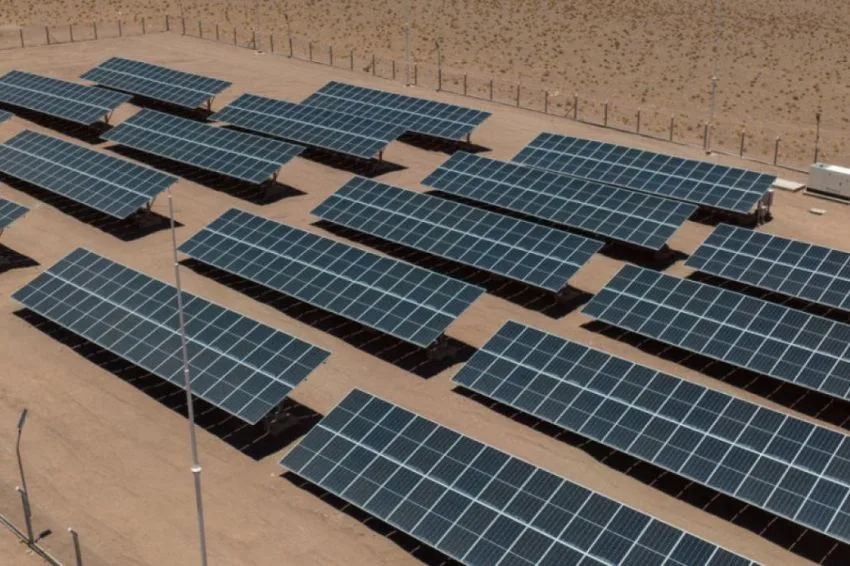

The project Genesis is the first tokenized solar plant in operation in Brazil. The 15.4 kWp photovoltaic plant was built in October 2022 by TAB Energy, Epcista solar company from Joinville (SC), on the roof of its own industrial office.

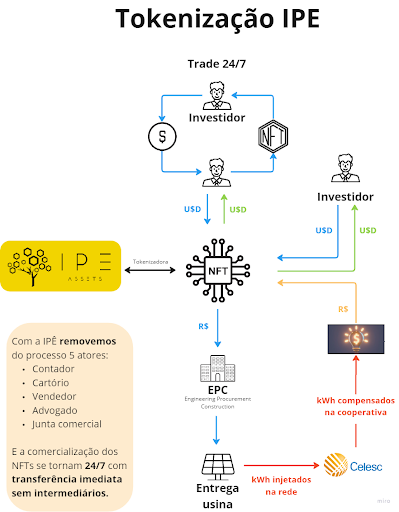

The plant was 100% financed through crowdfunding, where investors purchased shares in the plant by purchasing NFT (Non-fungible Token) tokens, at R$ 100 each. This is the startup's business model IPE Assets, created in March 2022, also in Joinville and incubated by TAB.

For Michel Pabst, co-founder of IPE Assets and blockchain technology enthusiast, the proposal brings together the main innovation trends in the energy and investment market.

“Renewable sources are at the forefront of the energy transition due to their low carbon footprint, as is blockchain technology, which has the potential to democratize access to investments in clean energy, previously more restricted to venture capital, family offices and investment funds and also offer a global offering of a real asset through NFT tokens”, comments Pabst.

The executive also explains that the innovation of crowdfunding occurs through the fractionation of the investment capital (Capex) of the plants into NFT tokens, where each token is the digital representation of the minimum fraction of this CAPEX.

In this model, each investor acquires one or more tokens and helps to facilitate the construction of the plant which, once connected, will generate energy and inject it into the local utility network generating credits, according to the DG (distributed generation) model.

These credits reduce the energy consumption of end consumers. Payment of the invoice with this rebate in turn remunerates the plant and consequently the investors.

The tokens are kept in the digital wallet of each person who invested. Monthly dividends are deposited in this same portfolio, arising from credits generated by the plant.

IPE also dollarizes these dividends before depositing them into investors' portfolios. As a result, it becomes an excellent opportunity to dollarize – in addition to the DCA (Dollar Cost Average) – and a great alternative for those looking to diversify their investment portfolio, with the additional advantage of being income tax free.

The startup's co-founder also highlights that this business model already exists in other markets, such as real estate, for example, where a project is tokenized at the plant and investors are remunerated for renting the properties, when completed.

However, in the solar photovoltaic market despite several previous initiatives, the Genesis project is the first to be delivered and pay dividends to investors.

“This is an important milestone in the constant process of consolidating the solar integration market and also the tokenization of assets: the startup’s MVP has already paid 5.54% of investment in the first five months of 2023, which gives a horizon of returns above income fixed in Brazil, even in a scenario of high Selic (currently at 13.75% pa)”, points out Pabst.

He also highlights that investment in renewables will not have its return linked to the basic interest rate, being in fact correlated with energy inflation, which is historically higher than the country's official inflation rates.

Pabst also reinforces the importance of working in partnership with TAB Energia, which believed in the project and incubated the startup, thus making use of its entire engineering and technical team, thus mitigating the risks of execution and operation of plants tokenized by IPE Assets , which according to the startup's co-founder is essential for investment security.

According to Lucas Lima, new business coordinator at IPE Assets, this type of asset financing brings in its essence all the pillars of ESG, as the core business is to tokenize renewable energy plants, democratizing the opportunity to invest in plants for individual investors. and given the nature of blockchain transactions, which are always 100% public and auditable.

“The whole thing is very simple, the token is like the June party token that we bought at the cashier, but it’s no longer on paper, now it’s digital. No one needs to pay for the party alone, if they want, they can, but the idea is that each person contributes a little and everyone will have their proportional share of the profit”, explains Lima.

“Furthermore, the concept of NFT is like a party: each token is from a different game, food or drink, they don’t mix. It's the same way at a startup, tokens from one collection don't mix with those from another. Each plant is a collection”, he adds.

He points out that an advantage of this digital version of the token is that blockchain technology allows the history of each token to be recorded. “This way, they are not even mixed in the same collection because we know all the transactions that occurred in each token, and this is the component that brings security to the process. If someone sells or transfers this wallet token, the payment of the dividend, which is via smart contract, follows the token, always paying the holder”, he adds.

Currently, IPE has the Genesis 1 collection, in operation since 2022. This project is expanding with 40 new modules (Genesis 2). This expansion will come into operation in June 2023.