As widely known in the consumer market, it is possible to generate your own energy by joining a “solar farm”. Despite popular jargon, technically solar farms are DG (distributed generation) projects, usually remote generation, that is, far from the load – place of consumption.

Nothing prevents projects of this type from being built next to the load or on contiguous land, but the fact is that a series of factors contributed to such projects being far from such consumers, even within the same concession area of the distributor, as required by the REN 482 (ANEEL Normative Resolution no. 482/2012).

What is rarely asked is what tax obligations are caused to the energy consumer when joining a solar farm.

To be part of a solar farm, the consumer needs to join a consortium or cooperative – which are types of shared generation, or a project with multiple consumer units – usually a condominium with several independent consumer units, including the common area.

As described by resolution 482, shared generation is characterized as a meeting of consumers, within the same area served by the electric energy concessionaire or licensee, through a cooperative or consortium formed by individuals or legal entities that have a microgeneration unit or distributed minigeneration. in a location other than the consumer units where the excess energy will be compensated.

Even though at first there was a debate about what type of consortium the aforementioned normative resolution referred to, a market consensus was reached that the most appropriate consortium model for distributed generation activity is the one provided for in the S Law. /A (Law no. 6,404/76).

The consortium, despite being a communion of companies aiming at a specific enterprise, does not have legal personality by express legal provision, being, therefore, a contract between companies.

Unlike consortia, cooperatives, regulated by Law No. 5,764/1971, are business companies created with the aim of carrying out an economic activity of common benefit with the members, without aiming for profit.

They have legal personality and may hold rights and duties, as well as enjoy advantages such as differentiated tax treatment, constitutionally guaranteed.

Condominiums consist of one of the forms of multiple consumer unit developments (“EMUC”), provided for in resolution 482, such as the independent use of electrical energy, in which each fraction with individual use constitutes a distinct consumer unit, under the responsibility of the condominium, with microgeneration or distributed minigeneration, located on the same property or on contiguous properties, with their installations in common areas or on contiguous properties. Like the consortium, the condominium does not have legal personality.

It is also worth informing that the texts amending REN 482 by ANEEL brought the figure of voluntary condominium as one of the possibilities for shared generation, and that it is in no way legally different from the condominium used for EMUC purposes, as both do not have their own legal personality.

Taking into account the modalities indicated above, as well as their peculiarities, especially due to the presence or absence of legal personality, questions arise related to the declaration in the IRPF (Individual Income Tax), in relation to participation in these types of generation projects distributed, as well as payments made periodically, in consideration for compensated energy generation.

It will not be everyone who will be obliged to comply with the additional obligation consisting of submitting a declaration, but rather taxpayers who, for example, fall into one of the situations provided for in art. 2nd, of the Brazilian Federal Revenue Normative Instruction No. 2,010/2021, such as the receipt of exempt, non-taxable or taxed at source income in a sum greater than R$ 40 thousand, receipt of taxable income whose sum was greater than R$ 28,559 .70, among other hypotheses.

Once one of the situations provided for in RFB Normative Instruction No. 2,010/2021 has occurred, the taxpayer will be obliged to submit the Income Tax Declaration. The following question then arises: what should he declare in relation to his participation in solar farm projects?

Well, before moving on to this answer, it is important to highlight that different types of legal structures are carried out by distributed generation entrepreneurs and, therefore, some clients actually have equity participation in some of these projects, while in others, participation in consortiums, cooperatives and condominiums is merely formal, given the requirement of REN 482 that the energy generated can be dispersed among the participants, but this does not mean that they have made any capital contribution to participate in a solar farm, as usually occurs in a society.

That said, to answer the question raised previously, we must remember what was presented previously, given that in the case of consortia and condominiums, despite having the obligation to maintain registration with the CNPJ (National Register of Legal Entities), they do not They have legal personality and, because of this, there is no obligation to declare participation in them.

Furthermore, only legal entities are authorized to participate in consortiums, although it is known that the Commercial Boards of some States, such as Minas Gerais, authorize the participation of Individual Entrepreneurs, MEI (Individual Microentrepreneurs) and Building Condominiums .

A different situation occurs when it comes to participation in cooperatives. The mere participation of the taxpayer does not in itself make the participation of the cooperative member mandatory, however, if one of the mentioned hypotheses relating to the obligation to submit a declaration arises, the need arises to declare participation in the cooperative, registering as “ Assets and Rights” under the code “32 – shares or shares of capital”, presenting additional information, such as the name of the cooperative, CNPJ and the subscribed value.

Finally, in relation to contributions paid to consortiums, cooperatives and condominiums as consideration for compensated energy generation, these do not have the prerogative of serving as deductible expenses in the calculation of individual income tax due to lack of legal provision, as by analogy, it would be like authorizing the deduction of expenses for paying an individual's electricity bill.

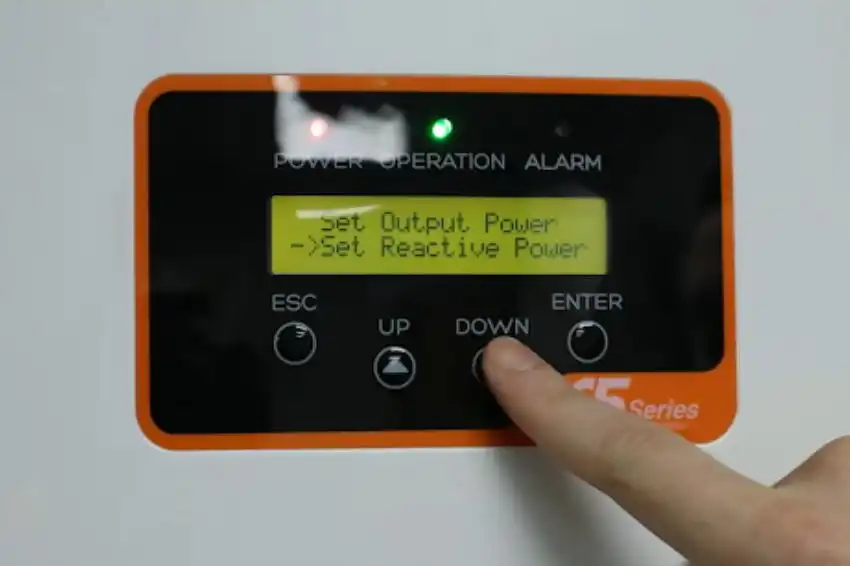

It is worth noting that those consumers of electric energy who have their own distributed generation system can include the costs of purchasing the equipment and installation as an asset incorporated into the residence (improvements) and which can later be deducted from any payment of capital gains. for the sale of the property.

This argument can be used commercially, considering that if the real cost of the equipment is analyzed from a tax perspective, there will be a deductibility of 15% to 22.5%, depending on the amount of gains determined.

The topic addressed has total affinity with the present moment, noting that taxpayers have until the 31st of May to submit their Income Tax, a deadline that could be extended to the 31st of July, considering the approval of the Project of Law No. 639/2021, just awaiting presidential sanction.

Therefore, taxpayers must pay attention to the appropriate forms and needs for declaring income tax, if they participate in solar farms, whether as a partner-investor or merely consumers participating in such legal instruments required by ANEEL.

3 Responses

What about private limited companies (SCP)? Does it work the same way? In relation to income tax, I can record the investment made to set up the association under the heading “99 – Others” and then under the sub heading “other assets and rights” or under “3- Corporate interests” and then under the sub heading “other assets and rights”?

Congratulations on the article!!!

Congratulations on the article. Great!