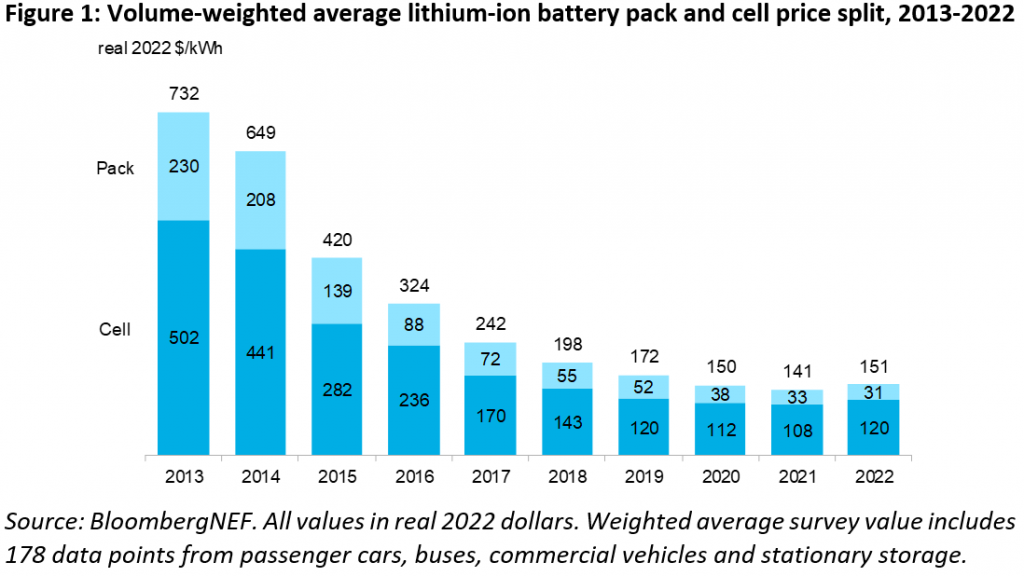

Rising prices for raw materials and battery components, as well as rising inflation, led to the first rising costs of lithium-ion batteries since the BNEF (BloombergNEF) began tracking the market in 2010.

According to research, after more than a decade of declines, Average prices increased to US$ 151/kWh in 2022, an increase of 7% compared to last year in real terms.

Rising cost pressure has outpaced increased adoption of lower-value chemicals such as lithium iron phosphate (LFP). BloombergNEF expects costs to remain at similar levels next year, further defying historical trends.

The numbers above represent an average of various battery end uses, including different types of EVs (electric vehicles), buses and stationary storage projects.

For battery-powered EV (BEV) packages in particular, prices were US$138/kWh on a volume-weighted average basis in 2022. At the cell level, average BEV costs were just US$115/kWh. This indicates that, on average, the cells represent 83% of the total package price.

Countries

On a regional basis, battery prices were cheapest in China, US$ 127/kWh. Packs in the US and Europe were larger 24% and 33%, respectively.

According to the study, higher prices reflect the relative immaturity of these markets, higher production costs, diversity of applications and battery imports. For the higher end of the range, low volume and custom orders increase values.

BNEF further stated that costs could have risen further in 2022 if not for the greater adoption of the low-cost cathode chemistry known as LFP, and the continued reduction of expensive cobalt in nickel-based cathodes.

On average, LFP cells were 20% cheaper than lithium manganese cobalt oxide (NMC) cells in 2021. However, even low-cost chemicals like LFP, which is particularly exposed to carbonate prices, lithium, have felt the bite of rising costs along the supply chain. LFP battery values increased by 27% in 2022 compared to 2021.

“Raw material and component price increases were the biggest contributors to the higher cell prices seen in 2022,” said Evelina Stoikou, energy storage associate at BNEF and lead author of the report.

“Amid these battery metal price increases, major battery manufacturers and automakers have adopted more aggressive strategies to protect themselves against volatility, including direct investments in mining and refining projects,” he pointed out.

Prices should remain high

Although prices for key battery metals such as lithium, nickel and cobalt have declined slightly in recent months, BNEF expects average battery prices to remain high in 2023 at US$ 152/kWh.

According to research, battery prices are estimated to begin falling again in 2024, when lithium costs are expected to decline as more extraction and refining capacity comes online.

Based on the updated observed learning rate, BloombergNEF predicts that average package prices are expected to fall below US$100/kWh by 2026. This is two years later than previously expected and will have a negative impact on automakers' ability to produce and sell mass market EVs in areas without subsidies or other forms of support.

Furthermore, they stated that higher battery prices could also harm the economics of energy projects. energy storage. “Despite a setback in falling prices, demand for batteries is still reaching new records every year. Demand will reach 603 GWh in 2022, almost double that of 2021”, highlighted Yayoi Sekine, head of energy storage at BNEF.

“Increasing supply at this growth rate is a real challenge for the sector, but investment in the sector is also increasing rapidly and technological innovation is not slowing down”, he highlighted.

Kwasi Ampofo, head of metals and mining at BloombergNEF, added that lithium costs remain high due to persistent supply chain constraints and the slow ramp-up of new production capacity.

“Additional lithium supply could ease price pressure in 2024, while geopolitics and trade tension remain the biggest uncertainties for prices of other key battery metals in the near term. Resolving these tensions could help calm values in 2023 and beyond,” he commented.

Therefore, BNEF reported that continued investment in R&D (Research and Development), manufacturing process improvements and capacity expansion across the supply chain will help improve battery technology and reduce costs over the next decade.

“We expect next-generation technologies such as silicon and lithium metal anodes, solid-state electrolytes, and new cathode materials and cell manufacturing processes to play an important role in enabling further cost reductions,” they concluded.