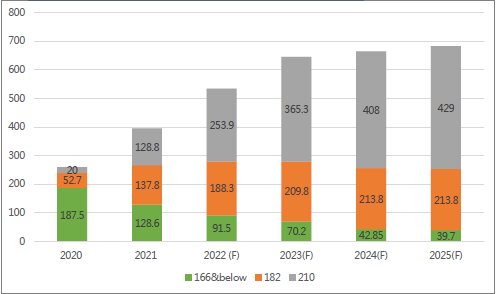

A study carried out by TrendForce pointed out that large modules are expected to reach 442.2 GW of capacity by the end of 2022 with a market share of 82.86%, of which 210 mm panels would account for 253.9 GW with a share of 47.57%.

According to the report, those of 166mm and below will gradually decrease in capacity and take up only 17.14% share amid demand migration as well as manufacturers' elimination or upgrade of old capacity.

“For the photovoltaic DG (distributed generation) area, companies are accelerating the launch of products compatible with large modules, more aligned with the sector’s demand, and more evident in advantages of conversion efficiency and power in the midst of a continued reduction in cost per single power,” the survey reported.

Module bidding

Another point highlighted by TrendForce is that several central and state-owned companies have announced 89.4 GW of PV module tenders in 2022 and remain the main driver of procurement as judged by bidders.

China Huadian and SPIC surpassed, for example, 10 GW in centralized panel procurement this year. New emerging companies such as Xing Gang Investment, Fushun Mining Group, Chinal Coal Energy and Tysen-kld have also begun to increase their module purchasing intensity.

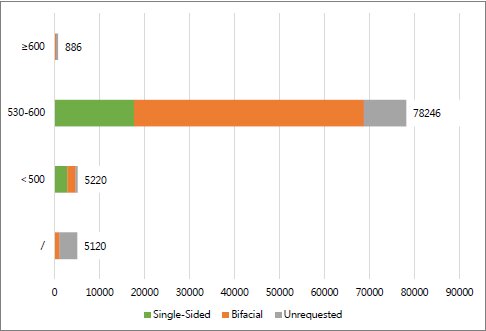

“High-power panels continue to thrive in demand among confirmed solar panel proposals. The confirmed bidding capacity for 530W+ modules is 82.9 GW, which occupies 92.69% of the total bidding scale,” the survey indicated.

“182/210mm modules are popular products preferred by central and state-owned enterprises this year. Type N exceeded 2 GW in bidding scale and are also favored. Those with 375W-470 W are only seeing a scale of 5 GW”, they exemplified.

Bifacial modules bidding

Regarding confirmed proposals for conventional and bifacial photovoltaic panels, they reached 73.9 GW in the centralized acquisition of modules for 2022.

In this case, bifacials are occupying 53.4 GW (60%), while monofacials represent 20.5 GW (23%), with double-glass bifacials occupying 41% (36.7 GW).

“Bifacials are expected to steadily increase future market share thanks to their annual depletion of 0.1%, compared to monofacials, and the relatively higher gains for power plants,” the study estimated.

Wafer production

The production of large wafers occupied a leading index of 75.42% in demand between January and May 2022, of which 210mm accounted for 20.06%. The demand for wafers of 166 mm and below yielded a production rate of 21.08% for the same period.

In total, more than 50% companies are currently producing 210mm wafers. Among them are Zhonghuan, Shangji, JYT, GCL, Gokin, Huantai Meike, Jinko, Yuze, Canadian Solar and Tonghe.

Regarding the demand for large-size N-type wafers, the report indicated that the demand is likely to increase gradually along with the market's increasing acceptance of N-type technology modules.

TOPCon enters mass production

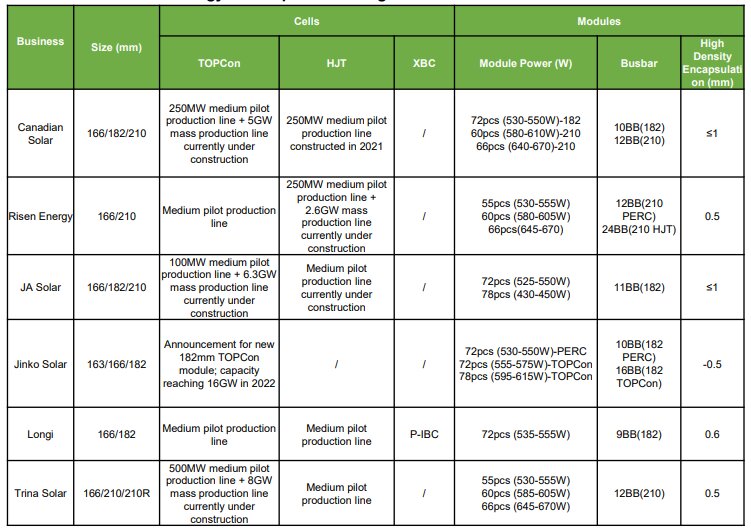

Another highlight highlighted by TrendForce is that the 182 and 210 mm modules are adopting MBB (multi-busbar) and non-destructive cutting technology, high-density encapsulation and slicing as standard configuration.

In addition to a continued adoption of 9BB by Longi, all other businesses have achieved a bus level of 10-12BB for their panels.

“In terms of building production lines, most companies are currently in the mid-sized pilot phase for HJT, while TOPCon businesses such as Jinko Solar, JA Solar and Trina Solar will start GW-level capacity in 2022 , with Longi beginning expansion into XBC cells and reaching mass production,” the research said.