The solar energy sector in Brazil has faced a challenging year. However, a report by XP Investimentos, carried out based on interviews with 37 executives in the photovoltaic market across Brazil, revealed a positive trend: 78% of respondents expressed high or medium confidence in the recovery of demand in the second half of 2023.

The interviews were carried out during the XP Solar Week, an event held by the brokerage and attended by Ecori, Intelbras, Trina, WDC and WEG. To access the full report click here.

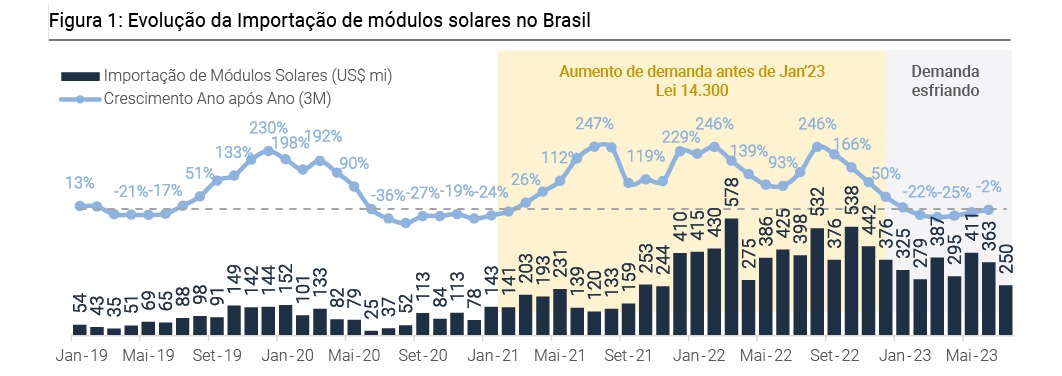

The report released by XP points out that the significant anticipation of demand in the fourth quarter of 2022 led to an increase in sales before the implementation of Law 14,300, which changed regulations for solar energy in Brazil.

Additionally, research shows that current macroeconomic conditions, including high interest rates and stricter credit approvals, have impacted businesses.

Another factor is the rising cost of financing projects which is leading clients to reconsider their investment plans, while many are facing rejection when applying for bank credit lines.

This last factor worries executives, especially for the residential panel segment, as approximately 60% of projects were financed.

To XP, Trina Solar pointed out that many suppliers were offering low-quality products at low prices, resulting in inefficient solar panels and increased default rates at banks, leading to a decrease in credit offers for the solar segment.

Although not mentioned in the report, the price of energy at lower levels than in previous years due to good hydrological conditions also contributed to a less heated first half of the year.

But where is the optimism then?

Despite these challenges, XP suggests that the worst may be behind us and that the presence of more prepared companies, such as resellers and importers, can favor competitive dynamics in the solar sector.

Also according to the report, companies pointed out that after the normalization of stock levels, the competitive scenario may become less aggressive, with customers potentially favoring quality over prices.

XP also highlighted that for businesspeople in the photovoltaic energy sector, the information disclosed in this report is crucial to understanding the current and future market scenario.

Furthermore, he highlighted that the key to success will be the ability of companies to adapt to regulatory and macroeconomic changes, efficiently manage inventories and maintain confidence in the market recovery.

The Brazilian multinational WEG, one of the main companies in the solar energy sector in Brazil, revealed some of the strategies used throughout the challenging year of 2023. According to XP, the company has demonstrated resilience amid the challenges of the photovoltaic market, maintaining a performance stable despite this year's drop in demand.

In its report, XP says that WEG's customers in the solar sector were, until recently, mainly C&I (Commercial and Industrial) customers in the DG (distributed generation) segment. This positioning provided the company with some stability in sales amid the drop in demand.

Looking to the future, one of WEG's strategic guidelines appears to be to expand its participation in the residential segment. The company plans to take advantage of potential synergies with other products, such as WEG Home.

However, to serve the residential segment, WEG structured a more extensive distribution channel. Harry Neto, Head of Distributed Solar Energy at WEG, highlighted that WEG integrators, as they are larger, focus primarily on three-phase commercial, industrial and power plants.

“To gain space in the residential market for small integrators, not exclusive to WEG, we are opening some exclusive WEG distributors, which will give access to all integrators, mainly focused on increasing market share in the residential area”, he informed.

“This opportunity to be a regional single-phase distributor is being given primarily to five-star WEG integrators who have the culture of our company and the size to stock products. In this way, WEG positions itself more as a manufacturer and will only directly serve exclusive integrators, non-exclusive integrators must purchase from the distributor who will only sell WEG products”, explained Neto.

Regarding product positioning, WEG should continue to focus on a more premium niche, targeting customers who prioritize quality over price. The company also commented on some products launched at Intersolar 2023.

These launches include the SIW100G microinverter, the 550 W WPV photovoltaic module with an efficiency of 21.5% and the SIW410G, intended for commercial and industrial applications and centralized generation. WEG also presented its portfolio of metallic structures and its own manufactured carport.

Another company that expressed confidence in the solar sector, despite the challenges faced in the second half of this year, is Intelbras.

XP reported that Intelbrás believes there is a better purchasing condition following the drop in the price of polysilicon and expects to accelerate inventory turnover in the second half of the year. For the company, the fourth quarter should improve a little with the new, cheaper inventory.

The report also indicated that Intelbras is positioned at a slightly higher price level, but with a consolidated distribution channel. Regarding the option of mergers and acquisitions in the solar segment, the company stated that it does not intend to acquire any other company in the segment, but that it believes in the natural consolidation of the sector.

The company is also optimistic about the mini power plant segment, which they believe has room for growth and increased market share. Intelbras continues to believe in the potential of the solar segment, but understands that the market needs to organize itself to grow sustainably.

In XP's assessment, these statements by Intelbras reinforce the importance of the solar energy sector for the future of the Brazilian energy matrix and highlight the growth potential of mini photovoltaic plants.

Stocks and sales prices

A point already considered but worth highlighting is the stock of companies in the solar sector. According to XP, solar companies purchased their inventory last year for around US$ 0.24 FOB (Free On Board) per 500W to 600W panel, due to uncertainties surrounding the high demand of 2022 and the potential shortage of polysilicon.

Already this year, after law 14,300 and credit restrictions on Brazilian banks, the same panel is costing half the price, around US$ 0.17 FOB, directly affecting companies' revenue and costs, with the sales price being reduced by around 30% in the Brazilian market.

WDC Networks informed XP that to overcome this situation it adopted the sale of projects in 21 installments, reduced the cost of operations and invested in new solutions, such as equipment rental.

Labor shortage is a relevant challenge for the sector

The XP report highlighted a significant obstacle: the lack of specialized labor. The challenge was pointed out to XP by Trina Solar, which highlighted that the shortage of labor becomes even more relevant when there are more than 300 solar plants currently under construction.

For the manufacturer, this lack of qualified professionals is an obstacle to the sector's growth. However, Trina Solar pointed out that it represents an opportunity for those who are willing to invest in their training and updating, as well-prepared and updated professionals have a significant competitive advantage in this fast-growing market.

In short, despite the current challenges, the photovoltaic energy market offers countless opportunities. The key to taking advantage of these opportunities is to invest in training and updating, thus ensuring a place in this fast-growing sector.