Since last week, the Solar Channel formalized a partnership with InfoLink Consulting with the aim of presenting to our readers every week the behavior of global photovoltaic industry prices. Prices are obtained through interviews with more than 100 companies in the sector.

A InfoLink clarifies that it publishes the spot price based on prices charged between Thursday and Wednesday of the following week. Average costs are obtained through the most common market transactions and are slightly adjusted weekly according to market conditions.

It is worth highlighting that the prices in RMB are those charged in China, while those in dollars are the prices abroad, not a direct conversion of RMB to US dollars.

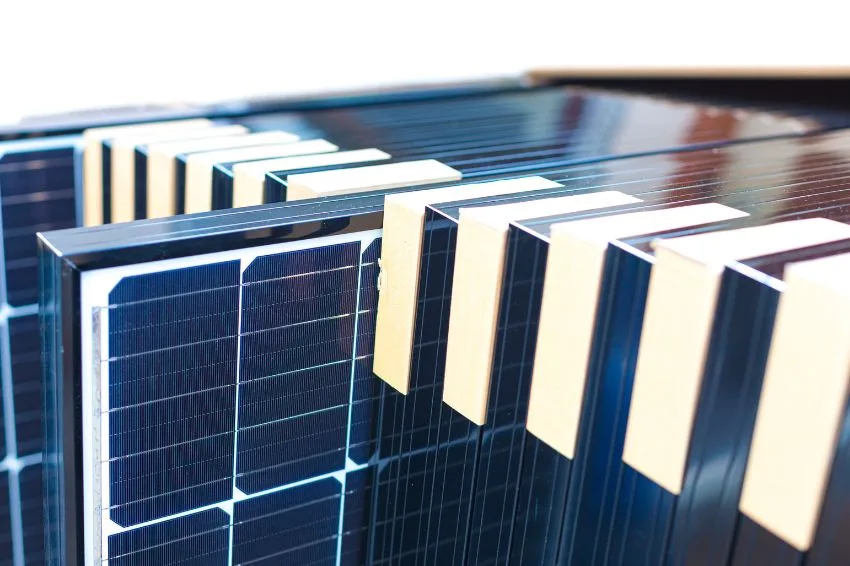

Check below how the prices were in the solar market.

Polysilicon

According to the consultancy, the global polysilicon supply is stabilizing, without a significant increase in supply from the main manufacturers. The polysilicon additions come from new capabilities, although quality requires improvements.

As order intake increases, bullion segment utilization rates recover, but price quotes decline.

Conventional polysilicon prices fell to RMB 63-68/kg, averaging RMB 65/kg, down 3% week after week. Granular polysilicon prices fell to RMB 58-62/kg. InfoLink believes the gap will narrow as prices generally fall.

Wafer

You wafer prices have stabilized despite currently narrow profit margin. The sector reaches a temporary period of balance between supply and demand.

Considering the potential for significant changes in cell production next month, wafer trading was subdued this week, with the market expecting a new round of supply chain price competition in December.

The average price of wafers remained unchanged this week, standing at RMB 2.3/piece and RMB 3.3/piece for P-type M10 and G12 wafers, respectively. For N-type wafers, the average trading price saw a slight drop from M10 to RMB 2.36-2.4/piece. N-type G12 wafers have been in tight supply, with prices remaining at RMB 3.4-3.45/piece.

According to the consultancy, as new and old production capabilities continue to emerge, manufacturers are concerned that increased supply will disrupt market dynamics, which will lead to greater price variations.

However, there is significant disagreement among wafer manufacturers on their production plans for December. While some manufacturers tend to increase production, others are reducing it. Future price trends will depend on production plans.

Cell

O cell sector has been suffering losses for some time. Some Tier-2 and Tier-3 manufacturers are experiencing operational difficulties, with some of them eventually going out of business. Only a few market-leading companies are managing to sustain their operations.

This week, cell prices continued to fall. M10 P-type cells were traded at RMB 0.42-0.44/W, with some transactions recorded at RMB 0.4/W.

G12 cell prices were supported by a mismatch between supply and demand, remaining at RMB 0.58/W – resulting in a price swing of RMB 0.16/W between M10 and G12 cells, highlighting the competitive advantages of the latter in a market with limited suppliers.

However, with the completion of G12 cell order deliveries, prices will return to normal levels in December, further narrowing the price gap.

For N-type M10 cells, prices remained at RMB 0.49-0.5/W this week. G12 HJT cells reached RMB 0.65/W for high efficiency ones. The price difference between N and P type cells reached RMB 0.07-0.08/W.

According to InfoLink, the depletion of stocks in the cell sector was efficient this week. Currently, the cell stock is equal to four to five days of production. However, the recent price drops are not the result of stockpiling, but rather the dwindling demand for P-type M10 cells. In contrast, G12 and N-type cells maintain a healthy supply-demand situation.

Module

You Module prices were mixed this week. In China, inventory has dwindled as major projects are completed in December.

For 182mm single-facial modules, prices were RMB 0.91-1.03/W. The price difference between 182mm and 210mm single-facial modules has started to narrow, now between RMB 0.03-0.05/W and will return to RMB 0.01-0.03/W in December.

The selling price of PERC modules reached US$ 0.12-0.13/W in Asia-Pacific and EUR 0.11-0.13/W in Europe.

The prices of TOPCon modules ranged from RMB 0.96/W to RMB 1.18/W. New orders were priced at RMB 0.98-1.05/W. Prices outside China are USD 0.13-0.14/W.

The costs of HJT modules were RMB 1.2-1.35/W. Prices outside China remained at USD 0.16-0.17/W.

With the exception of some manufacturers who maintain a stock fee high thanks to a sufficient quantity of order volumes, the majority plans to reduce production in December at 0.3-0.8 GW. Total module production for the month will be 48-50 GW.

Manufacturers reduce production and eliminate P-type products as demand shifts to N-type modules. On the other hand, TOPCon modules sustain robust demand and will see production plans increase as manufacturers free up production capacities. With prices near the bottom, declines will

slow down in December.

In terms of glass, the Negotiations for new orders in December are underway. Faced with the low price of modules and weakened demand, module manufacturers are trying to put downward pressure on the price of glass.

However, glass manufacturers can hardly relent as manufacturing costs have risen, potentially driving up raw material prices. The result of the negotiation between the two parties has not yet been defined.

All content on Canal Solar is protected by copyright law, and partial or total reproduction of this site in any medium is expressly prohibited. If you are interested in collaborating or reusing part of our material, we ask that you contact us via email: [email protected].