As already reported by Canal Solar, on June 23, 2022, it was Complementary Law 194/2022 (LC 194/2022) published, which reduced the amount of ICMS due on operations with fuel, natural gas, electricity, communications and transport services.

Since then, a lot has happened, as all 26 States and the Federal District announced the reduction of ICMS, limiting the percentage to operations in general (17% or 18%), which was immediately felt in consumers' pockets.

However, almost no State has commented on the new item X of article 3 of Complementary Law 87/1996 (Kandir Law), added by LC 194/2022, and which has been the subject of debate and a lot of insecurity in the electricity sector.

Said section states that ICMS does not apply to transmission and distribution services and sectoral charges linked to electricity operations. Simple writing, but with complexity and impact that is very relevant for the sector.

Just to give an example, some relevant questions have been asked by sector agents:

- Is ICMS applicable on contracted demand, even when consumed?

- Should sectoral charges applied to the Energy Tariff also be excluded from the ICMS calculation basis?

- Regarding tariff flags, is ICMS applicable after LC 194/2022?

As the tariff structure of the electricity sector is complex, Working Group 13 (GT13) of COTEPE (ICMS Permanent Technical Commission – COTEPE/ICMS), linked to CONFAZ, sent Official Letter No. 202349/2022/ME to ANEEL, to clarify what are the tariff components that should be excluded from the ICMS calculation basis, with the advent of LC 194/2022, as well as whether it would be possible to carry them out, given the current tariff composition.

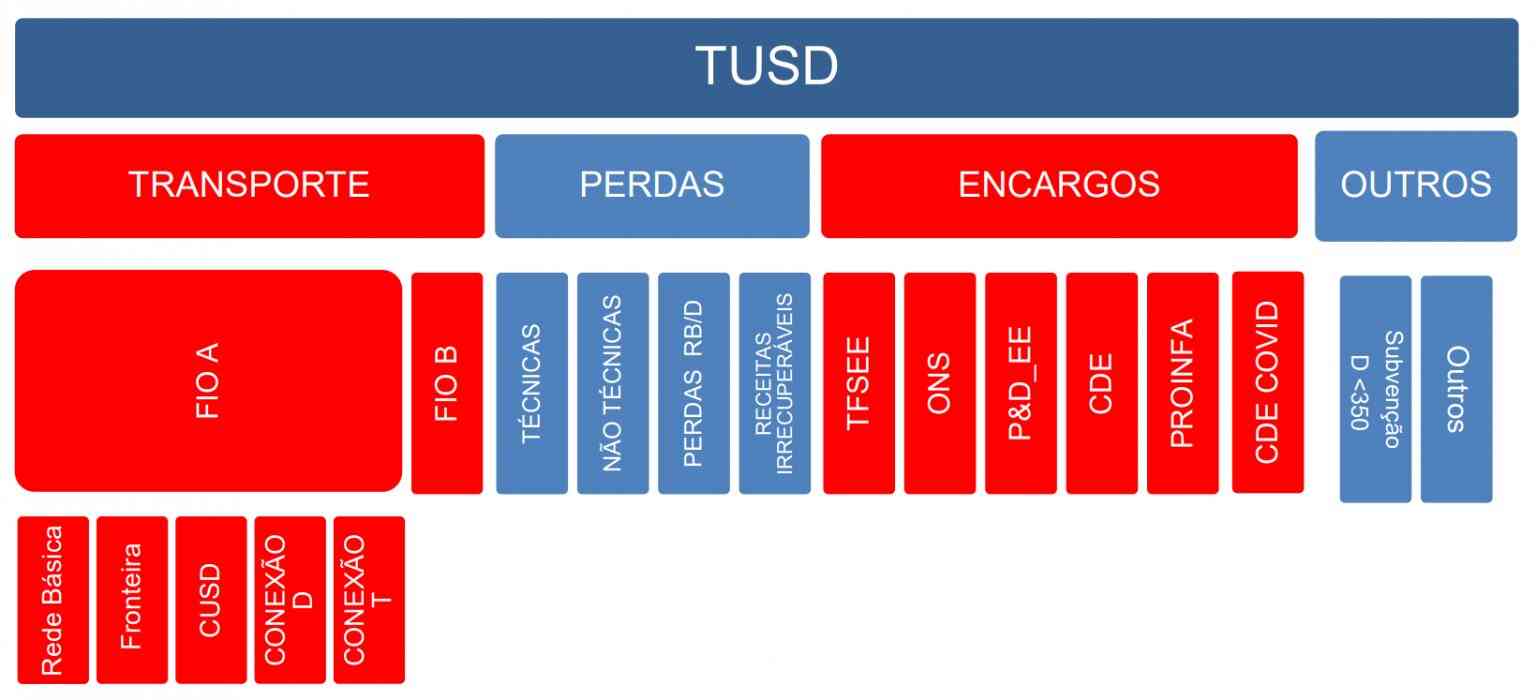

The answer to this letter can be checked here and which, to illustrate, resulted in two tables as contained in PRORET, which for ANEEL, should be excluded from the ICMS calculation basis, as components that refer to the remuneration of transmission, distribution services and sectoral charges (in red) .

In possession of this response, it is believed that GT 13 now has sufficient tools to decide and guide States on the interpretation to be given to section ICMS levied on electrical energy for consumers.