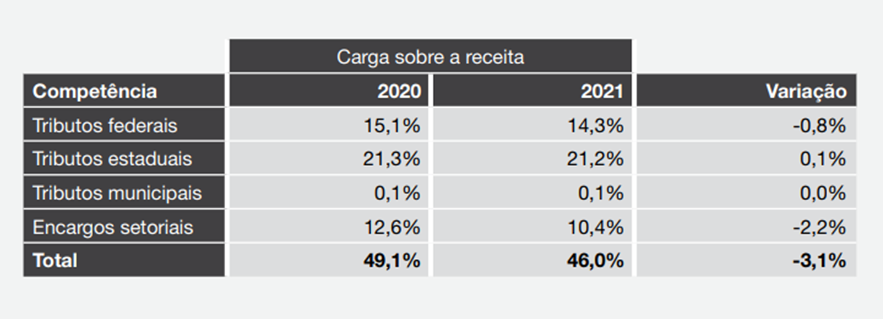

A survey carried out by PwC Brazil, in partnership with the Instituto Acende Brasil, revealed that almost half (46%) of the value paid by consumers in electricity bill is intended for charges and taxes of the three levels of the Federation (Union, States and municipalities).

The study was carried out with 2021 data provided by 45 companies (generators, transmitters and distributors), which represent 70% of the national market, and indicates a slight drop in the percentage of the tax burden on the electricity bill, as the 2020 data indicates a weight of 49.1%, just above the 46% of 2021.

The main reason for the slightly lower percentage is the reduction in the CDE (Energy Development Account) apportionment quota. The other items had smaller increases and decreases that canceled each other out (+0.2% and -0.2%).

According to Vandré Pereira, the partner at PwC Brasil and responsible for the research, when compared to the pandemic environment of 2020, the year 2021 was marked by the recovery of the economy and a period of concerns about energy supply for the country's productive sector. . “Despite this, we noticed in the financial statements included in the 2021 sample a relative stability in the participation of taxes in the energy chain”.

“However, the drop in revenue and the share of the charge with the CDE stands out, as a result of a new source of revenue (Research and Development resources) that was greater than the increase in expenses, bringing some relief in the overall calculation of the estimated burden for the energy sector from 49.1% in 2020 to 46% in 2021,” he stated.

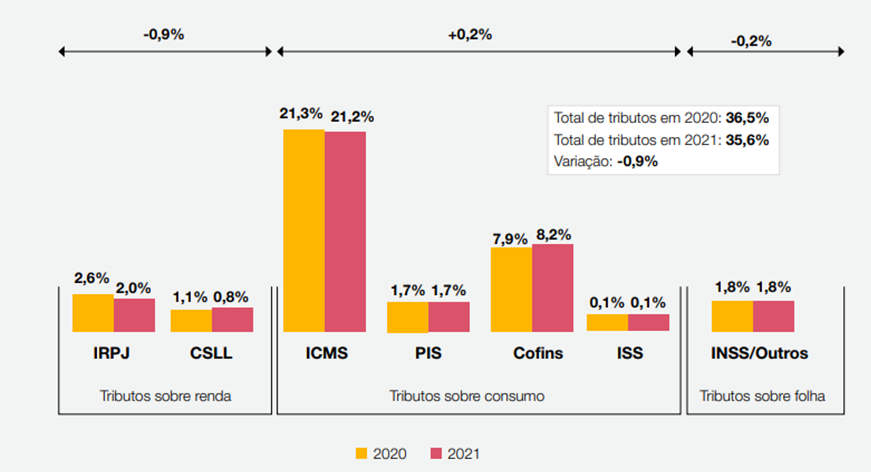

The survey also showed that when a segregated analysis is carried out, the consolidated tax burden in 2021 had a small drop in relation to 2020 (from 36.5% to 35.6%), mainly due to the reduction of 0.9% of the sum of IRPJ and CSLL.

“The study contains a historical series since 1999. The total load in that year and at the beginning of the millennium was around 35%. The level has changed and in recent years it has been above 46%. A burden that is too high, which affects Brazilian society, largely made up of lower-income families, and also the economy as a whole, which loses competitiveness”, said Claudio Sales, president of Instituto Acende Brasil.

Higher fundraising and prospects for 2022

Despite the negative variation in percentage terms, in nominal terms, there was an increase in tax collection: from R$ 70.6 billion in 2020 to R$ 82.1 billion in 2021. The taxes and sectoral charges collected by the companies that were part of the study amount to , in 2021, around R$106.1 billion (compared to R$95 billion in 2020).

For 2022, there is an expectation of a small decrease in the weight of the tax burden in the electricity sector, due to the creation by the National Congress (Complementary Law nº 194/2022) of the ceiling of 17% for the ICMS rate. The return of amounts to consumers from PIS/Cofins that affected ICMS, which is included in the negotiations of Law No. 14,385/2022, is also a factor that affects the reduction of the sector's burden.

On the other hand, despite the drop in CDE revenue from 2020 to 2021, those responsible for the research indicated that the CDE budget for 2022 foresees an increase of 34%, reaching R$ 32 billion in 2022, a factor that tends to increase the weight of the load tax.