are becoming common across the world.

Another point highlighted by the study is that batteries – both residential, commercial and industrial – are also expected to grow at a steady pace. Germany and Australia are currently the leaders in this segment, with sizeable markets in Japan and California as well.

In total, BNEF predicts that energy storage located in homes and businesses will represent about a quarter of global storage installations by 2030. “With ambition, such a sector has the potential to grow incredibly quickly,” commented Yayoi Sekine, head of energy storage. BNEF energy.

“The details of how energy storage projects will materialize as a result of major policies such as the US Inflation Reduction Act remain to be resolved. However, companies are already expanding operations to capture the upside,” he explained.

BNEF: evolving battery technology

According to research, rapidly evolving battery technology is driving the storage market. Lithium-ion batteries represent the majority of installations today, but many non-battery technologies are in development, such as compressed air and thermal energy storage.

However, BloombergNEF expects batteries to dominate the market until at least the 2030s, largely due to their price competitiveness, established supply chain and significant track record. “If new technologies can successfully overcome lithium-ion, the total absorption of energy storage could be greater,” they concluded.